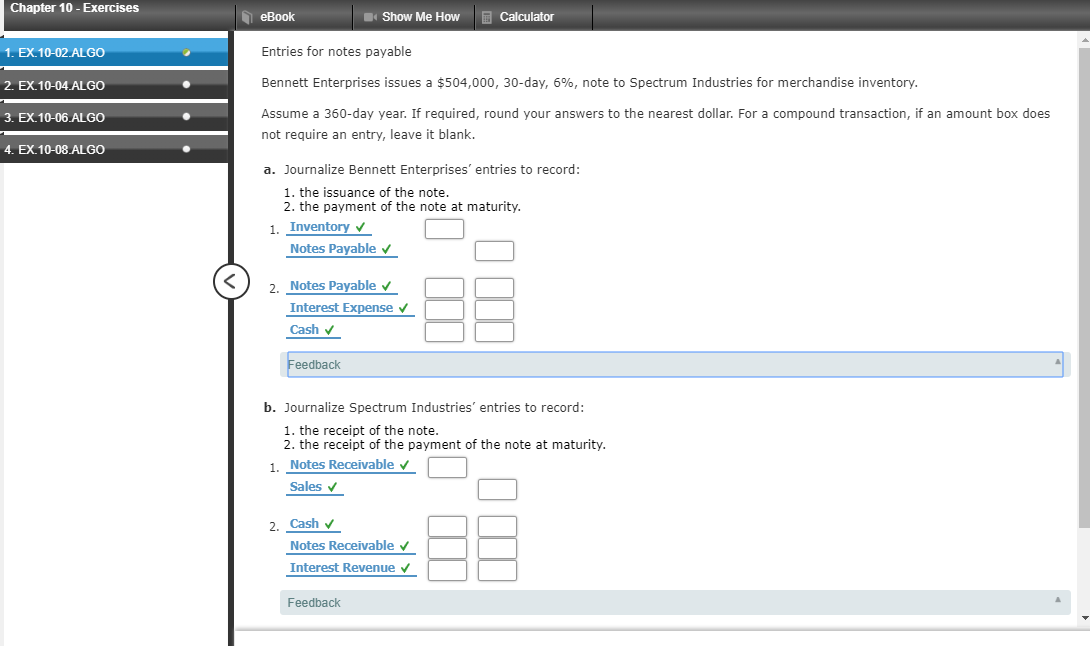

Question: Chapter 10 - Exercises eBook Show Me How Calculator 1. EX.10-02.ALGO Entries for notes payable 2. EX.10-04.ALGO Bennett Enterprises issues a $504,000, 30-day, 6%, note

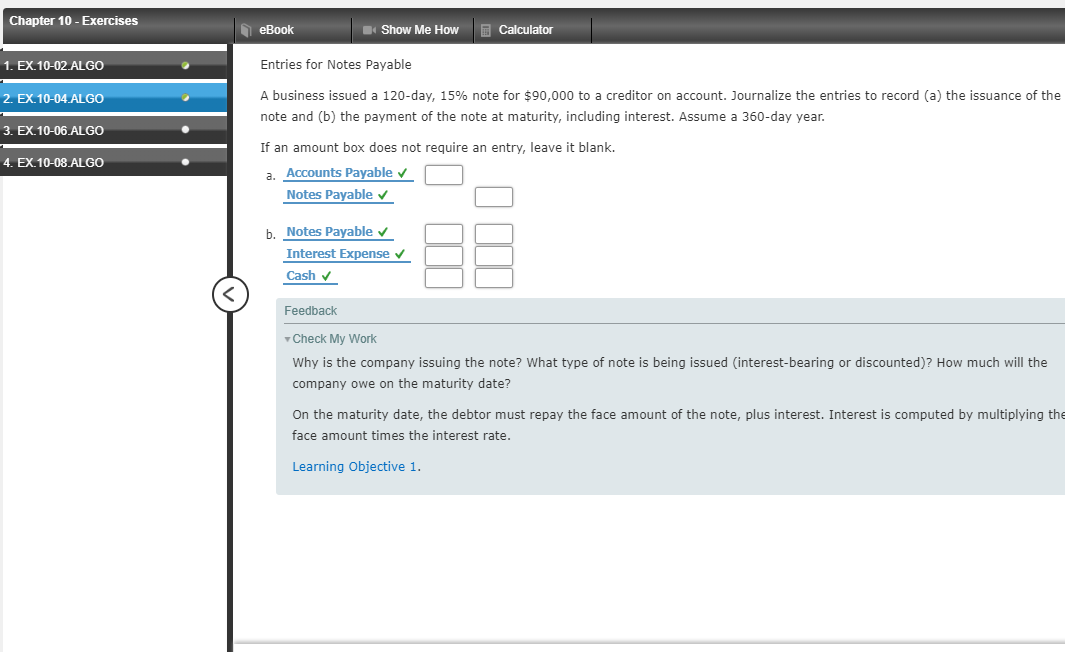

Chapter 10 - Exercises eBook Show Me How Calculator 1. EX.10-02.ALGO Entries for notes payable 2. EX.10-04.ALGO Bennett Enterprises issues a $504,000, 30-day, 6%, note to Spectrum Industries for merchandise inventory 3. EX.10-06. ALGO Assume a 360-day year. If required, round your answers to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. 4. EX.10-08.ALGO a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. 1. Inventory Notes Payable 2. Notes Payable Interest Expense Cash Feedback b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. 1. Notes Receivable Sales 2. Cash Notes Receivable Interest Revenue Feedback Chapter 10 - Exercises eBook Show Me How Calculator 1. EX.10-02.ALGO Entries for Notes Payable 2. EX.10-04.ALGO A business issued a 120-day, 15% note for $90,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. 3. EX.10-06 ALGO 4. EX.10-08 ALGO If an amount box does not require an entry, leave it blank. a. Accounts Payable Notes Payable b. Notes Payable Interest Expense Cash Feedback Check My Work Why is the company issuing the note? What type of note is being issued interest-bearing or discounted)? How much will the company owe on the maturity date? On the maturity date, the debtor must repay the face amount of the note, plus interest. Interest is computed by multiplying the face amount times the interest rate. Learning Objective 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts