Question: Chapter 10: 1) Explain the main difference between term life insurance and whole life insurance. 2) What is a beneficiary? What is a contingent beneficiary?

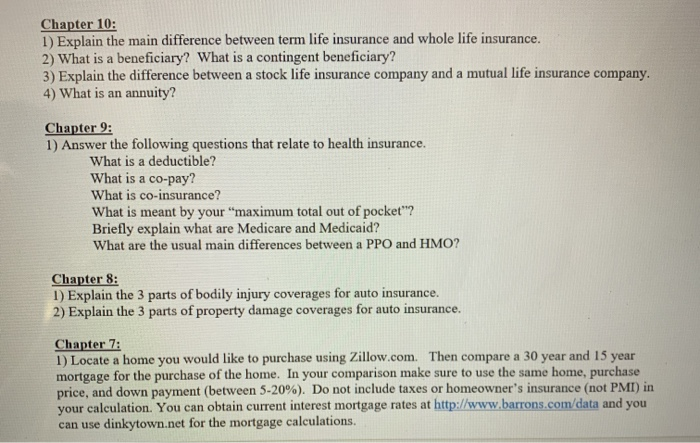

Chapter 10: 1) Explain the main difference between term life insurance and whole life insurance. 2) What is a beneficiary? What is a contingent beneficiary? 3) Explain the difference between a stock life insurance company and a mutual life insurance company 4) What is an annuity? Chapter 9: 1) Answer the following questions that relate to health insurance. What is a deductible? What is a co-pay? What is co-insurance? What is meant by your "maximum total out of pocket"? Briefly explain what are Medicare and Medicaid? What are the usual main differences between a PPO and HMO? Chapter 8: 1) Explain the 3 parts of bodily injury coverages for auto insurance. 2) Explain the 3 parts of property damage coverages for auto insurance. Chapter 7: 1) Locate a home you would like to purchase using Zillow.com. Then compare a 30 year and 15 year mortgage for the purchase of the home. In your comparison make sure to use the same home, purchase price, and down payment (between 5-20%). Do not include taxes or homeowner's insurance (not PMI) in your calculation. You can obtain current interest mortgage rates at http://www.barrons.com/data and you can use dinkytown.net for the mortgage calculations. 19) Which type of IRA are contributions (money you put into the account) tax deductible? 20) With insurance, what is a deductible? Chapter 10: 1) Explain the main difference between term life insurance and whole life insurance. 2) What is a beneficiary? What is a contingent beneficiary? 3) Explain the difference between a stock life insurance company and a mutual life insurance company 4) What is an annuity? Chapter 9: 1) Answer the following questions that relate to health insurance. What is a deductible? What is a co-pay? What is co-insurance? What is meant by your "maximum total out of pocket"? Briefly explain what are Medicare and Medicaid? What are the usual main differences between a PPO and HMO? Chapter 8: 1) Explain the 3 parts of bodily injury coverages for auto insurance. 2) Explain the 3 parts of property damage coverages for auto insurance. Chapter 7: 1) Locate a home you would like to purchase using Zillow.com. Then compare a 30 year and 15 year mortgage for the purchase of the home. In your comparison make sure to use the same home, purchase price, and down payment (between 5-20%). Do not include taxes or homeowner's insurance (not PMI) in your calculation. You can obtain current interest mortgage rates at http://www.barrons.com/data and you can use dinkytown.net for the mortgage calculations. 19) Which type of IRA are contributions (money you put into the account) tax deductible? 20) With insurance, what is a deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts