Question: Chapter 1 8 Group Assignment Assume that Bio - Tech Company reports pretax financial income of $ 2 0 0 , 0 0 0 in

Chapter Group Assignment

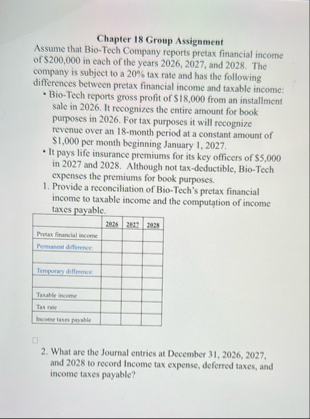

Assume that BioTech Company reports pretax financial income of $ in each of the years and The company is subject to a tax rate and has the following differences between pretax financial income and taxable income:

BioTech reports gross profit of $ from an installment sale in It recognizes the entire amount for book purposes in For tax purposes it will recognize revenue over an month period at a constant amount of $ per month beginning January

It pays life insurance premiums for its key officers of $ in and Although not taxdeductible, BioTech expenses the premiums for book purposes.

Provide a reconciliation of BioTech's pretax financial income to taxable income and the computation of income taxes payable.

tabletsPrears linuncial incoencePemment diftrence:Temparan diflermerTrashle incouseTas mespIncose Ieses payaly,,,

What are the Journal entries at December and to record Income tax expense, deferred taxes, and income taxes payable?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock