Question: Chapter 10, Problem #32 (The following questions are in reference to Problem #31, which I've attached below:) a. Compute Bathtub Rings contribution margin percentage per

Chapter 10, Problem #32

(The following questions are in reference to Problem #31, which I've attached below:)

a. Compute Bathtub Rings contribution margin percentage per unit.

b. Compute Bathtub Rings break-even point in sales dollars.

c. What total pretax income (loss) would Bathtub Rings have if its total sales revenue amounted to $216,000? Thanks!

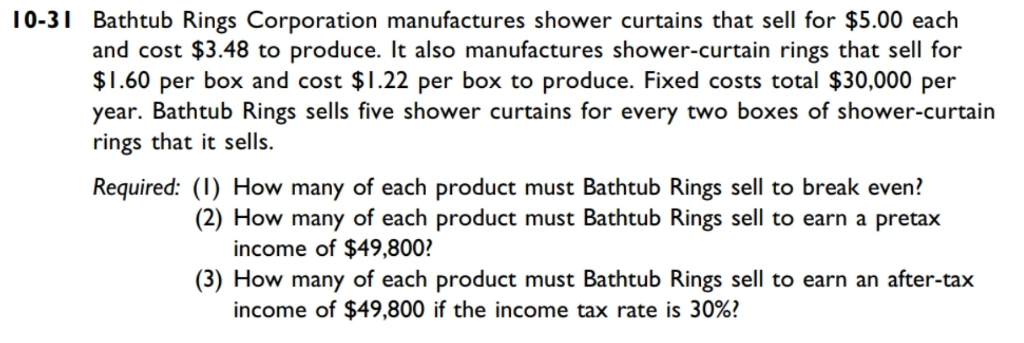

10-31 Bathtub Rings Corporation manufactures shower curtains that sell for $5.00 each and cost $3.48 to produce. It also manufactures shower-curtain rings that sell for $1.60 per box and cost $1.22 per box to produce. Fixed costs total $30,000 per year. Bathtub Rings sells five shower curtains for every two boxes of shower-curtain rings that it sells. Required: (I) How many of each product must Bathtub Rings sell to break even? (2) How many of each product must Bathtub Rings sell to earn a pretax income of $49,800? (3) How many of each product must Bathtub Rings sell to earn an after-tax income of $49,800 if the income tax rate is 30%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts