Question: Chapter 11: (90 points) 11.1. Consider an asset with a beta of -0.5, a risk-free rate of 10%, and a market return of 17%. a-

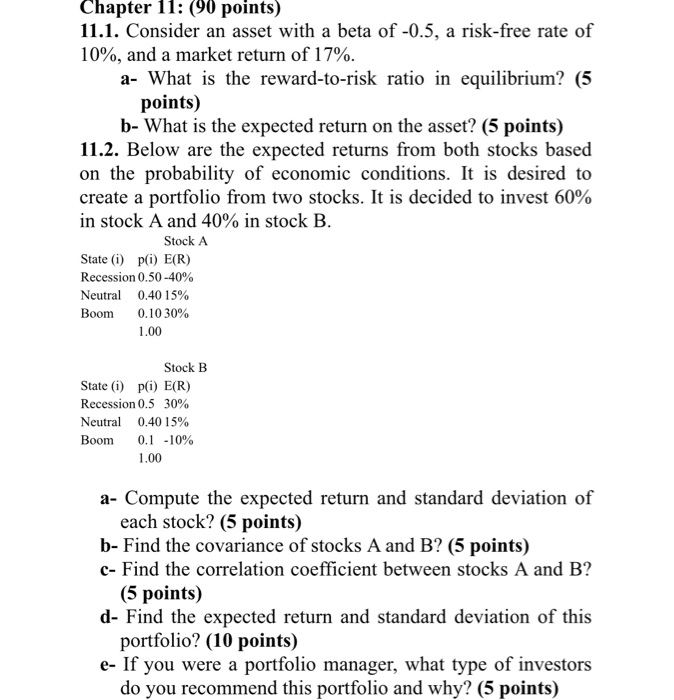

Chapter 11: (90 points) 11.1. Consider an asset with a beta of -0.5, a risk-free rate of 10%, and a market return of 17%. a- What is the reward-to-risk ratio in equilibrium? (5 points) b- What is the expected return on the asset? (5 points) 11.2. Below are the expected returns from both stocks based on the probability of economic conditions. It is desired to create a portfolio from two stocks. It is decided to invest 60% in stock A and 40% in stock B. Stock A State (i) p(i) E(R) Recession 0.50-40% Neutral 0.40 15% Boom 0.10 30% 1.00 Stock B State (i) p(i) E(R) Recession 0.5 30% Neutral 0.40 15% Boom 0.1 -10% 1.00 a- Compute the expected return and standard deviation of each stock? (5 points) b- Find the covariance of stocks A and B? (5 points) C- Find the correlation coefficient between stocks A and B? (5 points) d- Find the expected return and standard deviation of this portfolio? (10 points) e- If you were a portfolio manager, what type of investors do you recommend this portfolio and why? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts