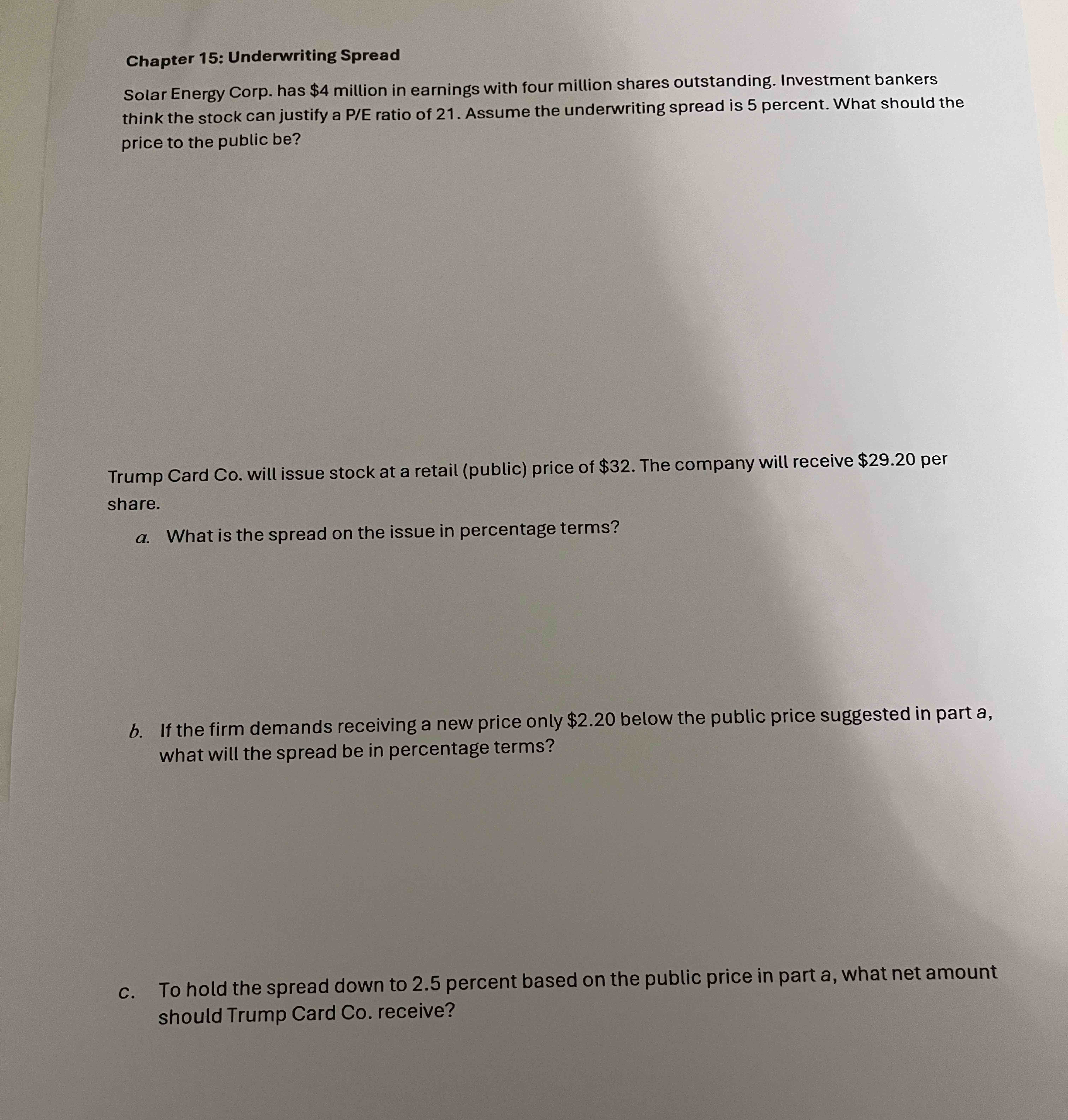

Question: Chapter 1 5 : Underwriting Spread Solar Energy Corp. has ( $ 4 ) million in earnings with four million shares outstanding.

Chapter : Underwriting Spread Solar Energy Corp. has $ million in earnings with four million shares outstanding. Investment bankers think the stock can justify a PE ratio of Assume the underwriting spread is percent. What should the price to the public be Trump Card Co will issue stock at a retail public price of $ The company will receive $ per share. a What is the spread on the issue in percentage terms? b If the firm demands receiving a new price only $ below the public price suggested in part a what will the spread be in percentage terms? c To hold the spread down to percent based on the public price in part a what net amount should Trump Card Co receive?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock