Question: Chapter 10 Problems Tax Equivalent Yield Maria Lopez is a wealthy investor and is looking for tax shield from the bond interest income Maria's income

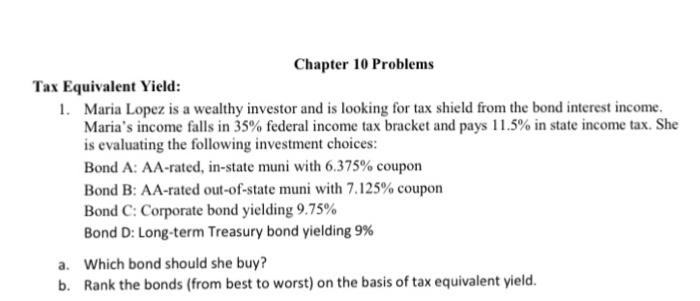

Chapter 10 Problems Tax Equivalent Yield Maria Lopez is a wealthy investor and is looking for tax shield from the bond interest income Maria's income falls in 35% federal income tax bracket and pays 11.5% in state income tax. She is evaluating the following investment choices Bond A: AA-rated, in-state muni with 6.375% coupon Bond B: AA-rated out-of-state muni with 7.125% coupon Bond C: Corporate bond yielding 9.75% Bond D: Long-term Treasury bond yielding 9% Which bond should she buy? Rank the bonds (from best to worst) on the basis of tax equivalent yield a. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts