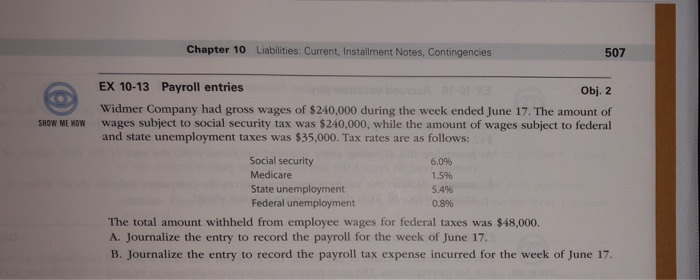

Question: Chapter 10 Liabilities: Current, Installment Notes, Contingencies 507 EX10-13 Payroll entries Widmer Company had gross wages of $240,000 during the week ended June 17. The

Chapter 10 Liabilities: Current, Installment Notes, Contingencies 507 EX10-13 Payroll entries Widmer Company had gross wages of $240,000 during the week ended June 17. The amount of and state unemployment taxes was $35,000. Tax rates are as follows: Obj. 2 SHOW ME HOWwages subject to social security tax was $240,000, while the amount of wages subject to federal Social security Medicare State unemployment Federal unemployment 6.096 1.5% 5.4% 0.896 The total amount withheld from employee wages for federal taxes was $48,000. A. Journalize the entry to record the payroll for the week of June 17. B. Journalize the entry to record the payroll tax expense incurred for the week of June 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts