Question: Chapter 1 1 : Capital Budgeting Cash Flows Integrative: Determining relevant cash flows Atlantic Drydock is considering replacing an existing hoist with one of two

Chapter : Capital Budgeting Cash Flows

Integrative: Determining relevant cash flows

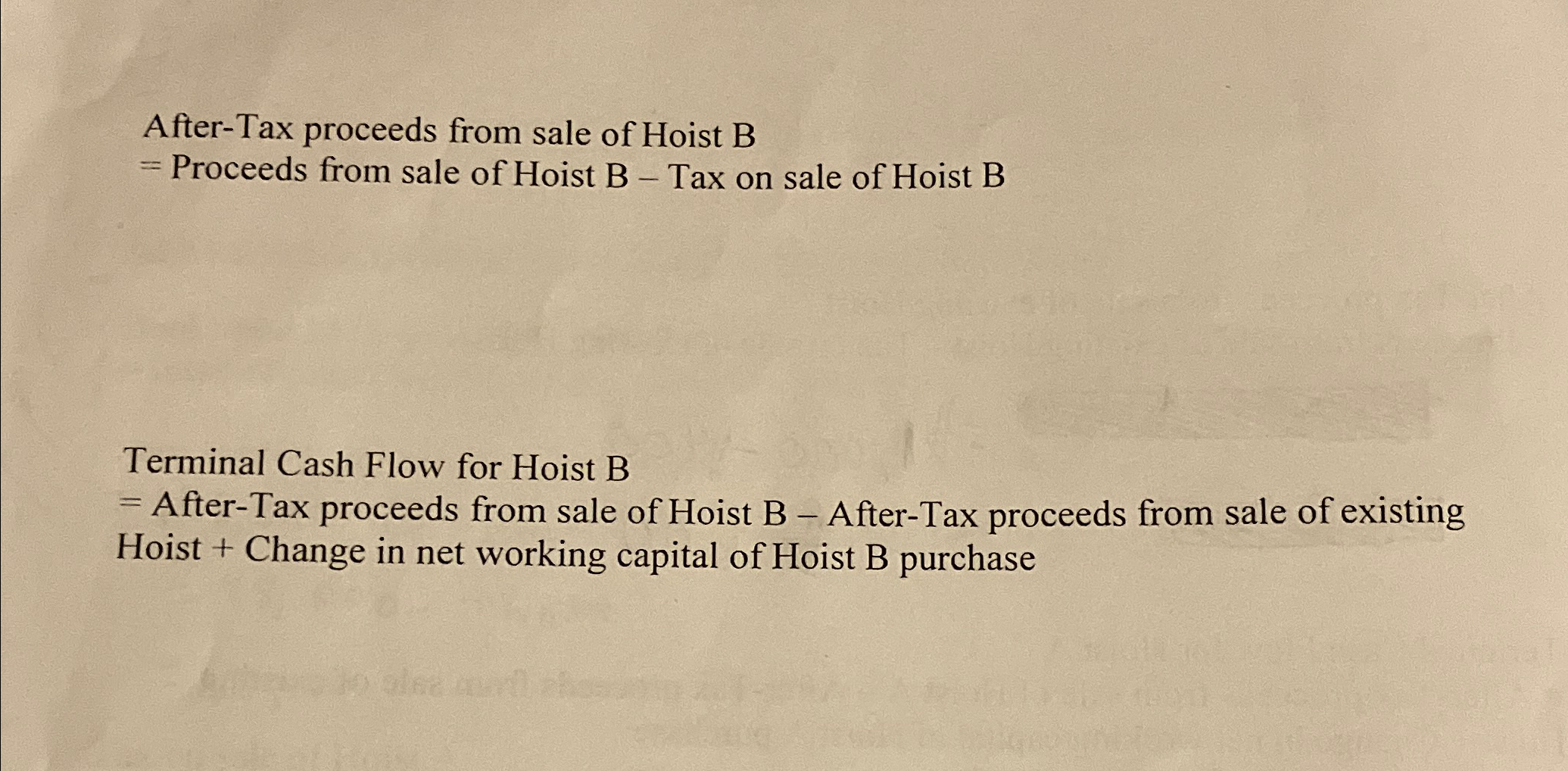

Atlantic Drydock is considering replacing an existing hoist with one of two newer, more efficient pieces of equipment. The existing hoist is years old, cost $ and is being depreciated under MACRS using a year recovery period. Although the existing hoist has only years years and of depreciation remaining under MACRS, it has a remaining usable life of years. Hoist one of the two possible replacement hoists, costs $ to purchase and $ to install. It has a year usable life and will be depreciated under MACRS using a year recovery period. Hoist B costs $ to purchase and $ to install. It also has a year usable life and will be depreciated under MACRS using a year recovery period.

Increased investments in net working capital will accompany the decision to acquire hoist A or hoist B Purchase of hoist A would result in a $ increase in net working capital; hoist B would result in a $ increase in net working capital. The proposed earnings before depreciation, interest, and taxes with each alternative hoist and the existing hoist are given in the following tables.

tableEarnings before depreciation, interest, and taxesYearWith hoist AWith hoist BWith existing hoist$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock