Question: CHAPTER 1: VALUE ADDED TAX 16 ASSESSMENT (VALUE-ADDED TAX) 1. Mr. BARRACKO imported a boar and swine for breeding purposes. He also imported horses (thoroughbred

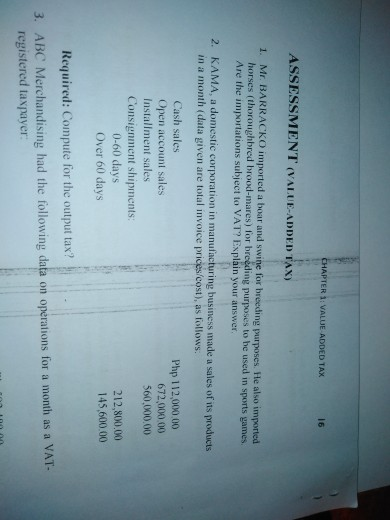

CHAPTER 1: VALUE ADDED TAX 16 ASSESSMENT (VALUE-ADDED TAX) 1. Mr. BARRACKO imported a boar and swine for breeding purposes. He also imported horses (thoroughbred brood-mares) for breeding purposes to be used in sports games. Are the importations subject to VAT? Explain your answer. 2. KAMA, a domestic corporation in manufacturing business made a sales of its products in a month (data given are total invoice prices/cost), as follows: Cash sales Php 112,000.00 Open account sales 672,000.00 Installment sales 560,000.00 Consignment shipments: 0-60 days 212,800.00 Over 60 days 145.600.00 Required: Compute for the output tax? 3. ABC Merchandising had the following data on operations for a month as a VAT- registered taxpayer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts