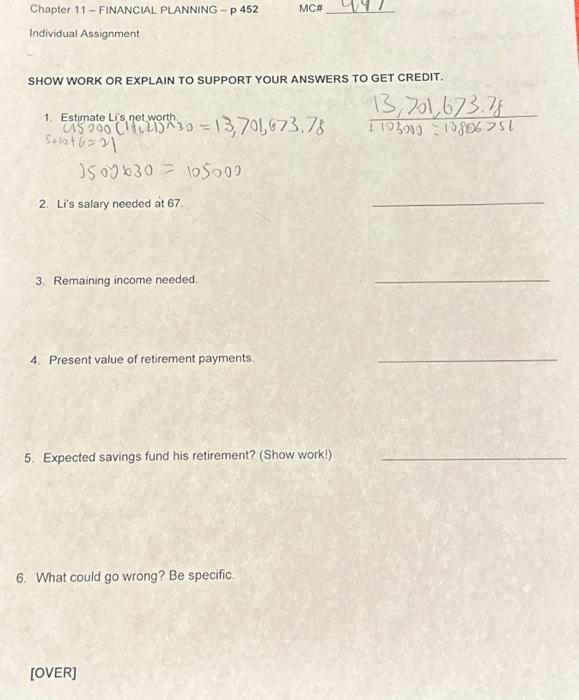

Question: Chapter 11- FINANCIAL PLANNING - p 452 Individual Assignment SHOW WORK OR EXPLAIN TO SUPPORT YOUR ANSWERS TO GET CREDIT. 1. Estimate Li's net worth.

![6. What could go wrong? Be specific. [OVER] 13,701,673.78 + 103000 13806751](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fc4c4ba088e_63566fc4c4b1ada0.jpg)

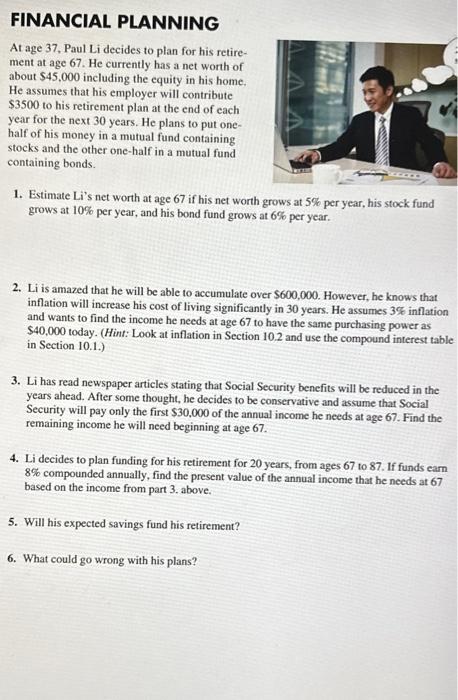

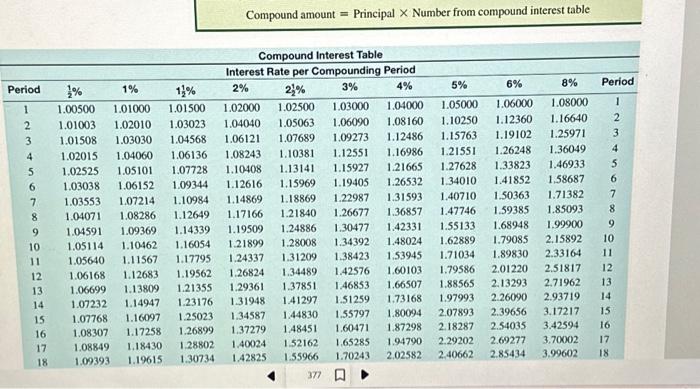

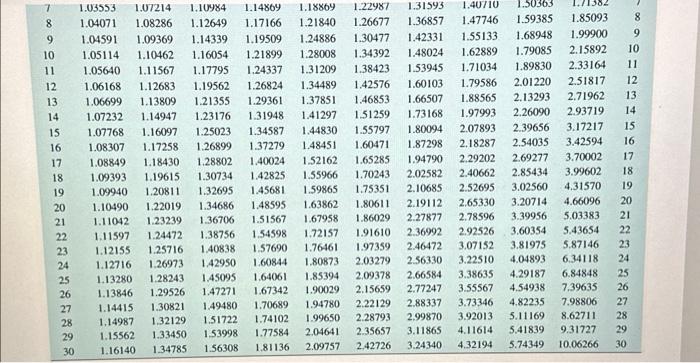

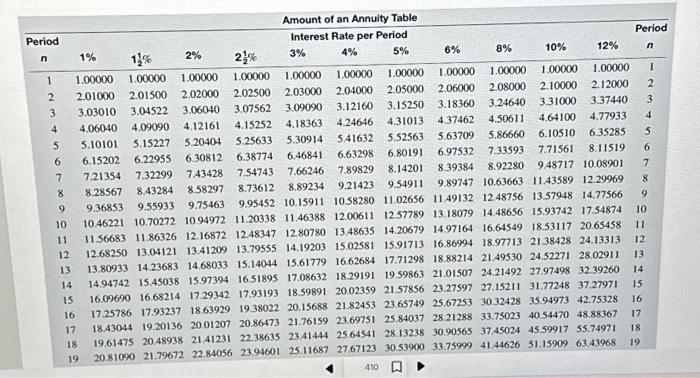

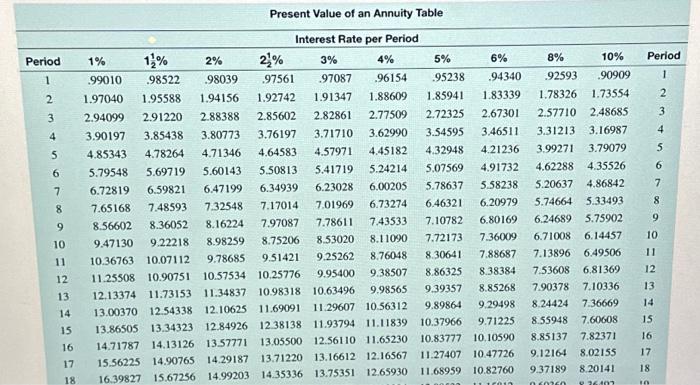

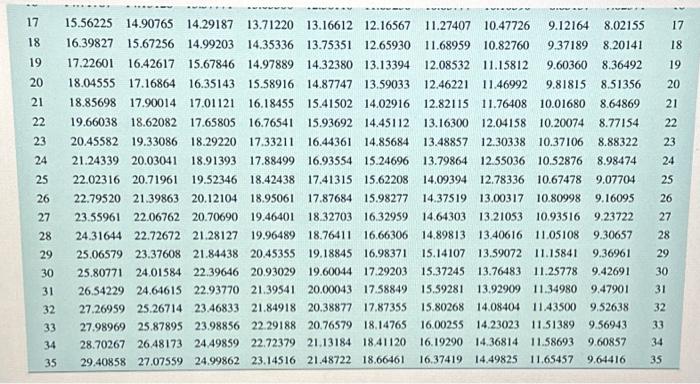

Individual Assignment SHOW WORK OR EXPLAIN TO SUPPORT YOUR ANSWERS TO GET CREDIT. 1. Estimate Lis net worth 3500630=105000 2. Li's salary needed at 67 3. Remaining income needed. 4. Present value of retirement payments. 5. Expected savings fund his retirement? (Show work!) 6. What could go wrong? Be specific [OVER] At age 37, Paul Li decides to plan for his retirement at age 67. He currently has a net worth of about \$45,000 including the equity in his home, He assumes that his employer will contribute $3500 to his retirement plan at the end of each year for the next 30 years. He plans to put onehalf of his money in a mutual fund containing stocks and the other one-half in a mutual fund containing bonds. 1. Estimate Li's net worth at age 67 if his net worth grows at 5% per year, his stock fund grows at 10% per year, and his bond fund grows at 6% per year. 2. Li is amazed that he will be able to accumulate over $600,000. However, he knows that inflation will increase his cost of living significantly in 30 years. He assumes 3% inflation and wants to find the income he needs at age 67 to have the same purchasing power as $40,000 today. (Hint: Look at inflation in Section 10.2 and use the compound interest table in Section 10.1.) 3. Li has read newspaper articles stating that Social Security benefits will be reduced in the years ahead. After some thought, he decides to be conservative and assume that Social Security will pay only the first $30,000 of the annual income he needs at age 67 . Find the remaining income he will need beginning at age 67. 4. Li decides to plan funding for his retirement for 20 years, from ages 67 to 87 . If funds earn 8% compounded annually, find the present value of the annual income that he needs at 67 based on the income from part 3. above. 5. Will his expected savings fund his retirement? 6. What could go wrong with his plans? Compound amount = Principal Number from compound interest table \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 7 & 553 & 214 & 984 & 1.14869 & 869 & 1.22987 & 1.31593 & 1.40/10 & 1.50363 & 1+1 & \\ \hline 8 & 1.04071 & 1.08286 & 1.12649 & 1.17166 & 1.21840 & 1.26677 & 1.36857 & 1.47746 & 1.59385 & 1.85093 & \\ \hline 9 & 1.04591 & 1.09369 & 1.14339 & 1.19509 & 1.24886 & 1.30477 & 1.42331 & 1.55133 & 1.68948 & 1.99900 & 0 \\ \hline 10 & 1.05114 & 1.10462 & 1.16054 & 1.21899 & 1.28008 & 1.34392 & 1.48024 & 1.62889 & 1.79085 & 2.15892 & 10 \\ \hline 11 & 1.05640 & 1.11567 & 1.17795 & 1.24337 & 1.31209 & 1.38423 & 1.53945 & 1.71034 & 1.89830 & 2.33164 & 1 \\ \hline 12 & 1.06168 & 1.12683 & 1.19562 & 1.26824 & 1.34489 & 1.42576 & 1.60103 & 1.79586 & 2.01220 & 2.51817 & 12 \\ \hline 13 & 1.06699 & 1.13809 & 1.21355 & 1.29361 & 1.37851 & 1.46853 & 1.66507 & 1.88565 & 2.13293 & 2.71962 & 13 \\ \hline 14 & 1.07232 & 1.14947 & 1.23176 & 1.31948 & 1.41297 & 1.51259 & 1.73168 & 1.97993 & 2.26090 & 2.93719 & 14 \\ \hline 15 & 1.07768 & 1.16097 & 1.25023 & 1.34587 & 1.44830 & 1.55797 & 1.80094 & 2.07893 & 2.39656 & 3.17217 & \\ \hline 16 & 1.08307 & 1.17258 & 1.26899 & 1.37279 & 1.48451 & 1.60471 & 1.87298 & 2,18287 & 2.54035 & 3.42594 & 16 \\ \hline 17 & 1.08849 & 1.18430 & 1.28802 & 1.40024 & 1.52162 & 1.65285 & 1.94790 & 2.29202 & 2.69277 & 3.70002 & 17 \\ \hline 18 & 1.09393 & 1.19615 & 1.30734 & 1.42825 & 1.55966 & 1.70243 & 2.02582 & 2.40662 & 2.85434 & 3.99602 & 18 \\ \hline 19 & 1.09940 & 1.20811 & 1.32695 & 1.45681 & 1.59865 & 1.75351 & 2.10685 & 2.52695 & 3.02560 & 4.31570 & 19 \\ \hline 20 & 1.10490 & 1.22019 & 1.34686 & 1.48595 & 1.63862 & 1.80611 & 2.19112 & 2.65330 & 3.20714 & 4.66096 & 20 \\ \hline 21 & 1.11042 & 1.23239 & 1.36706 & 1.51567 & 1.67958 & 1.86029 & 2.27877 & 2.78596 & 3.39956 & 5.03383 & 21 \\ \hline 22 & 1.11597 & 1.24472 & 1.38756 & 1.54598 & 1.72157 & 1.91610 & 2.36992 & 2.92526 & 3.60354 & 5.43654 & 22 \\ \hline 23 & 1.12155 & 1.25716 & 1.40838 & 1.57690 & 1.76461 & 1.97359 & 2.46472 & 3.07152 & 3.81975 & 5.87146 & 23 \\ \hline 24 & 1.12716 & 1.26973 & 1.42950 & 1.60844 & 1.80873 & 2.03279 & 2.56330 & 3.22510 & 4.04893 & 6.34118 & 24 \\ \hline 25 & 1.13280 & 1.28243 & 1.45095 & 1.64061 & 1.85394 & 2.09378 & 2.66584 & 3.38635 & 4.29187 & 6.84848 & 25 \\ \hline 26 & 1.13846 & 1.29526 & 1.47271 & 1.67342 & 1.90029 & 2.15659 & 2.77247 & 3.55567 & 4.54938 & 7,39635 & 26 \\ \hline 27 & 1.14415 & 1.30821 & 1.49480 & 1.70689 & 1.94780 & 2.22129 & 2.88337 & 3.73346 & 4.82235 & 7.98806 & 27 \\ \hline 28 & 1,14987 & 1.32129 & 1.51722 & 1.74102 & 1.99650 & 2.28793 & 2.99870 & 3.92013 & 5.11169 & 8.62711 & 28 \\ \hline 29 & 1.15562 & 1.33450 & 1.53998 & 1.77584 & 2.04641 & 2.35657 & 3.11865 & 4.11614 & 5.41839 & 9.31727 & 29 \\ \hline 30 & 1.16140 & 1.34785 & 1.56308 & 1.81136 & 2.09757 & 2,42726 & 3.24340 & 4.32194 & 5.74349 & 10.06266 & 30 \\ \hline \end{tabular} 11 Annuities, Stocks, and Bonds \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 17 & 18.43044 & 19.20136 & 20.01207 & 20.86473 & 21.76159 & 8.69751 & 25.84037 & 28.21288 & 33.75023 & 40.54470 & 367 & 17 \\ \hline 18 & 19.61475 & .48938 & .41231 & 22.3 & 23.41444 & 25.64541 & 28.13238 & 30.90565 & 37.45024 & 45.59917 & 55.74971 & 18 \\ \hline 19 & 20.81090 & 21.79672 & 22.84056 & 23.94601 & 25.11687 & 27.67123 & 30.53900 & 33.75999 & 41.44626 & 51.15909 & 63.43968 & 19 \\ \hline 20 & 22.01900 & 23.12367 & 24.29737 & 25.54466 & 26.87037 & 29.77808 & 33.06595 & 36.78559 & 45.76196 & 57.27500 & 72.05244 & 20 \\ \hline 2 & 23919 & 24.47052 & 25.78332 & 27.18327 & 28.67649 & 31.96920 & 35.71925 & 39.99273 & 50.42292 & 64.00250 & 81.69874 & 21 \\ \hline 22 & 7159 & 25.83758 & 27.29898 & 28.86286 & 30.53678 & 34.24797 & 38.50521 & 43.39229 & 55.45676 & 71,40275 & 92.50258 & 22 \\ \hline 23 & 25.71630 & 27.22514 & 28.84496 & 30.58443 & 32.45288 & 36.61789 & 41.43048 & 46.99583 & 60.89330 & 79.54302 & 104.60289 & 23 \\ \hline 24 & 26.97346 & 28.63352 & 30.42186 & 32.34904 & 34.42647 & 39.08260 & 44.50200 & 50.81558 & 66.76476 & 88.49733 & 118.15524 & 24 \\ \hline 25 & 28.24320 & 30.06302 & 32.03030 & 34.15776 & 36.45926 & 41.64591 & 47.72710 & 54.86451 & 73,10594 & 98.34706 & 133.33387 & 25 \\ \hline 26 & 29.52563 & 31.51397 & 33.67091 & 36.01171 & 38.55304 & 44.31174 & 51.11345 & 59.15638 & 79.95442 & 109.18177 & 150.33393 & 26 \\ \hline 27 & 30.82089 & 32.98668 & 35.34432 & 37.91200 & 40.70963 & 47.08421 & 54.66913 & 63.70577 & 87.35077 & 121.099941 & 169.37401 & 27 \\ \hline 28 & 32.12910 & 34,48148 & 37.05121 & 39.85980 & 42.93092 & 49.96758 & 58.40258 & 68.52811 & 95.33883 & 134.209941 & 190.69889 & 28 \\ \hline 29 & 33,45039 & 35.99870 & 38.79223 & 41.85630 & 45.21885 & 52.96629 & 62.32271 & 73.63980 & 103,965941 & 148.630932 & 214.58275 & 29 \\ \hline 30 & 34.78489 & 37.53868 & 40.56808 & 43.90270 & 47.57542 & 56.08494 & 66.43885 & 79.05819 & 113.283211 & 164,49402.2 & 241.33268 & 30 \\ \hline 31 & 36.13274 & 39.10176 & 42.37944 & 46.00027 & 50.00268 & 59.32834 & 70.76079 & 84.80168 & 123.345871 & 181.943422 & 271.29261 & 31 \\ \hline 32 & 37.86901 & 40.68829 & 44.22703 & 48.15028 & 52.50276 & 62.70147 & 75.29883 & 9088978 & 134.213542 & 201.137773 & 304.84772 & 32 \\ \hline 33 & 38.86901 & 42.29861 & 46.11157 & 50.35403 & 55.07784 & 66.20953 & 80.06377 & 97.34316 & 145.950622 & 222.251543 & 342,42945 & 33 \\ \hline 34 & 40.25770 & 43.93309 & 48.03380 & 52.61289 & 57.73018 & 69.85791 & 85.06696 & 5104.18375 & 158.626672 & 245.476703 & 384.52098 & 34 \\ \hline 35 & 41.66028 & 45.59209 & 49.99448 & 54.92821 & 60.46208 & 73.65222 & 90.32031 & 111.43478 & 172.316802 & 271.024374 & 7431.66350 & 35 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ Present Value of an Annuity Table } \\ \hline \multicolumn{3}{|c|}{8} & \multicolumn{4}{|c|}{ Interest Rate per Period } & \multirow[b]{2}{*}{6%} & \multirow[b]{2}{*}{8%} & \multirow[b]{2}{*}{10%} & \multirow[b]{2}{*}{ Period } \\ \hline 1% & 121% & 2% & 221% & 3% & 4% & 5% & & & & \\ \hline .99010 & .98522 & .98039 & .97561 & .97087 & .96154 & .95238 & .94340 & .92593 & .90909 & 1 \\ \hline 1.97040 & 1.95588 & 1.94156 & 1.92742 & 1.91347 & 1.88609 & 1.85941 & 1.83339 & 1.78326 & 1.73554 & 2 \\ \hline 2.94099 & 2.91220 & 2.88388 & 2.85602 & 2.82861 & 2.77509 & 2.72325 & 2.67301 & 2.57710 & 2.48685 & 3 \\ \hline 3.90197 & 3.85438 & 3.80773 & 3.76197 & 3.71710 & 3.62990 & 3.54595 & 3.46511 & 3.31213 & 3.16987 & 4 \\ \hline 4.85343 & 4.78264 & 4.71346 & 4.64583 & 4.57971 & 4.45182 & 4.32948 & 4.21236 & 3.99271 & 3.79079 & 5 \\ \hline 5.79548 & 5.69719 & 5.60143 & 5.50813 & 5.41719 & 5.24214 & 5.07569 & 4.91732 & 4.62288 & 4.35526 & 6 \\ \hline 6.72819 & 6.59821 & 6.47199 & 6.34939 & 6.23028 & 6.00205 & 5.78637 & 5.58238 & 5.20637 & 4.86842 & 7 \\ \hline 7.65168 & 7.48593 & 7.32548 & 7.17014 & 7.01969 & 6.73274 & 6.46321 & 6.20979 & 5.74664 & 5.33493 & 8 \\ \hline 8.56602 & 8.36052 & 8.16224 & 7.97087 & 7.78611 & 7.43533 & 7.10782 & 6.80169 & 6.24689 & 5.75902 & 9 \\ \hline 9.47130 & 9.22218 & 8.98259 & 8.75206 & 8.53020 & 8.11090 & 7.72173 & 7.36009 & 6.71008 & 6.14457 & 10 \\ \hline 10.36763 & 10.07112 & 9.78685 & 9.51421 & 9.25262 & 8.76048 & 8.30641 & 7.88687 & 7.13896 & 6.49506 & 11 \\ \hline 11.25508 & 10.90751 & 10.57534 & 10.25776 & 9.95400 & 9.38507 & 8.86325 & 8.38384 & 7.53608 & 6.81369 & 12 \\ \hline 12.13374 & 11.73153 & 11.34837 & 10.98318 & 10.63496 & 9.98565 & 9.39357 & 8.85268 & 7.90378 & 7.10336 & 13 \\ \hline 13.00370 & 12.54338 & 12.10625 & 11.69091 & 11.29607 & 10.56312 & 9.89864 & 9.29498 & 8.24424 & 7.36669 & 14 \\ \hline 13.86505 & 13.34323 & 12.84926 & 12.38138 & 11.93794 & 11.11839 & 10.37966 & 9.71225 & 8.55948 & 7.60608 & 15 \\ \hline 14.71787 & 14.13126 & 1357771 & 13.05500 & 12.56110 & 11.65230 & 10.83777 & 10,10590 & 8.85137 & 7.82371 & 16 \\ \hline 15.56225 & 14.90765 & 14.29187 & 13.71220 & 13.16612 & 12.16567 & 11.27407 & 10.47726 & 9.12164 & 8.02155 & 17 \\ \hline 16.39827 & 15.67256 & 14.99203 & 14.35336 & 13.75351 & 12.65930 & 11.68959 & 10.82760 & 9.37189 & 8.20141 & 18 \\ \hline \end{tabular} \begin{tabular}{|rrrrrrrrrrrrr} 17 & 15.56225 & 14.90765 & 14.29187 & 13.71220 & 13.16612 & 12.16567 & 11.27407 & 10.47726 & 9.12164 & 8.02155 & 17 \\ 18 & 16.39827 & 15.67256 & 14.99203 & 14.35336 & 13.75351 & 12.65930 & 11.68959 & 10.82760 & 9.37189 & 8.20141 & 18 \\ 19 & 17.22601 & 16.42617 & 15.67846 & 14.97889 & 14.32380 & 13.13394 & 12.08532 & 11.15812 & 9.60360 & 8.36492 & 19 \\ 20 & 18.04555 & 17.16864 & 16.35143 & 15.58916 & 14.87747 & 13.59033 & 12.46221 & 11.46992 & 9.81815 & 8.51356 & 20 \\ 21 & 18.85698 & 17.90014 & 17.01121 & 16.18455 & 15.41502 & 14.02916 & 12.82115 & 11.76408 & 10.01680 & 8.64869 & 21 \\ 22 & 19.66038 & 18.62082 & 17.65805 & 16.76541 & 15.93692 & 14.45112 & 13.16300 & 12.04158 & 10.20074 & 8.77154 & 22 \\ 23 & 20.45582 & 19.33086 & 18.29220 & 17.33211 & 16.44361 & 14.85684 & 13.48857 & 12.30338 & 10.37106 & 8.88322 & 23 \\ 24 & 21.24339 & 20.03041 & 18.91393 & 17.88499 & 16.93554 & 15.24696 & 13.79864 & 12.55036 & 10.52876 & 8.98474 & 24 \\ 25 & 22.02316 & 20.71961 & 19.52346 & 18.42438 & 17.41315 & 15.62208 & 14.09394 & 12.78336 & 10.67478 & 9.07704 & 25 \\ 26 & 22.79520 & 21.39863 & 20.12104 & 18.95061 & 17.87684 & 15.98277 & 14.37519 & 13.00317 & 10.80998 & 9.16095 & 26 \\ 27 & 23.55961 & 22.06762 & 20.70690 & 19.46401 & 18.32703 & 16.32959 & 14.64303 & 13.21053 & 10.93516 & 9.23722 & 27 \\ 28 & 24.31644 & 22.72672 & 21.28127 & 19.96489 & 18.76411 & 16.66306 & 14.89813 & 13.40616 & 11.05108 & 9.30657 & 28 \\ 29 & 25.06579 & 23.37608 & 21.84438 & 20.45355 & 19.18845 & 16.98371 & 15.14107 & 13.59072 & 11.15841 & 9.36961 & 29 \\ 30 & 25.80771 & 24.01584 & 22.39646 & 20.93029 & 19.60044 & 17.29203 & 15.37245 & 13.76483 & 11.25778 & 9.42691 & 30 \\ 31 & 26.54229 & 24.64615 & 22.93770 & 21.39541 & 20.00043 & 17.58849 & 15.59281 & 13.92909 & 11.34980 & 9.47901 & 31 \\ 32 & 27.26959 & 25.26714 & 23.46833 & 21.84918 & 20.38877 & 17.87355 & 15.80268 & 14.08404 & 11.43500 & 9.526 .38 & 32 \\ 33 & 27.98969 & 25.87895 & 23.98856 & 22.29188 & 20.76579 & 18.14765 & 16.00255 & 14.23023 & 11.51389 & 9.56943 & 33 \\ 34 & 28.70267 & 26.48173 & 24.49859 & 22.72379 & 21.13184 & 18.41120 & 16.19290 & 14.36814 & 11.58693 & 9.60857 & 34 \\ 35 & 29.40858 & 27.07559 & 24.99862 & 23.14516 & 21.48722 & 18.66461 & 16.37419 & 14.49825 & 11.65457 & 9.64416 & 35 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts