Question: Chapter 10 question 1 question 3 question 7 question 8 question 9 question 10 Question 1 Incorrect Mark 0.00 out of 1.00 P Flag question

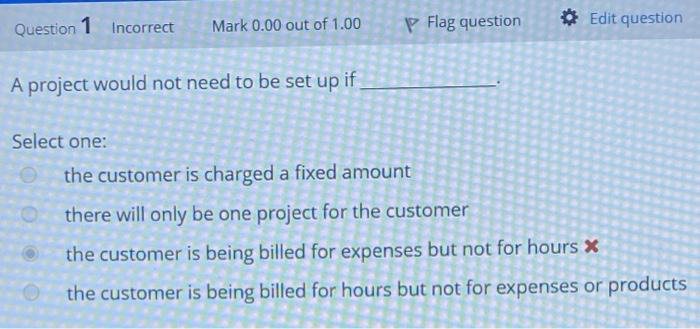

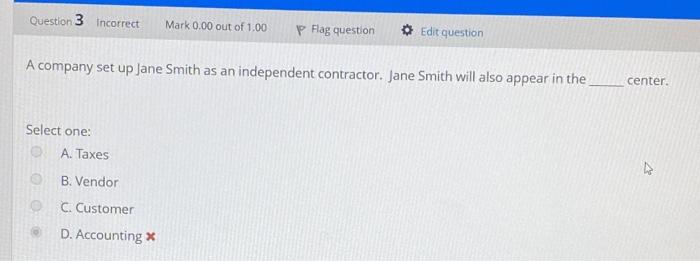

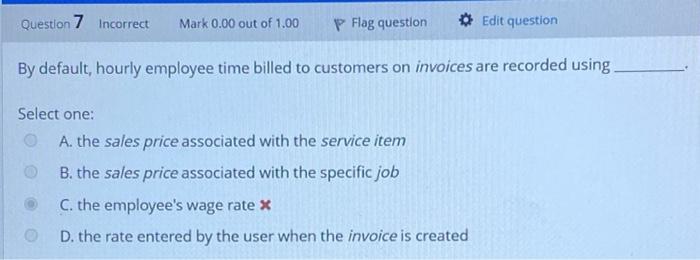

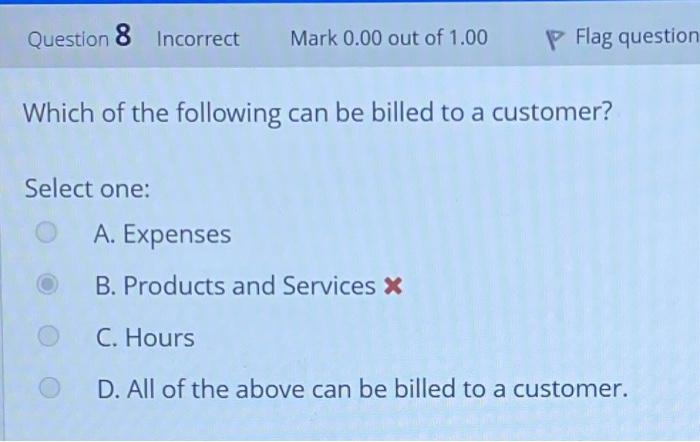

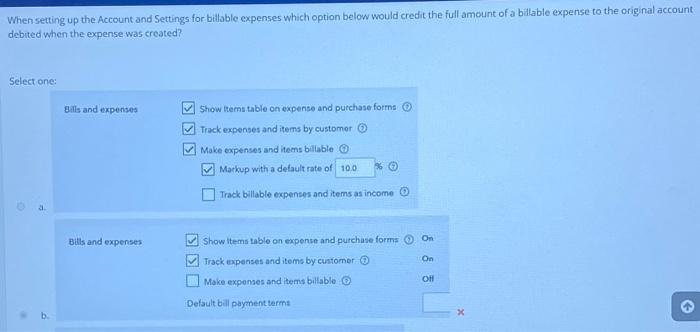

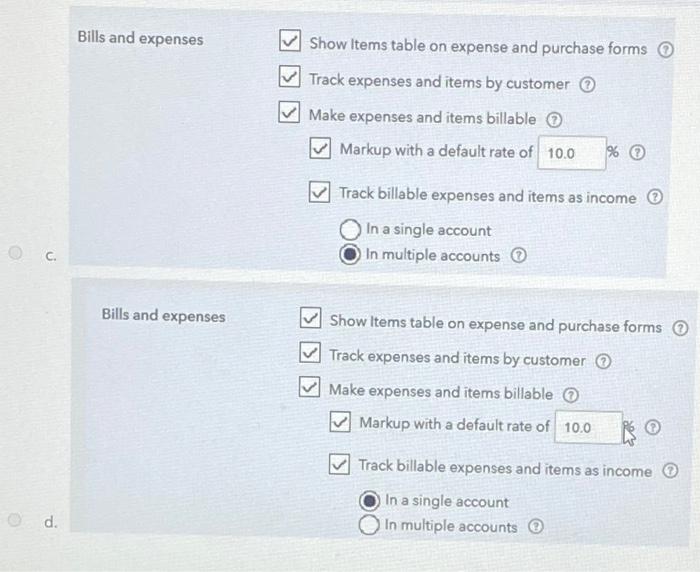

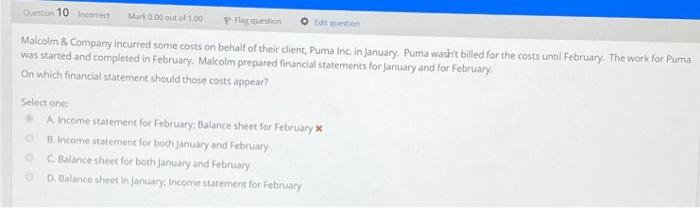

Question 1 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question A project would not need to be set up if Select one: the customer is charged a fixed amount there will only be one project for the customer the customer is being billed for expenses but not for hours X the customer is being billed for hours but not for expenses or products Question 3 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question A company set up Jane Smith as an independent contractor. Jane Smith will also appear in the center. Select one: A. Taxes B. Vendor C. Customer D. Accounting X Question 7 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question By default, hourly employee time billed to customers on invoices are recorded using Select one: A. the sales price associated with the service item B. the sales price associated with the specific job C. the employee's wage rate X D. the rate entered by the user when the invoice is created Question 8 Incorrect Mark 0.00 out of 1.00 P Flag question Which of the following can be billed to a customer? Select one: A. Expenses B. Products and Services X C. Hours D. All of the above can be billed to a customer. When setting up the Account and Settings for billable expenses which option below would credit the full amount of a billable expense to the original account debited when the expense was created? Select one: Bills and expenses Show Items table on expense and purchase forms Track expenses and items by customer Make expenses and items billable Markup with a default rate of 100 % 0 s Track billable expenses and items as income . Bills and expenses Show Items table on expense and purchase forms On Track expenses and items by customer On Make expenses and items billable 232 Default bill payment terms X Bills and expenses Show Items table on expense and purchase forms o Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 Track billable expenses and items as income In a single account In multiple accounts 0 C. Bills and expenses Show Items table on expense and purchase forms Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 Track billable expenses and items as income In a single account In multiple accounts O d. Queron 10 cores Marko Do out of 100 Plaquestion O testo Malcolm & Company incurred some costs on behalf of their client, Puma Inc in January, Puma washit billed for the costs until February. The work for Puma was started and completed in February Makolm prepared financial statements for January and for February On which financial statement should those costs appear? Select one A. Income statement for February, Batance sheet for February * B. Income statement for both January and February Balance sheet for both January and February Balance sheet in January, Income statement for February Question 1 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question A project would not need to be set up if Select one: the customer is charged a fixed amount there will only be one project for the customer the customer is being billed for expenses but not for hours X the customer is being billed for hours but not for expenses or products Question 3 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question A company set up Jane Smith as an independent contractor. Jane Smith will also appear in the center. Select one: A. Taxes B. Vendor C. Customer D. Accounting X Question 7 Incorrect Mark 0.00 out of 1.00 P Flag question Edit question By default, hourly employee time billed to customers on invoices are recorded using Select one: A. the sales price associated with the service item B. the sales price associated with the specific job C. the employee's wage rate X D. the rate entered by the user when the invoice is created Question 8 Incorrect Mark 0.00 out of 1.00 P Flag question Which of the following can be billed to a customer? Select one: A. Expenses B. Products and Services X C. Hours D. All of the above can be billed to a customer. When setting up the Account and Settings for billable expenses which option below would credit the full amount of a billable expense to the original account debited when the expense was created? Select one: Bills and expenses Show Items table on expense and purchase forms Track expenses and items by customer Make expenses and items billable Markup with a default rate of 100 % 0 s Track billable expenses and items as income . Bills and expenses Show Items table on expense and purchase forms On Track expenses and items by customer On Make expenses and items billable 232 Default bill payment terms X Bills and expenses Show Items table on expense and purchase forms o Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 Track billable expenses and items as income In a single account In multiple accounts 0 C. Bills and expenses Show Items table on expense and purchase forms Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 Track billable expenses and items as income In a single account In multiple accounts O d. Queron 10 cores Marko Do out of 100 Plaquestion O testo Malcolm & Company incurred some costs on behalf of their client, Puma Inc in January, Puma washit billed for the costs until February. The work for Puma was started and completed in February Makolm prepared financial statements for January and for February On which financial statement should those costs appear? Select one A. Income statement for February, Batance sheet for February * B. Income statement for both January and February Balance sheet for both January and February Balance sheet in January, Income statement for February

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts