Question: Chapter 11: Current Liabilities and Payroll Part 1 (Use the annual report of the company that you are researching) Please examine the current liabilities on

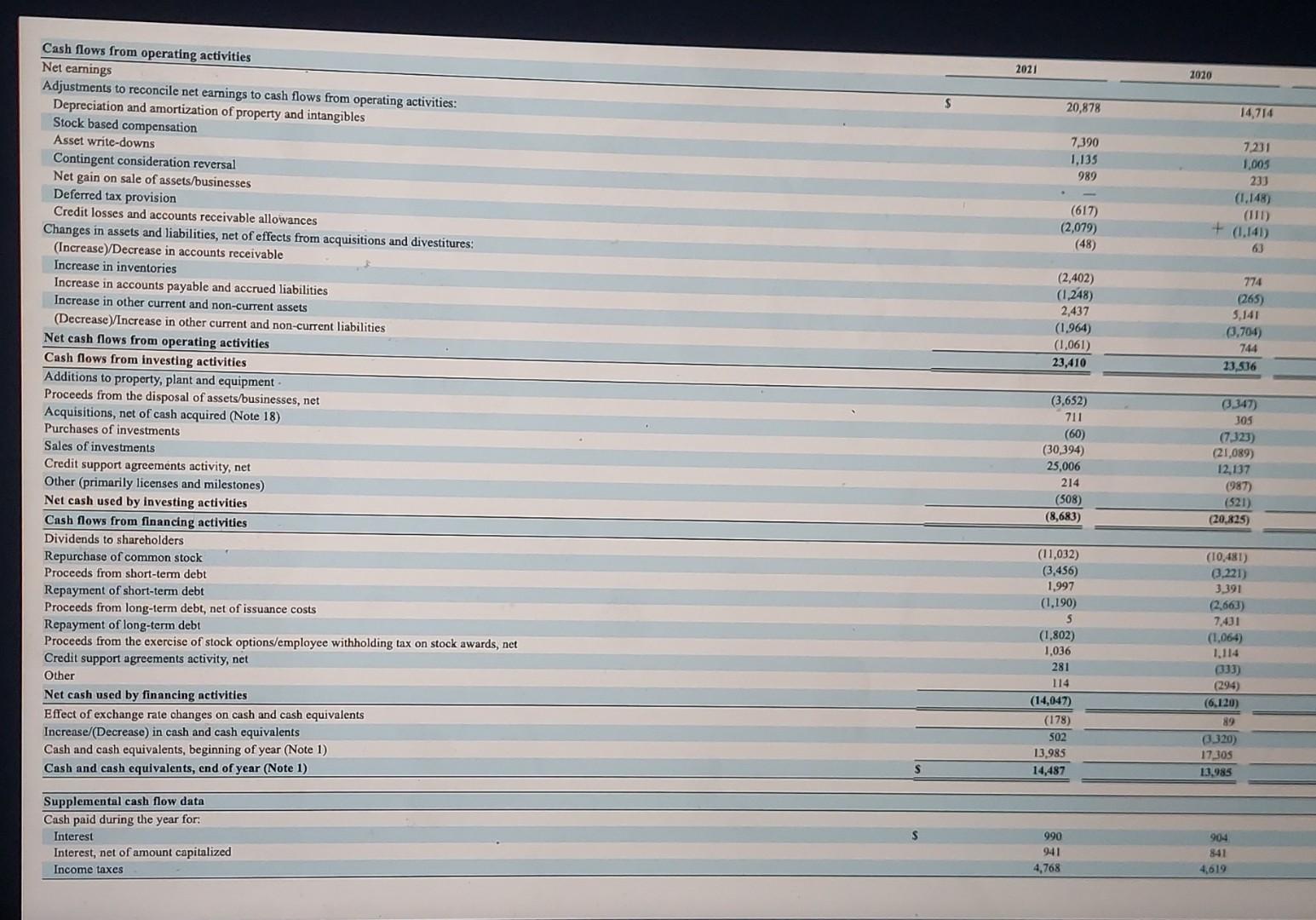

Chapter 11: Current Liabilities and Payroll Part 1 (Use the annual report of the company that you are researching) Please examine the current liabilities on the Balance Sheet and identify those that are definitely determinable and those that are probably estimates. Does the corporation have any liabilities with respect to pensions, vacation pay, or warranties? Please see the notes to the financial statements for details with respect to these liabilities. Please let us know what a contingent liikility is and if your company has any contingent liabilities. Part 2 Employees are subject to taxes withheld from their paychecks. Please indicate the federal taxes that are withheld from most employee paychecks. Please let us know why deductions from employees earnings are classified as liabilities for the employer. Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to cash flows from operating activities: Depreciation and amortization of property and intangibles Stock based compensation Asset write-downs Contingent consideration reversal Net gain on sale of assets/businesses Deferred tax provision Credit losses and accounts receivable allowances Changes in assets and liabilities, net of effects from acquisitions and divestitures: (Increase)/Decrease in accounts receivable Increase in inventories Increase in accounts payable and accrued liabilities Increase in other current and non-current assets (Decrease)/Increase in other current and non-current liabilities Net cash flows from operating activities Cash flows from investing activities Additions to property, plant and equipment - Proceeds from the disposal of assets/businesses, net Acquisitions, net of cash acquired (Note 18) Purchases of investments Sales of investments Credit support agreements activity, net Other (primarily licenses and milestones) Net cash used by investing activities Cash flows from financing activities Dividends to shareholders Repurchase of common stock Proceeds from short-term debt Repayment of short-term debt Proceeds from long-term debt, net of issuance costs Repayment of long-term debt Proceeds from the exercise of stock options/employee withholding tax on stock awards, net Credit support agreements activity, net Other Net cash used by financing activities Effect of exchange rate ohanges on cash and cash equivalents Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year (Note 1) Cash and cash equivalents, end of year (Note 1) Supplemental cash flow data Cash paid during the year for. Interest Interest, net of amount capitalized Income taxes 2021 2020 $ 20,878 14,7147,2311,005233(1,148)(111)+(1,141)63774(265)5,141(3,704)74423,536 (3,652)711(60)(30,394)25,006214(508)(8,683) (11,032) (3,456) 1,997 (1,190) 7,390 1,135 989 (617) (2,079) (48) (2,402) (1,248) 2,437 (1,964) 23,410(1,061) (1,802) 1,036 281 1,036281114 \begin{tabular}{rr} \hline & (14,047) \\ \hline(178) \\ \hline 502 \\ & 13,985 \\ \hline & 14,487 \\ \hline \end{tabular} \begin{tabular}{rr} \hline(6,120) \\ \hline & (3930) \\ \hline 17,305 \\ \hline 13,985 \\ \hline \end{tabular} e taxes Chapter 11: Current Liabilities and Payroll Part 1 (Use the annual report of the company that you are researching) Please examine the current liabilities on the Balance Sheet and identify those that are definitely determinable and those that are probably estimates. Does the corporation have any liabilities with respect to pensions, vacation pay, or warranties? Please see the notes to the financial statements for details with respect to these liabilities. Please let us know what a contingent liikility is and if your company has any contingent liabilities. Part 2 Employees are subject to taxes withheld from their paychecks. Please indicate the federal taxes that are withheld from most employee paychecks. Please let us know why deductions from employees earnings are classified as liabilities for the employer. Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to cash flows from operating activities: Depreciation and amortization of property and intangibles Stock based compensation Asset write-downs Contingent consideration reversal Net gain on sale of assets/businesses Deferred tax provision Credit losses and accounts receivable allowances Changes in assets and liabilities, net of effects from acquisitions and divestitures: (Increase)/Decrease in accounts receivable Increase in inventories Increase in accounts payable and accrued liabilities Increase in other current and non-current assets (Decrease)/Increase in other current and non-current liabilities Net cash flows from operating activities Cash flows from investing activities Additions to property, plant and equipment - Proceeds from the disposal of assets/businesses, net Acquisitions, net of cash acquired (Note 18) Purchases of investments Sales of investments Credit support agreements activity, net Other (primarily licenses and milestones) Net cash used by investing activities Cash flows from financing activities Dividends to shareholders Repurchase of common stock Proceeds from short-term debt Repayment of short-term debt Proceeds from long-term debt, net of issuance costs Repayment of long-term debt Proceeds from the exercise of stock options/employee withholding tax on stock awards, net Credit support agreements activity, net Other Net cash used by financing activities Effect of exchange rate ohanges on cash and cash equivalents Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year (Note 1) Cash and cash equivalents, end of year (Note 1) Supplemental cash flow data Cash paid during the year for. Interest Interest, net of amount capitalized Income taxes 2021 2020 $ 20,878 14,7147,2311,005233(1,148)(111)+(1,141)63774(265)5,141(3,704)74423,536 (3,652)711(60)(30,394)25,006214(508)(8,683) (11,032) (3,456) 1,997 (1,190) 7,390 1,135 989 (617) (2,079) (48) (2,402) (1,248) 2,437 (1,964) 23,410(1,061) (1,802) 1,036 281 1,036281114 \begin{tabular}{rr} \hline & (14,047) \\ \hline(178) \\ \hline 502 \\ & 13,985 \\ \hline & 14,487 \\ \hline \end{tabular} \begin{tabular}{rr} \hline(6,120) \\ \hline & (3930) \\ \hline 17,305 \\ \hline 13,985 \\ \hline \end{tabular} e taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts