Question: Chapter 10 - Q1: Please answer the following question in the image below. There may be multiple answers as noted by the empty boxes. Thank

Chapter 10 - Q1: Please answer the following question in the image below. There may be multiple answers as noted by the empty boxes. Thank you!

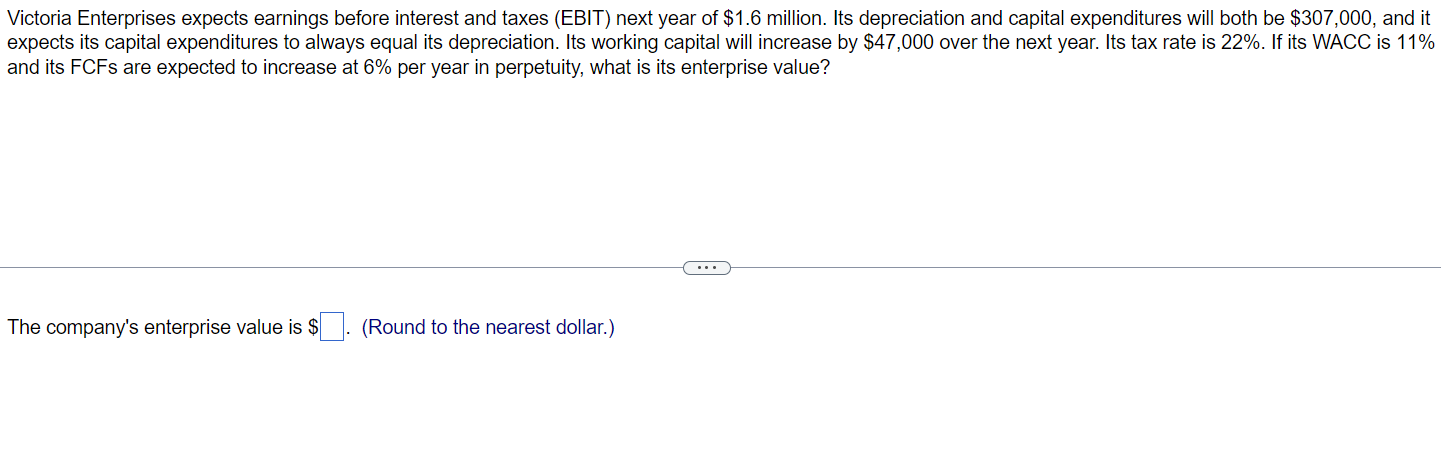

Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $1.6 million. Its depreciation and capital expenditures will both be $307,000, and it expects its capital expenditures to always equal its depreciation. Its working capital will increase by $47,000 over the next year. Its tax rate is 22%. If its WACC is 11% and its FCFs are expected to increase at 6% per year in perpetuity, what is its enterprise value? The company's enterprise value is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts