Question: Chapter 10, Problem 051 A granary is considering a conveyor used in the manufacture of grain for transporting, filling, or emptying. It can be purchased

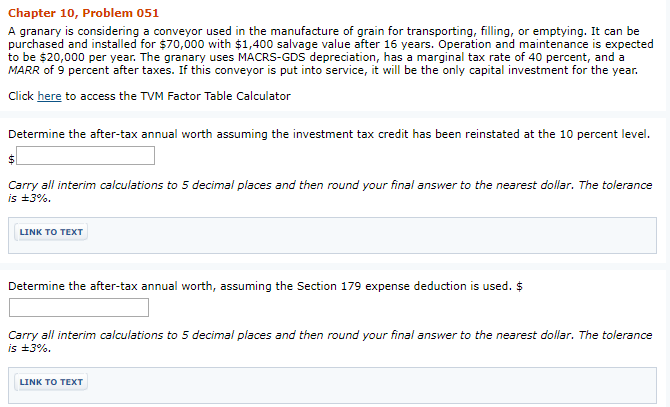

Chapter 10, Problem 051 A granary is considering a conveyor used in the manufacture of grain for transporting, filling, or emptying. It can be purchased and installed for $70,000 with $1,400 salvage value after 16 years. Operation and maintenance is expected to be $20,000 per year. The granary uses MACRS-GDS depreciation, has a marginal tax rate of 40 percent, and a MARR of 9 percent after taxes. If this conveyor is put into service, it will be the only capital investment for the year. Click here to access the TVM Factor Table Calculator Determine the after-tax annual worth assuming the investment tax credit has been reinstated at the 10 percent level. Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 3%. LINK TO TEXT Determine the after-tax annual worth, assuming the Section 179 expense deduction is used. $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 396. LINK TO TEXT Chapter 10, Problem 051 A granary is considering a conveyor used in the manufacture of grain for transporting, filling, or emptying. It can be purchased and installed for $70,000 with $1,400 salvage value after 16 years. Operation and maintenance is expected to be $20,000 per year. The granary uses MACRS-GDS depreciation, has a marginal tax rate of 40 percent, and a MARR of 9 percent after taxes. If this conveyor is put into service, it will be the only capital investment for the year. Click here to access the TVM Factor Table Calculator Determine the after-tax annual worth assuming the investment tax credit has been reinstated at the 10 percent level. Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 3%. LINK TO TEXT Determine the after-tax annual worth, assuming the Section 179 expense deduction is used. $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 396. LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts