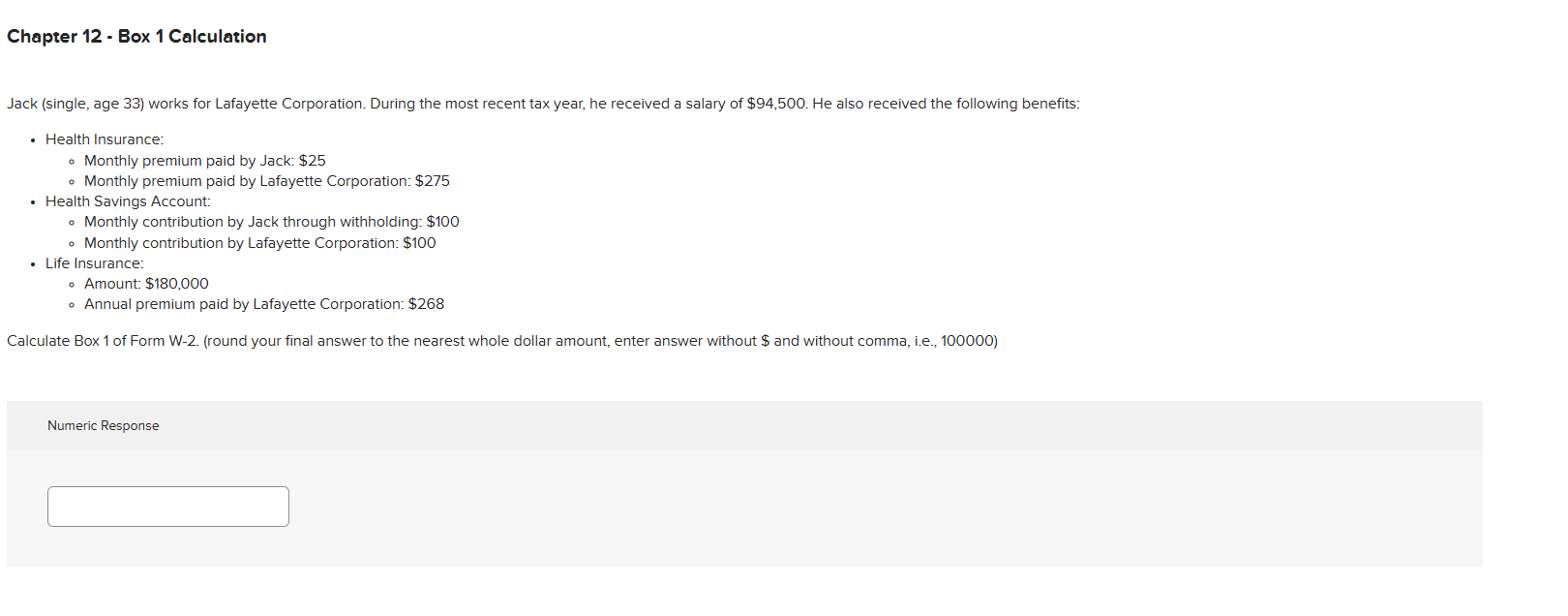

Question: Chapter 1 2 - Box 1 Calculation Jack ( single , age 3 3 ) works for Lafayette Corporation. During the most recent tax year,

Chapter Box Calculation Jack single age works for Lafayette Corporation. During the most recent tax year, he received a salary of $ He also received the following benefits: Health Insurance: Monthly premium paid by Jack: $ Monthly premium paid by Lafayette Corporation: $ Health Savings Account: Monthly contribution by Jack through withholding: $ Monthly contribution by Lafayette Corporation: $ Life Insurance: Amount: $ Annual premium paid by Lafayette Corporation: $ Calculate Box of Form Wround your final answer to the nearest whole dollar amount, enter answer without $ and without comma, ie Numeric Response

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock