Question: Chapter 11 1 What are the portfolio Weights for a portfolio that has 185 shares of stock A that sells for $64 per share, 115

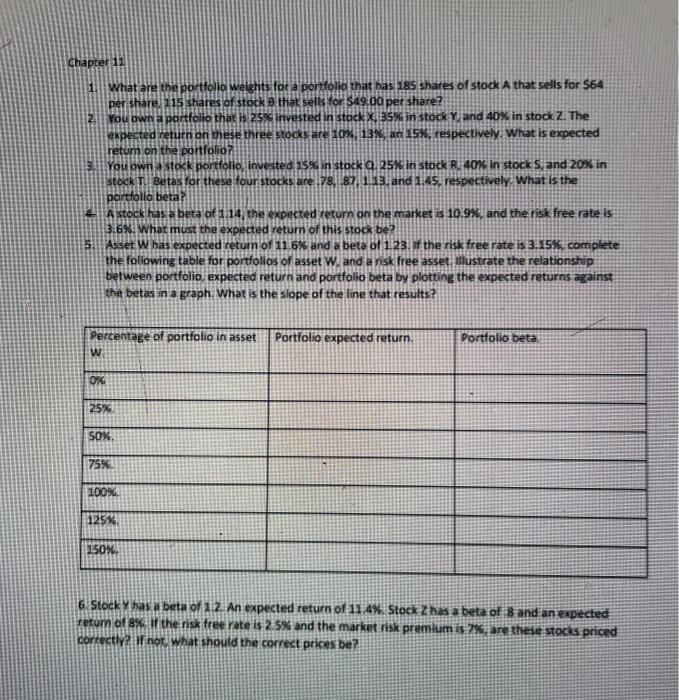

Chapter 11 1 What are the portfolio Weights for a portfolio that has 185 shares of stock A that sells for $64 per share, 115 shares of stock B that sells for $49.00 per share? 24 You own a portfolio that is 25% invested in stock X 35% in stock Y and 40% in stock Z. The expected return on these three stocks are 10%, 13%, an 15%, respectively. What is expected retum on the portfolio? 3 You own a stock portfolio Invested 15% in stock 4.25% in stock R. 40% in stock Sand 20% in stock T. Betas for these four stocks are 78, 87, 1.13. and 1.45. respectively. What is the portfolio beta? A stock has a beta of 114, the expected return on the market is 10.9%, and the risk free rate is 3.68. What must the expected return of this stock be? 5:11 Asset Whas expected return of 11.6% and a beta of 1.23. If the risk free rate is 3.15%, complete the following table for portfolios of asset W. and a nsk free asset, illustrate the relationship between portfolio, expected return and portfolio beta by plotting the expected returns against the betas in a graph. What is the slope of the line that results? Percentage of portfolio in asset w Portfolio expected return. Portfolio beta 0% 25% SOK 75% 100% 125% 150%, 6 Stock Y has a beta of 12 An expected return of 11.4% Stock Zhas a beta of 8 and an expected return of 8% of the risk tree rate is 2.5% and the market risk premium is 2% are these stocis priced correctly? If not. What should the correct prices be? Chapter 11 1 What are the portfolio Weights for a portfolio that has 185 shares of stock A that sells for $64 per share, 115 shares of stock B that sells for $49.00 per share? 24 You own a portfolio that is 25% invested in stock X 35% in stock Y and 40% in stock Z. The expected return on these three stocks are 10%, 13%, an 15%, respectively. What is expected retum on the portfolio? 3 You own a stock portfolio Invested 15% in stock 4.25% in stock R. 40% in stock Sand 20% in stock T. Betas for these four stocks are 78, 87, 1.13. and 1.45. respectively. What is the portfolio beta? A stock has a beta of 114, the expected return on the market is 10.9%, and the risk free rate is 3.68. What must the expected return of this stock be? 5:11 Asset Whas expected return of 11.6% and a beta of 1.23. If the risk free rate is 3.15%, complete the following table for portfolios of asset W. and a nsk free asset, illustrate the relationship between portfolio, expected return and portfolio beta by plotting the expected returns against the betas in a graph. What is the slope of the line that results? Percentage of portfolio in asset w Portfolio expected return. Portfolio beta 0% 25% SOK 75% 100% 125% 150%, 6 Stock Y has a beta of 12 An expected return of 11.4% Stock Zhas a beta of 8 and an expected return of 8% of the risk tree rate is 2.5% and the market risk premium is 2% are these stocis priced correctly? If not. What should the correct prices be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts