Question: Chapter 1 Questions ( 1-1 ) : What is a firm's intrinsic value? Its current stock price? Is the stock's true long-run value more closely

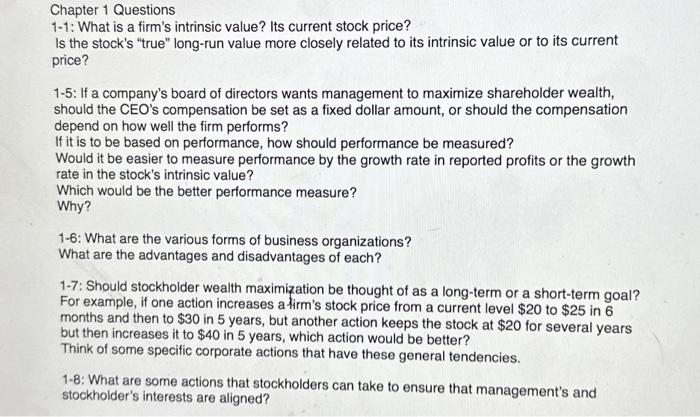

Chapter 1 Questions \\( 1-1 \\) : What is a firm's intrinsic value? Its current stock price? Is the stock's \"true\" long-run value more closely related to its intrinsic value or to its current price? 1-5: If a company's board of directors wants management to maximize shareholder wealth, should the CEO's compensation be set as a fixed dollar amount, or should the compensation depend on how well the firm performs? If it is to be based on performance, how should performance be measured? Would it be easier to measure performance by the growth rate in reported profits or the growth rate in the stock's intrinsic value? Which would be the better performance measure? Why? 1-6: What are the various forms of business organizations? What are the advantages and disadvantages of each? 1-7: Should stockholder wealth maximization be thought of as a long-term or a short-term goal? For example, if one action increases a firm's stock price from a current level \\( \\$ 20 \\) to \\( \\$ 25 \\) in 6 months and then to \\( \\$ 30 \\) in 5 years, but another action keeps the stock at \\( \\$ 20 \\) for several years but then increases it to \\( \\$ 40 \\) in 5 years, which action would be better? Think of some specific corporate actions that have these general tendencies. 1-8: What are some actions that stockholders can take to ensure that management's and stockholder's interests are aligned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts