Question: Chapter 1 6 - Does Debt Policy Matter? Saved Increasing financial leverage increases both the cost of debt ( r d e b t )

Chapter Does Debt Policy Matter?

Saved

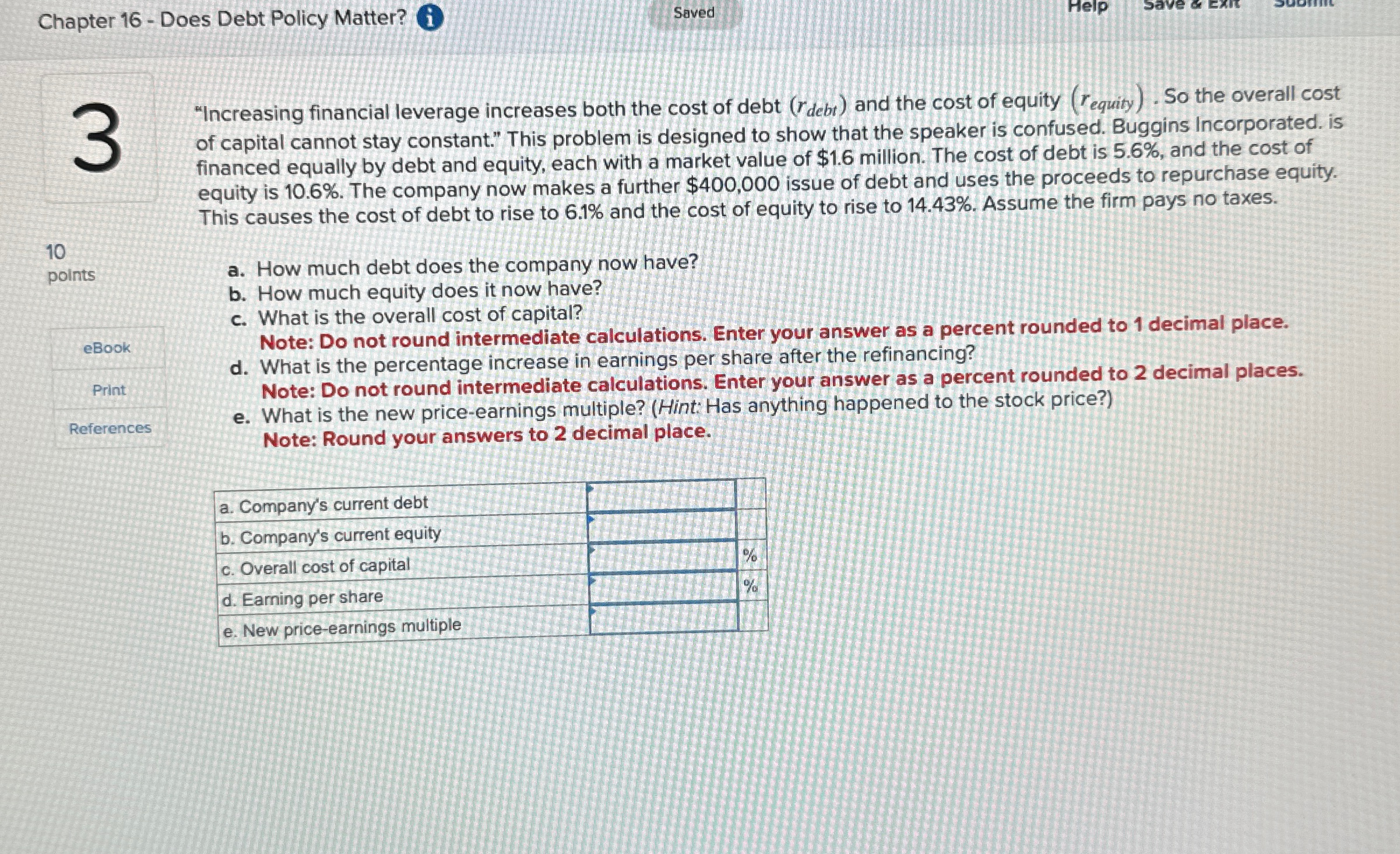

"Increasing financial leverage increases both the cost of debt and the cost of equity So the overall cost of capital cannot stay constant." This problem is designed to show that the speaker is confused. Buggins Incorporated. is financed equally by debt and equity, each with a market value of $ million. The cost of debt is and the cost of equity is The company now makes a further $ issue of debt and uses the proceeds to repurchase equity. This causes the cost of debt to rise to and the cost of equity to rise to Assume the firm pays no taxes.

points

eBook

Print

References

a How much debt does the company now have?

b How much equity does it now have?

c What is the overall cost of capital?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal place.

d What is the percentage increase in earnings per share after the refinancing?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

e What is the new priceearnings multiple? Hint: Has anything happened to the stock price?

Note: Round your answers to decimal place.

tablea Company's current debt,,b Company's current equity,,c Overall cost of capital,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock