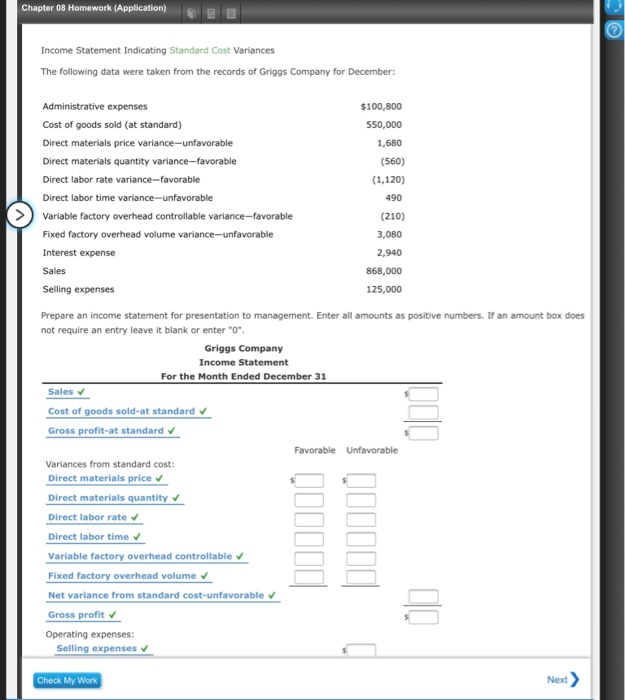

Question: Chapter 08 Homework (Application) Income Statement Indicating Standard Cost Variances The following data were taken from the records of Griggs Company for December: 1,680 490

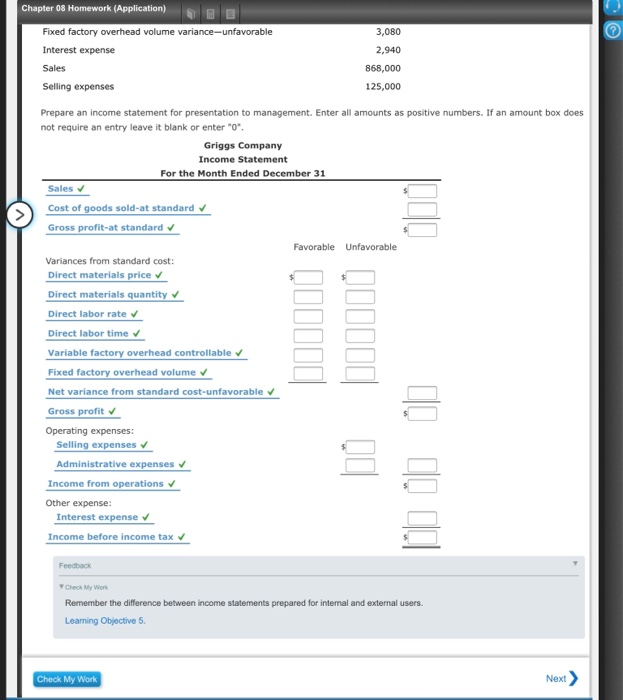

Chapter 08 Homework (Application) Income Statement Indicating Standard Cost Variances The following data were taken from the records of Griggs Company for December: 1,680 490 Administrative expenses $100,800 Cost of goods sold (at standard) 550,000 Direct materials price variance-unfavorable Direct materials quantity variance-favorable (560) Direct labor rate variance-favorable (1,120) Direct labor time variance-unfavorable Variable factory overhead controllable variance-favorable (210) Fixed factory overhead volume variance-unfavorable 3,080 Interest expense 2,940 Sales 868,000 Selling expenses 125,000 Prepare an income statement for presentation to management. Enter all amounts as positive numbers. If an amount box does not require an entry leave it blank or enter "O". Griggs Company Income Statement For the Month Ended December 31 Sales Cost of goods sold-at standard Gross profit-at standard Favorable Favorable Unfavorable Variances from standard cost: Direct materials price Direct materials quantity Direct labor rate Direct labor time Variable factory overhead controllable v Fixed factory overhead volume Net variance from standard cost-unfavorable Gross profit Operating expenses: Selling expenses Check My Work Next > Chapter 08 Homework (Application) Fixed factory overhead volume variance-unfavorable Interest expense Sales Selling expenses 3,080 2,940 868,000 125,000 Prepare an income statement for presentation to management. Enter all amounts as positive numbers. If an amount box does not require an entry leave it blank or enter "o". Griggs Company Income Statement For the Month Ended December 31 Sales Cost of goods sold-at standard Gross profit-at standard Favorable Unfavorable Variances from standard cost: Direct materials price Direct materials quantity Direct labor rate Direct labor time Variable factory overhead controllable Fixed factory overhead volume v Net variance from standard cost-unfavorable Gross profit Operating expenses: Selling expenses Administrative expenses Income from operations Other expense: Interest expense Income before income tax Feedback Check My Work Remember the difference between income statements prepared for internal and external users. Learning Objective 5 Check My Work Next > Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts