Question: CHAPTER #10 PROBLEM A Scott Tire Co. began operations January 1, 2014. Keith, the sole proprietor, purchased a building, land, and one piece of machinery

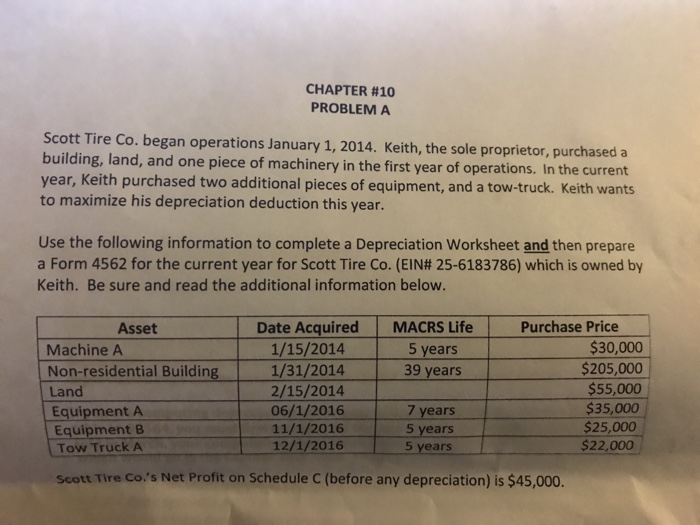

CHAPTER #10 PROBLEM A Scott Tire Co. began operations January 1, 2014. Keith, the sole proprietor, purchased a building, land, and one piece of machinery in the first year of operations. In the current year, Keith purchased two additional pieces of equipment, and a tow-truck. Keith wants to maximize his depreciation deduction this year. Use the following information to complete a Depreciation Worksheet and then prepare a Form 4562 for the current year for Scott Tire Co. (EIN# 25-6183786) which is owned by Keith. Be sure and read the additional information below Date Acquired MACRS LifePurchase Price 5 years 39 years Asset Machine A Non-residential Building Land Equipment A Equipment B Tow Truck A 1/15/2014 1/31/2014 2/15/2014 06/1/2016 11/1/2016 12/1/2016 $30,000 $205,000 $55,000 $35,000 $25,000 $22,000 7 years 5 years 5 years Scott Tire Co.'s Net Profit on Schedule C(before any depreciation) is $45,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts