Question: Chapter 10 In-Class Practice Problems: Interest Capitalization (Example #2) A company borrowed $100,000 at 10% interest from State Bank in the form of a six-month

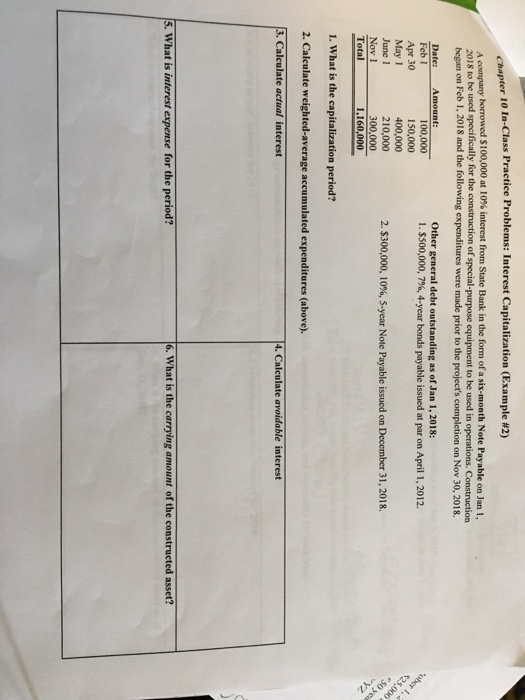

Chapter 10 In-Class Practice Problems: Interest Capitalization (Example #2) A company borrowed $100,000 at 10% interest from State Bank in the form of a six-month Note Payable on Jan 1. 2018 to be used specifically for the construction of special purpose equipment to be used in operations. Construction began on Feb 1, 2018 and the following expenditures were made prior to the project's completion on Nov 30, 2018 Other general debt outstanding as of Jan 1, 2018: 1. $500,000,7%, 4-year bonds payable issued at par on April 1, 2012. Date: Feb 1 Apr 30 May 1 June 1 Nov 1 Total Amount: 100,000 150,000 400,000 210,000 300,000 1,160,000 $25.000 ober 1.4 2. $300,000, 10%, 5-year Note Payable issued on December 31, 2018. akos 1. What is the capitalization period? 2. Calculate weighted average accumulated expenditures (above). 3. Calculate actual interest 4. Calculate avoidable interest 5. What is interest expense for the period? 6. What is the carrying amount of the constructed asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts