Question: chapter 10 nr. 27 i need hlep Chapter 10 Capital Markets and the Pricing of Risk X 27. Suppose the risk-free interest rate is 2%,

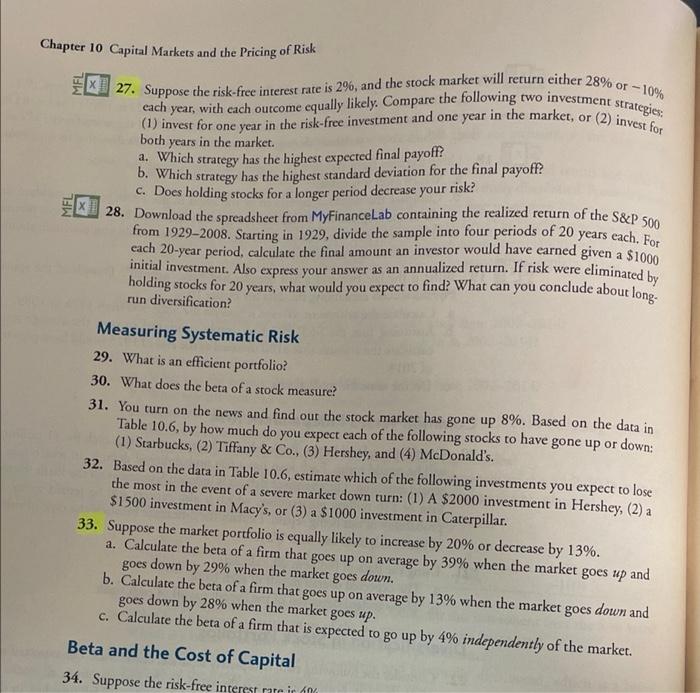

Chapter 10 Capital Markets and the Pricing of Risk X 27. Suppose the risk-free interest rate is 2%, and the stock market will return either 28% or -10% with each outcome equally likely. Compare the following two investment strategies: (1) invest for one year in the risk-free investment and one year in the market, or (2) invest for each year, both years in the market. a. Which strategy has the highest expected final payoff? b. Which strategy has the highest standard deviation for the final payoff? c. Does holding stocks for a longer period decrease your risk? 28. Download the spreadsheet from MyFinanceLab containing the realized return of the S&P 500 each 20-year period, calculate the final amount an investor would have earned given a $1000 from 1929-2008. Starting in 1929, divide the sample into four periods of 20 years each. For initial investment. Also express your answer as an annualized return. If risk were eliminated by holding stocks for 20 years, what would you expect to find? What can you conclude about long- run diversification? Measuring Systematic Risk 29. What is an efficient portfolio? 30. What does the beta of a stock measure? 31. You turn on the news and find out the stock market has gone up 8%. Based on the data in Table 10.6, by how much do you expect each of the following stocks to have gone up or down: (1) Starbucks, (2) Tiffany & Co., (3) Hershey, and (4) McDonald's. 32. Based on the data in Table 10.6, estimate which of the following investments you expect to lose the most in the event of a severe market down turn: (1) A $2000 investment in Hershey, (2) a $1500 investment in Macy's, or (3) a $1000 investment in Caterpillar. 33. Suppose the market portfolio is equally likely to increase by 20% or decrease by 13%. a. Calculate the beta of a firm that goes up on average by 39% when the market goes up and goes down by 29% when the market down. goes b. Calculate the beta of a firm that goes up on average by 13% when the market goes down and goes down by 28% when the market goes up. c. Calculate the beta of a firm that is expected to go up by 4% independently of the market. Beta and the Cost of Capital 34. Suppose the risk-free interest rate in 100 MFL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts