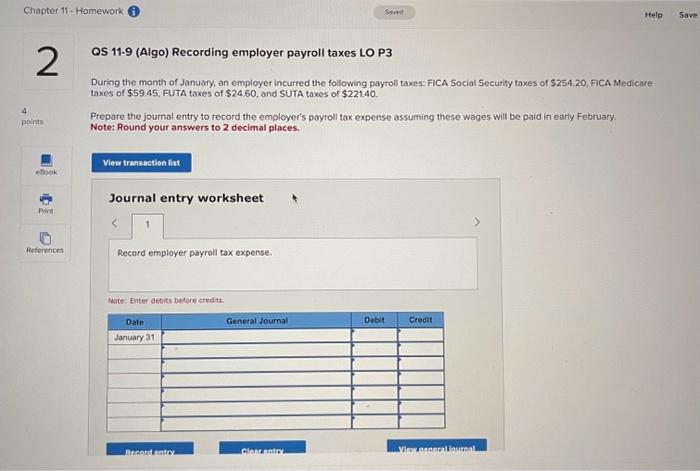

Question: Chapter 11 - Homework i 2 4 points eBook Print References QS 11-9 (Algo) Recording employer payroll taxes LO P3 During the month of January,

QS 11-9 (Algo) Recording employer payroll taxes LO P3 During the month of January, an empleyer incurted the following payroll taxes: FICA Social Security taxes of \$254,20, FICA Medicare taxes of $59.45. FUTA taxes of $24.60, and \$UTA taxes of $221.40. Prepare the journal entry to record the employer's payroll tax expense assuming these wages will be paid in sarly February. Note: Round your answers to 2 decimal places. Journal entry worksheet Record employer pryroll tax expense. Nate: Enter debits before eredth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts