Question: Chapter 1 Homework Problem: Accounting for Intercorporate Investments 36. Interpreting equity method footnote In its March 31, 2017 SEC Form 20-F (i.e., the annual report

Chapter 1 Homework Problem: Accounting for Intercorporate Investments

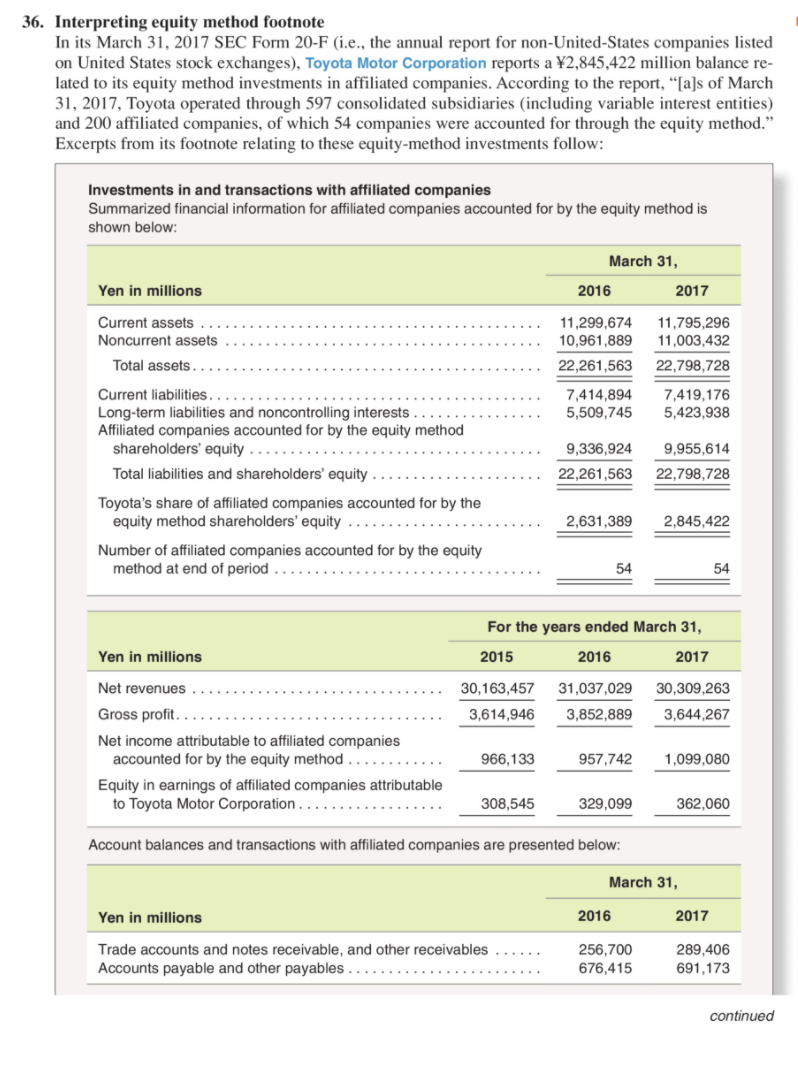

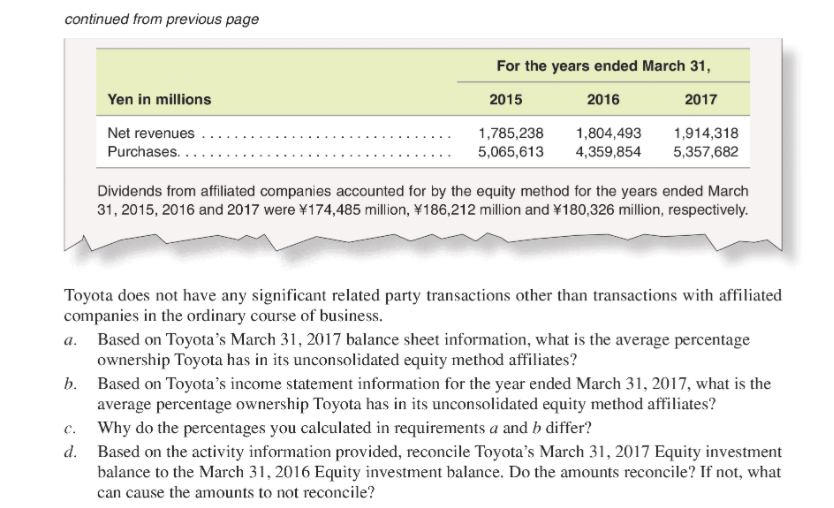

36. Interpreting equity method footnote In its March 31, 2017 SEC Form 20-F (i.e., the annual report for non-United-States companies listed on United States stock exchanges), Toyota Motor Corporation reports a V2,845,422 million balance re- lated to its equity method investments in affiliated companies. According to the report, "[als of March 31, 2017, Toyota operated through 597 consolidated subsidiaries (including variable interest entities) and 200 affiliated companies, of which 54 companies were accounted for through the equity method." Excerpts from its footnote relating to these equity-method investments follow: Investments in and transactions with affiliated companies Summarized financial information for affiliated companies accounted for by the equity method is shown below: March 31, Yen in millions 2016 2017 Current assets . . . . . 11,299,674 11,795,296 Noncurrent assets 10,961,889 11,003,432 Total assets . . . 22,261,563 22,798,728 Current liabilities . . . . . 7,414,894 7,419,176 Long-term liabilities and noncontrolling interests . . . . . . . . . . . . 5,509,745 5,423,938 Affiliated companies accounted for by the equity method shareholders' equity . . . . 9,336,924 9,955,614 Total liabilities and shareholders' equity . . . . . . . . . . . . . . . . . . ... 22,261,563 22,798,728 Toyota's share of affiliated companies accounted for by the equity method shareholders' equity . 2,631,389 2,845,422 Number of affiliated companies accounted for by the equity method at end of period . . .. 54 54 For the years ended March 31, Yen in millions 2015 2016 2017 Net revenues . . . . . . 30,163,457 31,037,029 30,309,263 Gross profit. . . . . . 3,614,946 3,852,889 3,644,267 Net income attributable to affiliated companies accounted for by the equity method . . .. .. 966,133 957,742 1,099,080 Equity in earnings of affiliated companies attributable to Toyota Motor Corporation . . .. 308.545 329.099 362.060 Account balances and transactions with affiliated companies are presented below: March 31, Yen in millions 2016 2017 Trade accounts and notes receivable, and other receivables . . . . . 256,700 289,406 Accounts payable and other payables . . . . . . . . . . . . . . . . . . . . . . . . 676,415 691,173 continuedcontinued from previous page For the years ended March 31, Yen in millions 2015 2016 2017 Net revenues . . . . 1,785,238 1,804,493 1,914,318 Purchases. . . . 5,065,613 4,359,854 5,357,682 Dividends from affiliated companies accounted for by the equity method for the years ended March 31, 2015, 2016 and 2017 were Y174,485 million, v186,212 million and v180,326 million, respectively. Toyota does not have any significant related party transactions other than transactions with affiliated companies in the ordinary course of business. a. Based on Toyota's March 31, 2017 balance sheet information, what is the average percentage ownership Toyota has in its unconsolidated equity method affiliates? b. Based on Toyota's income statement information for the year ended March 31, 2017, what is the average percentage ownership Toyota has in its unconsolidated equity method affiliates? C. Why do the percentages you calculated in requirements a and b differ? d. Based on the activity information provided, reconcile Toyota's March 31, 2017 Equity investment balance to the March 31, 2016 Equity investment balance. Do the amounts reconcile? If not, what can cause the amounts to not reconcile