Question: Chapter 10 HW i Saved Help Save & Exit Check my Lauprechta Incorporated has the following employees on payroll. Assume that all the employees has

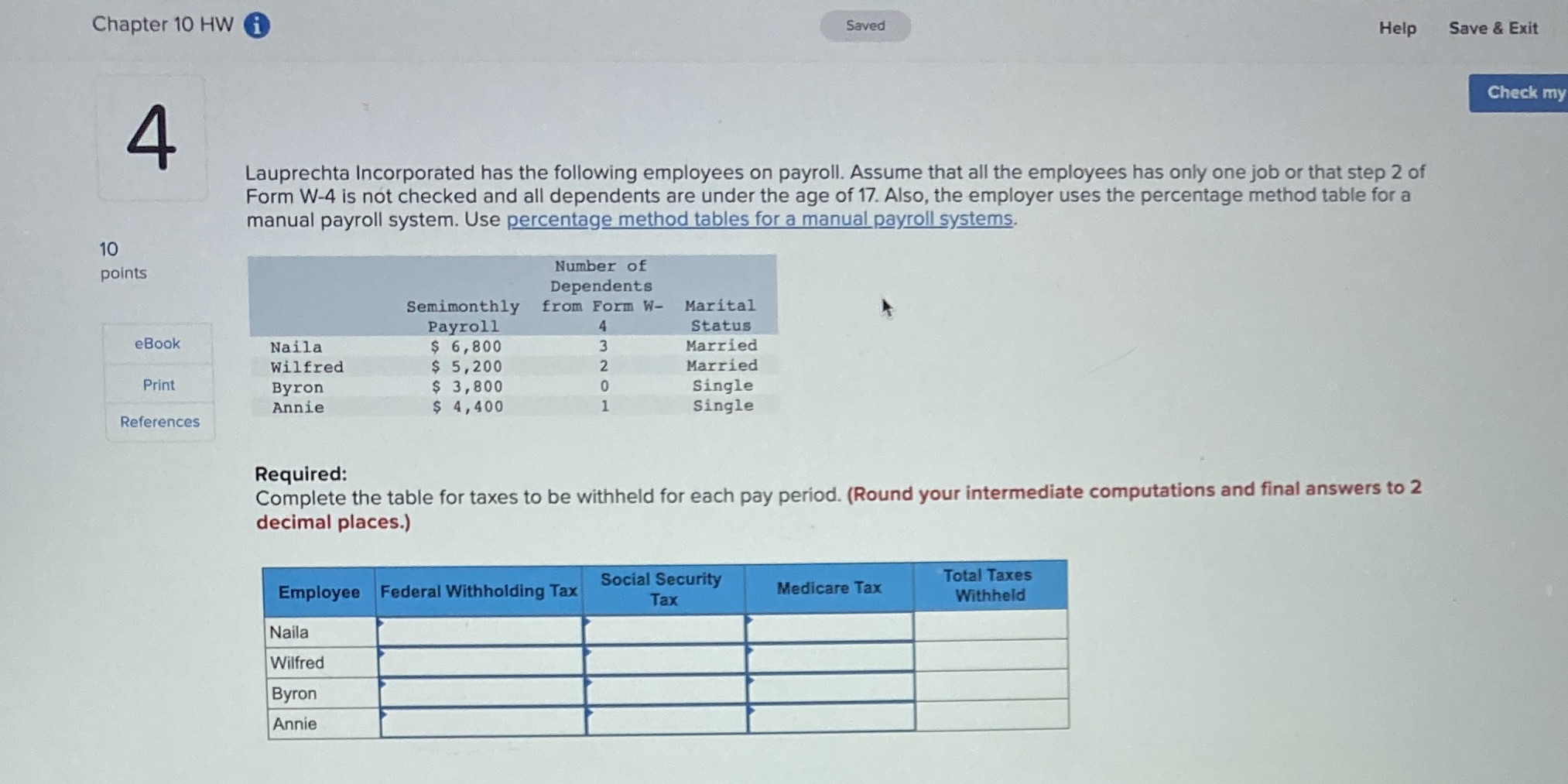

Chapter 10 HW i Saved Help Save & Exit Check my Lauprechta Incorporated has the following employees on payroll. Assume that all the employees has only one job or that step 2 of Form W-4 is not checked and all dependents are under the age of 17. Also, the employer uses the percentage method table for a manual payroll system. Use percentage method tables for a manual payroll systems. 10 points Number of Dependents Semimonthly from Form W- Marital Payroll Status eBook Naila $ 6, 800 Married Wilfred $ 5,200 HONWA Married Print Byron $ 3, 800 Single Annie $ 4, 400 Single References Required: Complete the table for taxes to be withheld for each pay period. (Round your intermediate computations and final answers to 2 decimal places.) Social Security Total Taxes Employee Federal Withholding Tax Medicare Tax Tax Withheld Naila Wilfred Byron Annie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts