Question: Chapter 11 Class examples Example 1: On January 1, we purchase equipment for 550,000 cash. The equipment has an estimated service life of 5 years

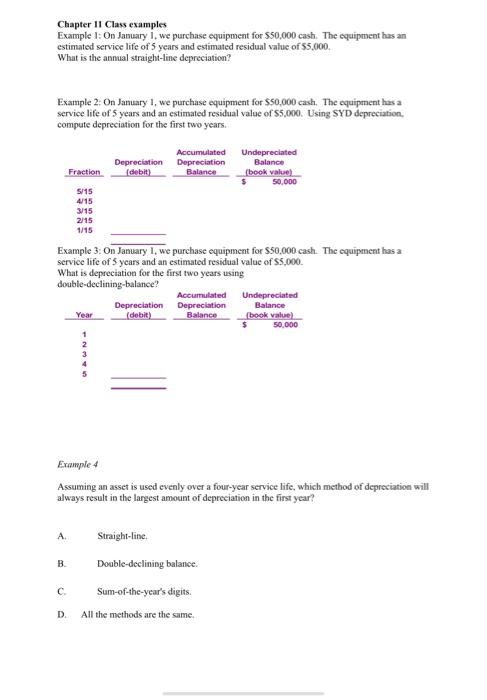

Chapter 11 Class examples Example 1: On January 1, we purchase equipment for 550,000 cash. The equipment has an estimated service life of 5 years and estimated residual value of 55,000 What is the annual straight-line depreciation? Example 2: On January 1, we purchase equipment for $50,000 cash. The equipment has a service life of 5 years and an estimated residual value of $5,000. Using SYD depreciation compute depreciation for the first two years. Accumulated Undepreciated Depreciation Depreciation Balance Fraction (debit) Balance (book value) $ 50,000 5/15 4/15 3/15 2/15 1/15 Example 3: On January 1, we purchase equipment for S50,000 cash. The equipment has a service life of 5 years and an estimated residual value of $5,000 What is depreciation for the first two years using double-declining-balance? Accumulated Undepreciated Depreciation Depreciation Balance Year (debit) Balance book value) $ 50,000 Example 4 Assuming an asset is used evenly over a four-year service life, which method of depreciation will always result in the largest amount of depreciation in the first year? A . Straight-line Double-doclining balance Sum-of-the-year's digits. All the methods are the same C D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts