Question: CHAPTER 11, 2 (PART 2) PLEASE READ: This is one question that has 5 parts (A-1, A-2, A-3, b, and c), please answer the FULL

CHAPTER 11, 2 (PART 2)

PLEASE READ: This is one question that has 5 parts (A-1, A-2, A-3, b, and c), please answer the FULL question, please TYPE your answer, please LABEL your answer.

A-1)

A-2)

A-3)

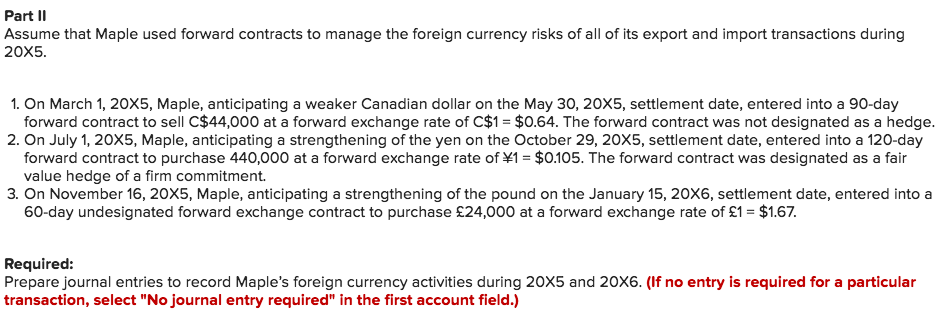

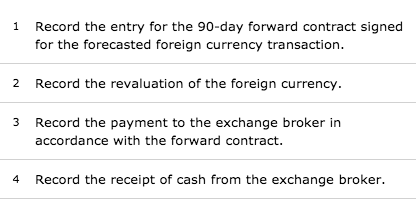

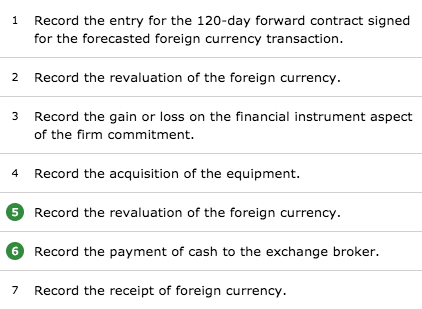

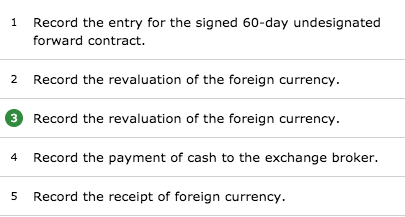

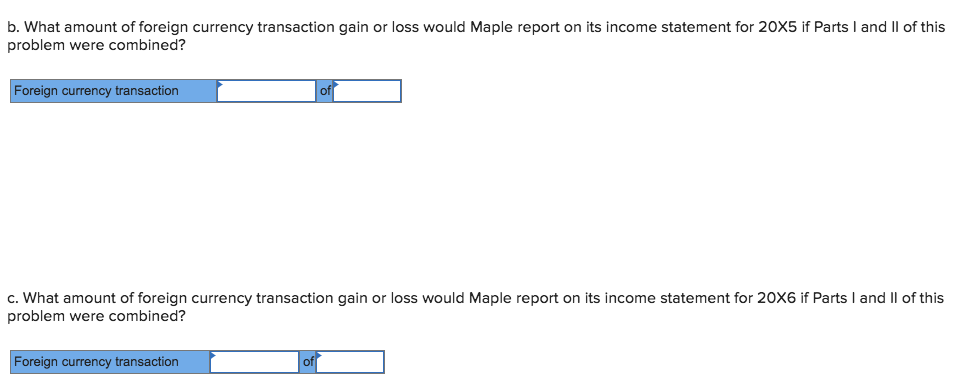

PartII Assume that Maple used forward contracts to manage the foreign currency risks of all of its export and import transactions during 205 1. On March 1, 20X5, Maple, anticipating a weaker Canadian dollar on the May 30, 20X5, settlement date, entered into a 90-day forward contract to sell C$44,000 at a forward exchange rate of C$1 = $0.64. The forward contract was not designated as a hedge. 2. On July 1, 20X5, Maple, anticipating a strengthening of the yen on the October 29, 20X5, settlement date, entered into a 120-day forward contract to purchase 440,000 at a forward exchange rate of 1 = $0.105. The forward contract was designated as a fair value hedge of a firm commitment. 3. On November 16, 20X5, Maple, anticipating a strengthening of the pound on the January 15, 20X6, settlement date, entered into a 60-day undesignated forward exchange contract to purchase 24,000 at a forward exchange rate of 1 = $1.67 Required: Prepare journal entries to record Maple's foreign currency activities during 20X5 and 20X6. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts