Question: Chapter 1 4 Q 4 ) a ) Dimond 7 has been operating an excavation company in British Columbia for the last 2 0 years.

Chapter

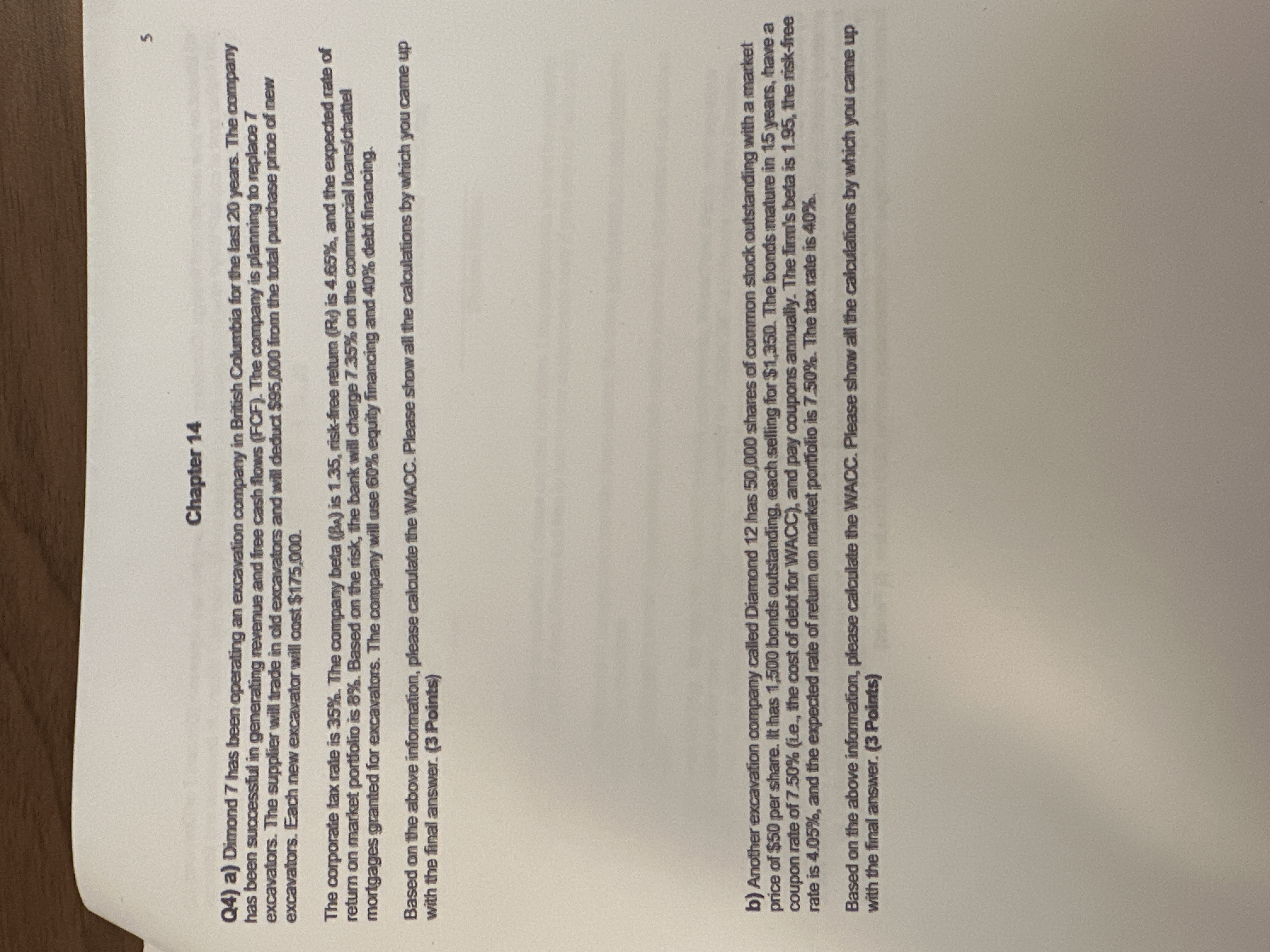

Q a Dimond has been operating an excavation company in British Columbia for the last years. The company

has been successful in generaling revenue and free cash flows FCF The company is planning to replace

excavators. The supplier will trade in old excavators and will deduct $ from the total purchase price of inew

excavalors. Each new excavator will cost $

The corporate tax rate is The company beta is riskfree return is and the expected rate of

return on market portiolio is Based on the risk, the bank will charge on the comimercial loanschattel

mortgages granted for excavators. The company will use equily financing and debt financing.

Based on the above information, please calculate the WACC. Please show all the calculations by which you came up

with the final answer. Points

b Another excavation company called Diamond has shares of common stock outstanding with a market

price of $ per share. It thas bonds outstanding, each selling for $ The bonds mature in years, have a

coupon rate of ie the cost of debt for WACC and pay coupons annually. The firmis beta is the riskfree

rate is and the expected rate of retum on market porticilio is The tax rate is

Based on the above information, please calculate the WACC. Please show all the calculations by which you came up

with the final answer. Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock