Question: Chapter 09 - Long-Term Liabilities Blooms: Analyze Topic: Pricing Bonds Issued at a Discount [QUESTION) 70. Seaside issues a bond with a stated interest rate

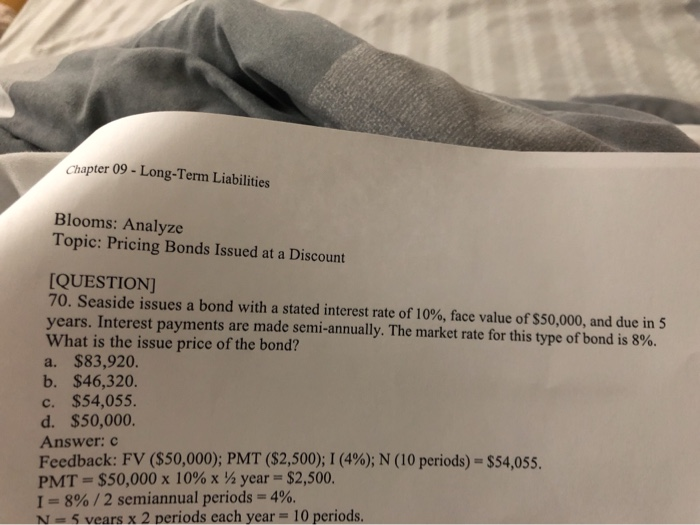

Chapter 09 - Long-Term Liabilities Blooms: Analyze Topic: Pricing Bonds Issued at a Discount [QUESTION) 70. Seaside issues a bond with a stated interest rate of 10%, face value of $50,000, and due in 5 years. Interest payments are made semi-annually. The market rate for this type of bond is 8%. What is the issue price of the bond? a. $83,920. b. $46,320. c. $54,055. d. $50,000. Answer: c Feedback: FV ($50,000); PMT ($2,500); I (4%); N (10 periods) - $54,055. PMT = $50,000 x 10% x year $2,500. I=8%/2 semiannual periods = 4%. N-5 vears x 2 periods each year = 10 periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts