Question: Chapter 11 Homework I need help with Q4 Q5 and Q6 below Thanks! Q4. Bb Lessons / Assignment X CengageNOWv2 | Onl x Cengage Learning

Chapter 11 Homework

I need help with Q4 Q5 and Q6 below

Thanks!

Q4.

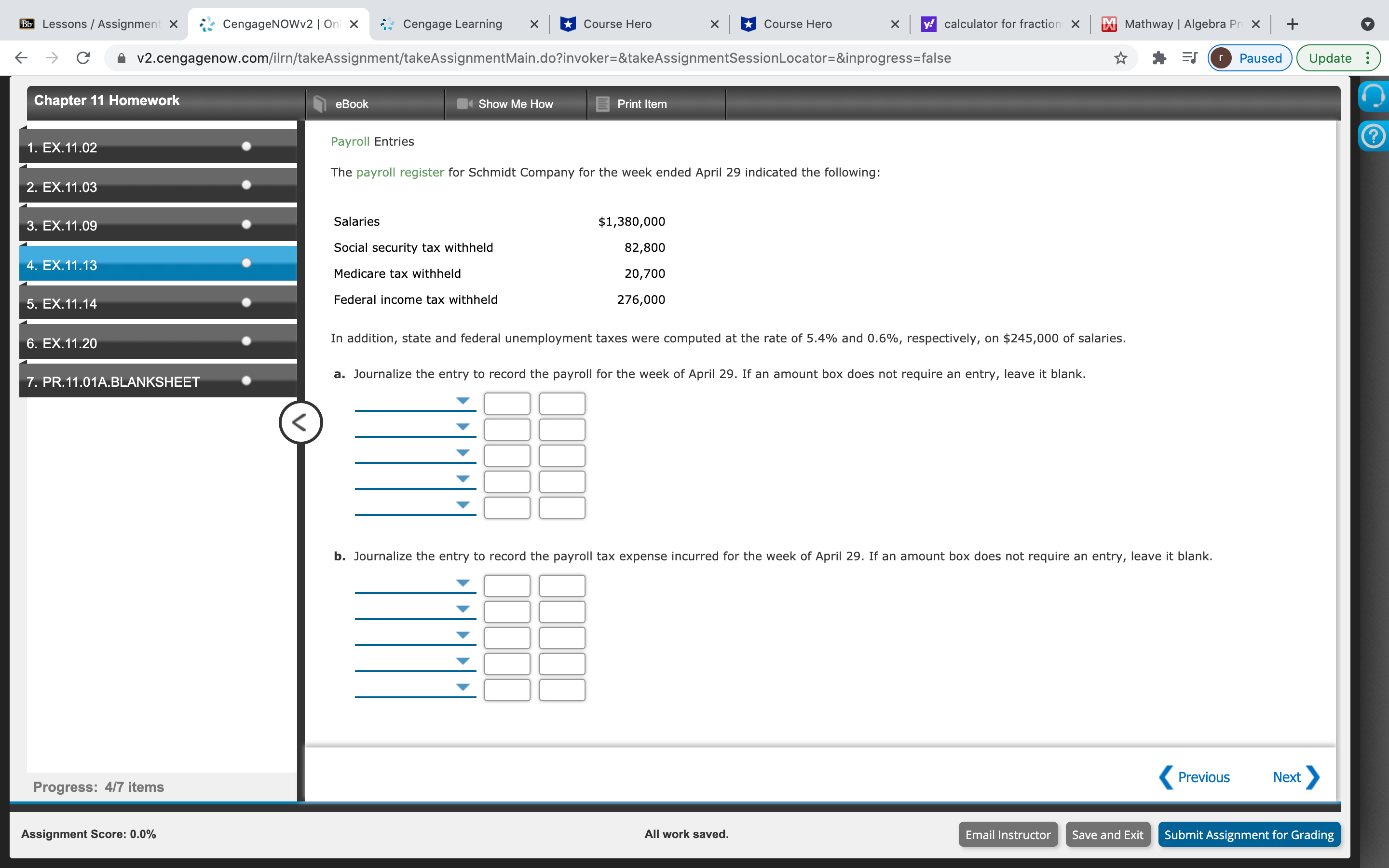

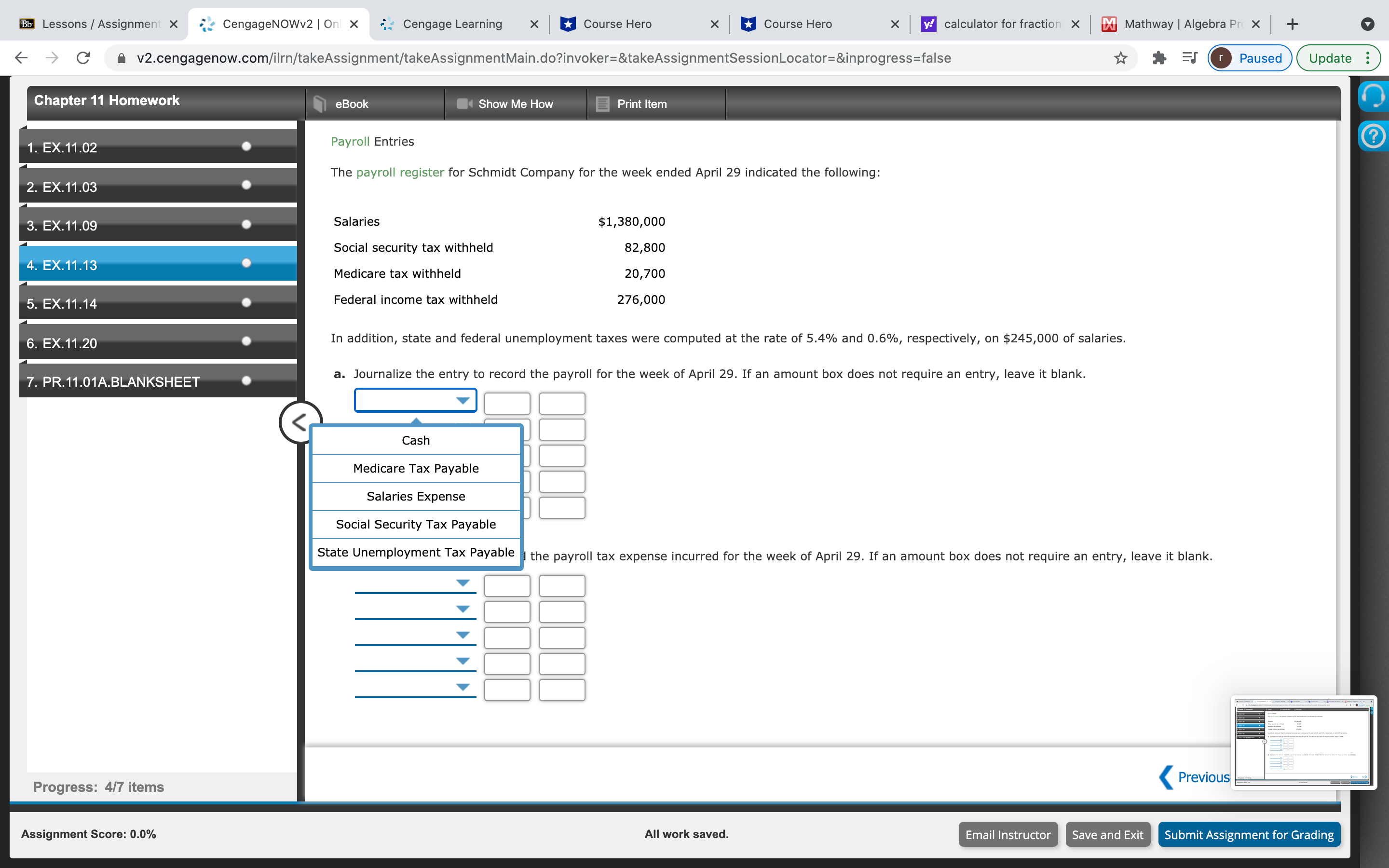

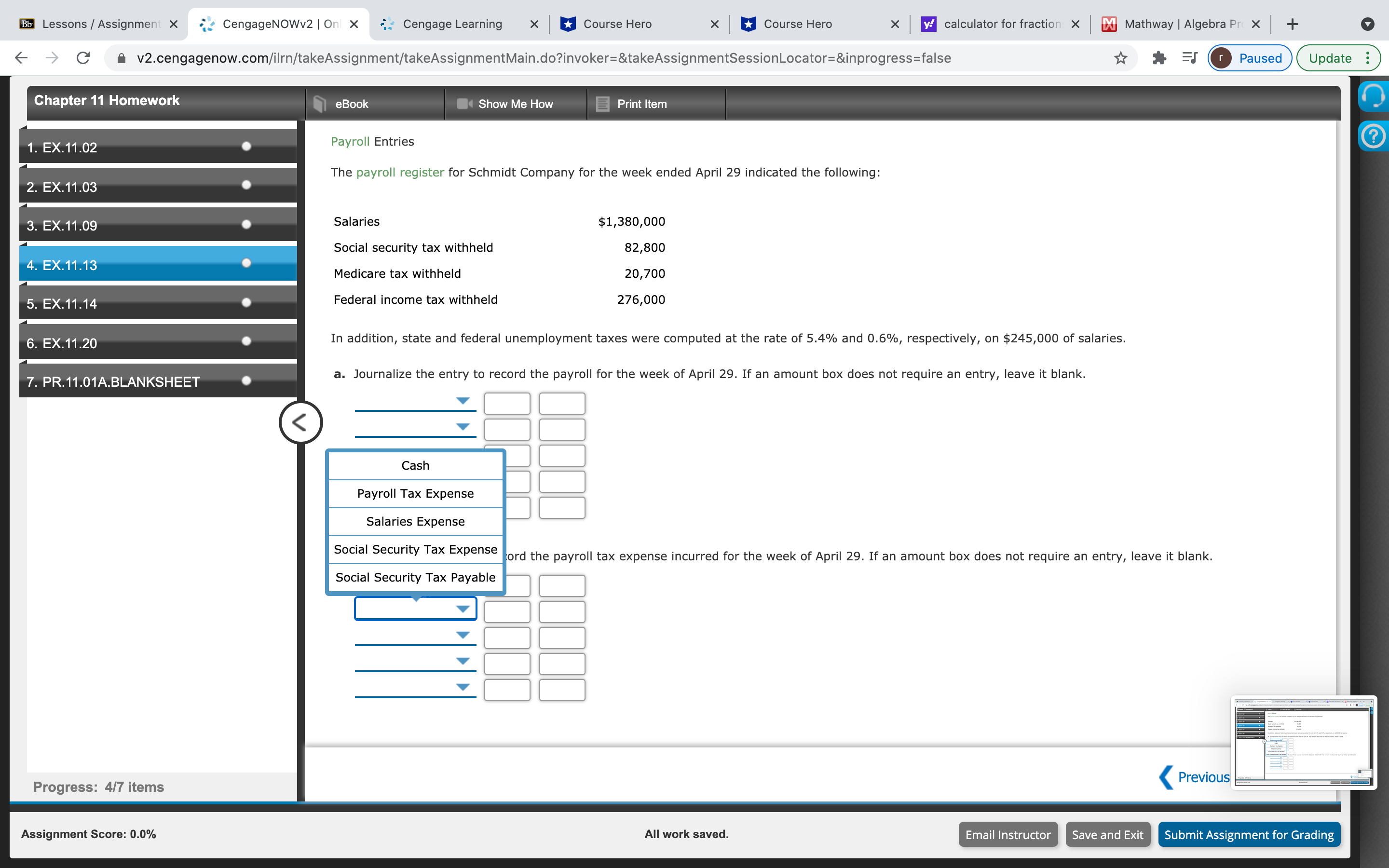

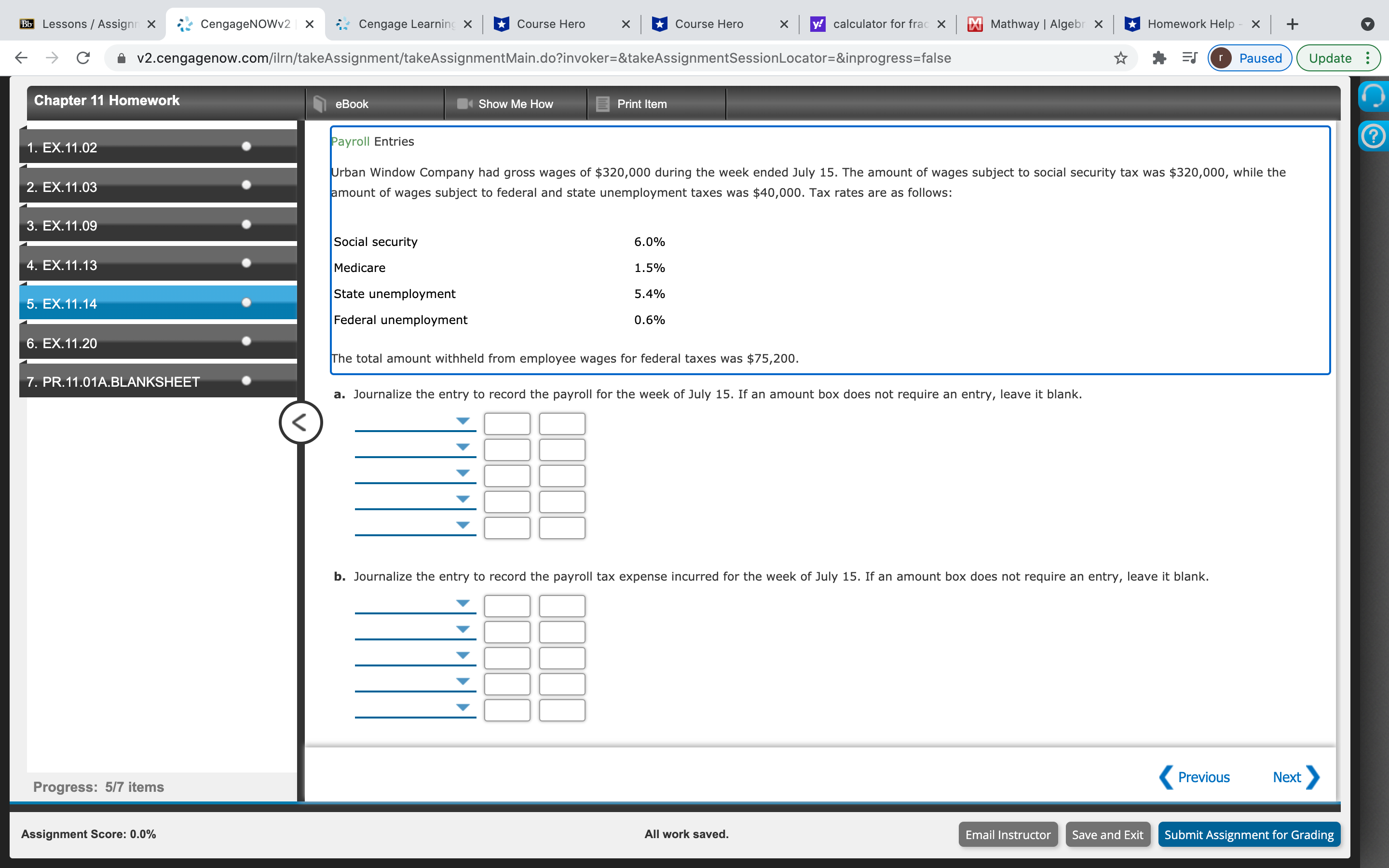

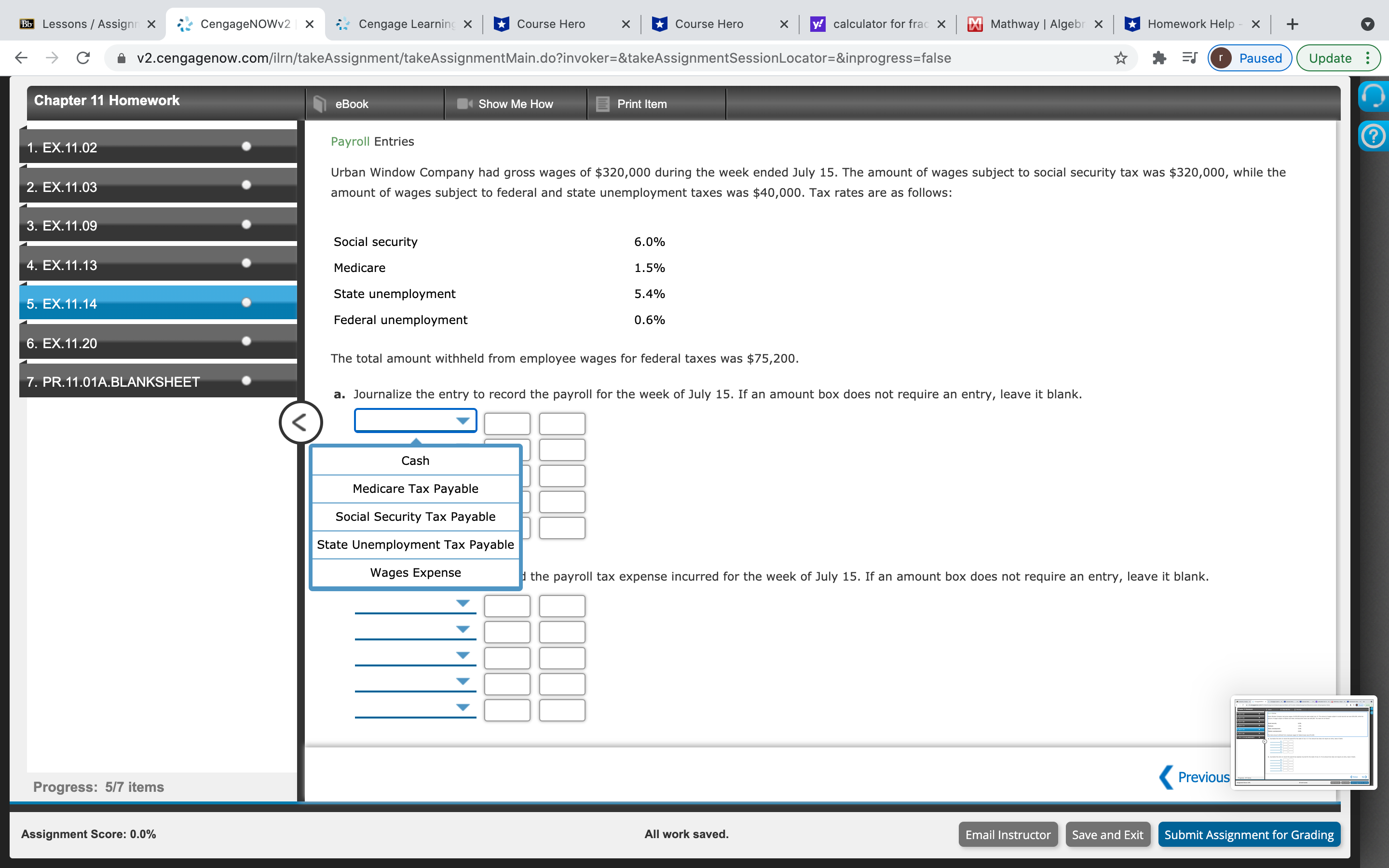

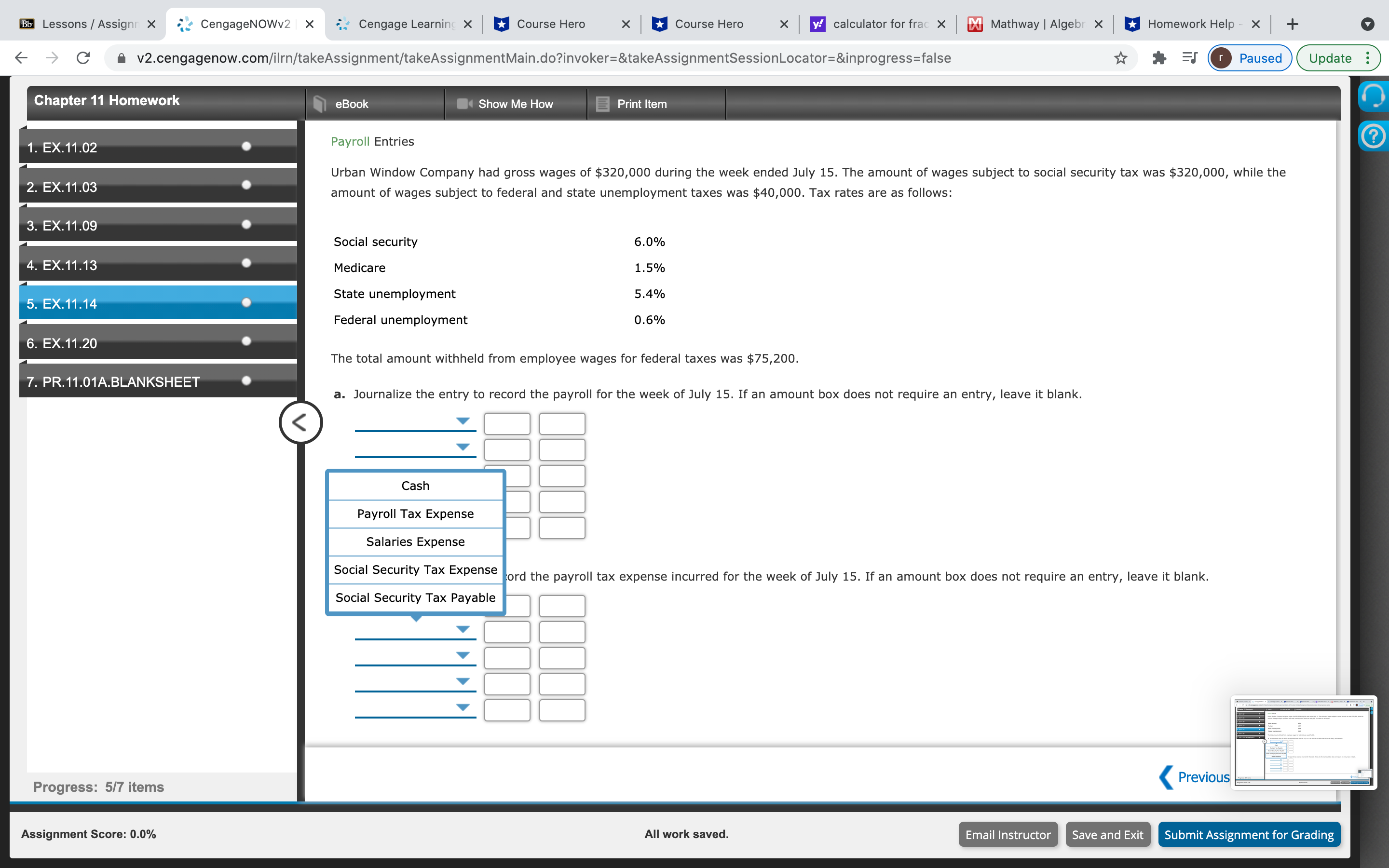

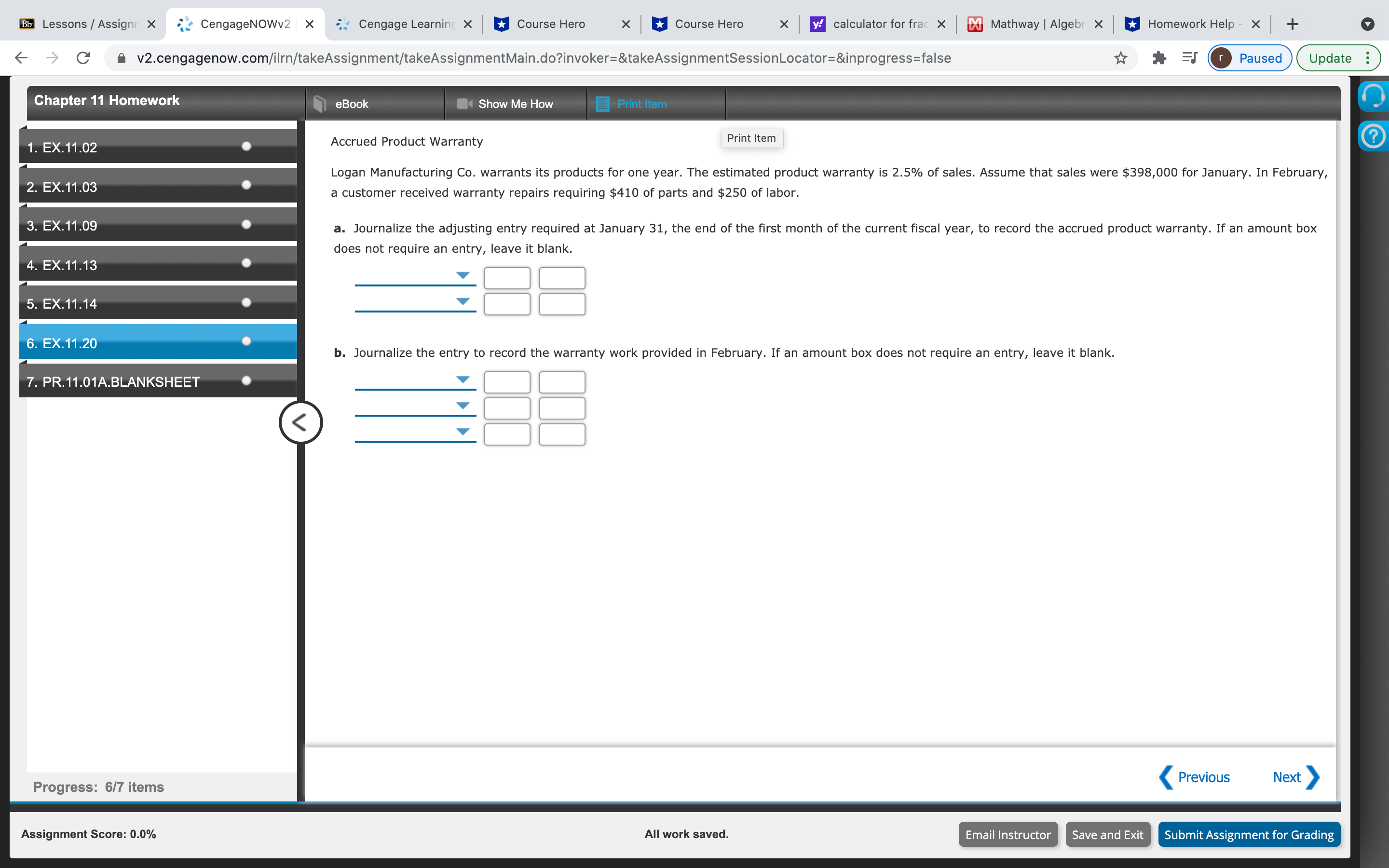

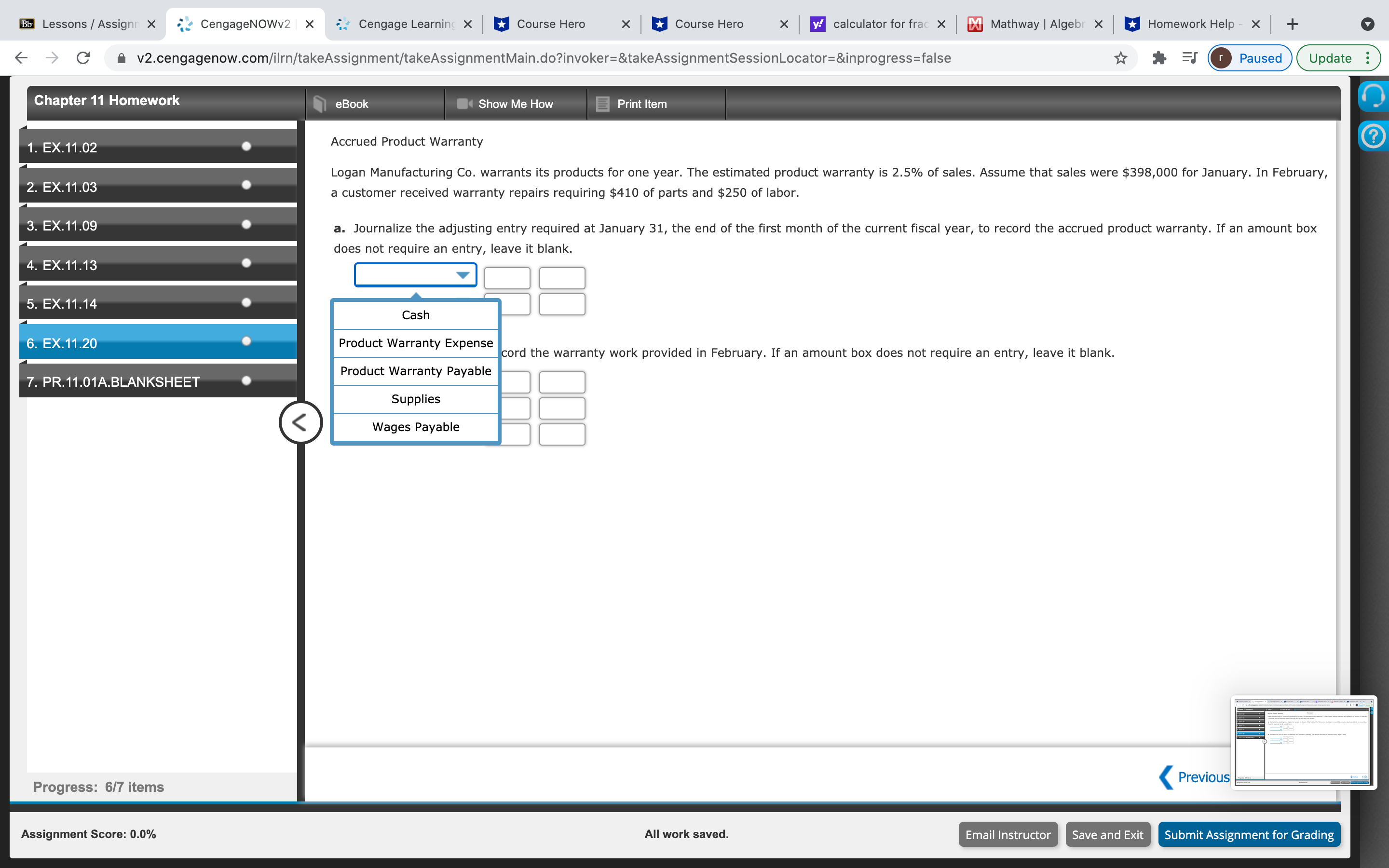

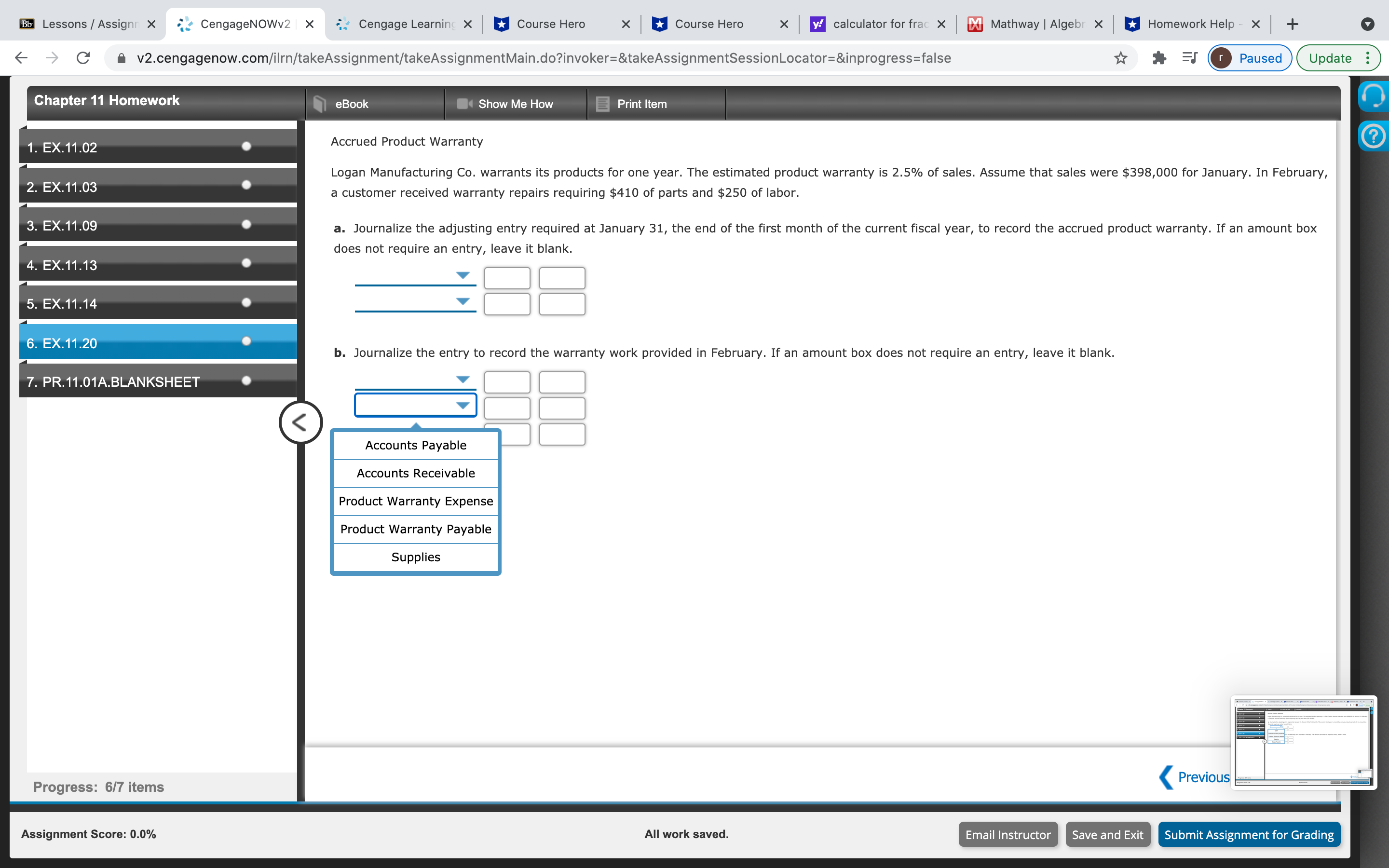

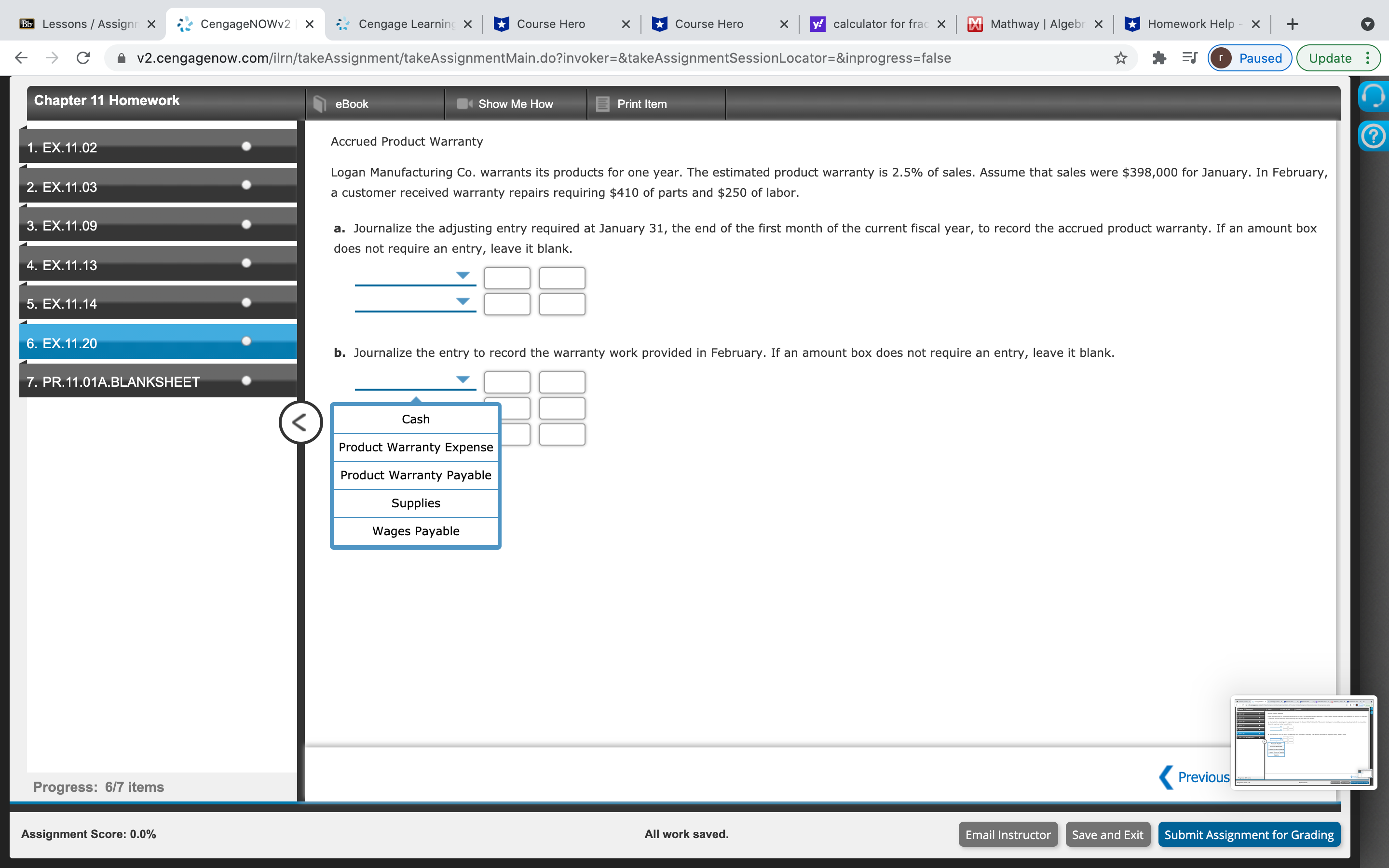

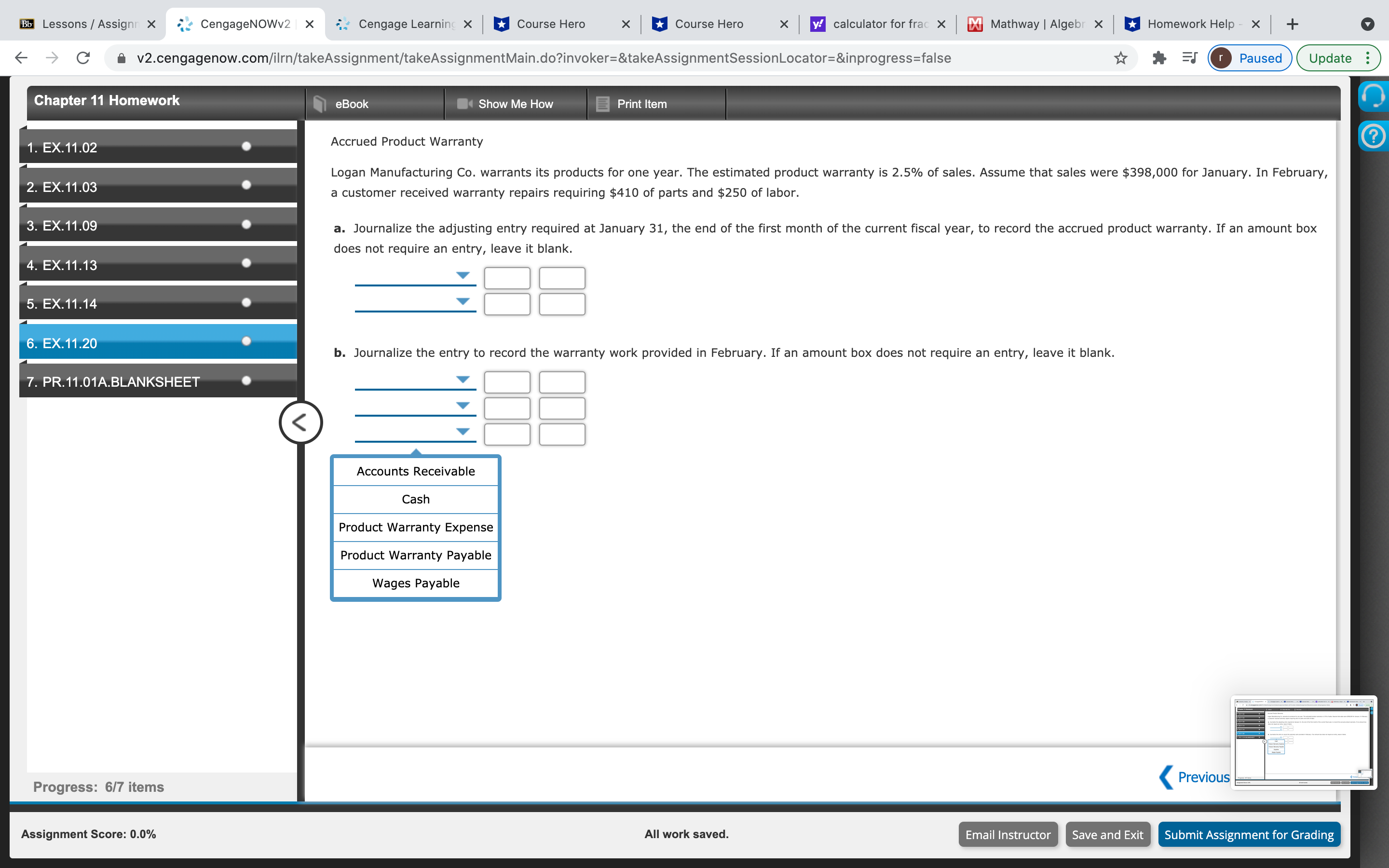

Bb Lessons / Assignment X CengageNOWv2 | Onl x Cengage Learning * *Course Hero x Course Hero x y! calculator for fraction x X Mathway | Algebra Pr( X + C v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item Payroll Entries ? 1. EX. 11.02 The payroll register for Schmidt Company for the week ended April 29 indicated the following: 2. EX. 11.03 3. EX. 11.09 Salaries $1,380,000 Social security tax withheld 82,800 4. EX. 11.13 Medicare tax withheld 20,700 5. EX. 11.14 Federal income tax withheld 276,000 6. EX. 11.20 In addition, state and federal unemployment taxes were computed at the rate of 5.4% and 0.6%, respectively, on $245,000 of salaries. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of April 29. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the payroll tax expense incurred for the week of April 29. If an amount box does not require an entry, leave it blank. Progress: 4/7 items Previous Next Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignment X CengageNOWv2 | Onl x Cengage Learning * *Course Hero x Course Hero x y! calculator for fraction x X Mathway | Algebra Pr( X + C v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item ? 1. EX. 11.02 Payroll Entries The payroll register for Schmidt Company for the week ended April 29 indicated the following: 2. EX. 11.03 3. EX. 11.09 Salaries $1,380,000 Social security tax withheld 82,800 4. EX. 11.13 Medicare tax withheld 20,700 5. EX. 11.14 Federal income tax withheld 276,000 6. EX. 11.20 In addition, state and federal unemployment taxes were computed at the rate of 5.4% and 0.6%, respectively, on $245,000 of salaries. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of April 29. If an amount box does not require an entry, leave it blank. Cash Medicare Tax Payable Salaries Expense Social Security Tax Payable State Unemployment Tax Payable the payroll tax expense incurred for the week of April 29. If an amount box does not require an entry, leave it blank. Progress: 4/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignment X CengageNOWv2 | Onl x Cengage Learning * *Course Hero x Course Hero x y! calculator for fraction x X Mathway | Algebra Pr( X + C v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item Payroll Entries ? 1. EX. 11.02 The payroll register for Schmidt Company for the week ended April 29 indicated the following: 2. EX. 11.03 3. EX. 11.09 Salaries $1,380,000 Social security tax withheld 82,800 4. EX. 11.13 Medicare tax withheld 20,700 5. EX. 11.14 Federal income tax withheld 276,000 6. EX. 11.20 In addition, state and federal unemployment taxes were computed at the rate of 5.4% and 0.6%, respectively, on $245,000 of salaries. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of April 29. If an amount box does not require an entry, leave it blank. Cash Payroll Tax Expense Salaries Expense Social Security Tax Expense ford the payroll tax expense incurred for the week of April 29. If an amount box does not require an entry, leave it blank. Social Security Tax Payable Progress: 4/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac x Mathway | AlgebraX Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item O 1. EX. 11.02 ayroll Entries ? Urban Window Company had gross wages of $320,000 during the week ended July 15. The amount of wages subject to social security tax was $320,000, while the 2. EX. 11.03 amount of wages subject to federal and state unemployment taxes was $40,000. Tax rates are as follows: 3. EX. 11.09 Social security 4. EX. 11.13 Medicare 1.5% State unemployment 5.4% 5. EX. 11.14 Federal unemployment 0.6% 6. EX. 11.20 The total amount withheld from employee wages for federal taxes was $75,200. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of July 15. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the payroll tax expense incurred for the week of July 15. If an amount box does not require an entry, leave it blank. Progress: 5/7 items Previous Next Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item O Payroll Entries ? 1. EX. 11.02 Urban Window Company had gross wages of $320,000 during the week ended July 15. The amount of wages subject to social security tax was $320,000, while the 2. EX. 11.03 amount of wages subject to federal and state unemployment taxes was $40,000. Tax rates are as follows: 3. EX. 11.09 Social security 4. EX. 11.13 Medicare 1.5% State unemployment 5.4% 5. EX. 11.14 Federal unemployment 0.6% 6. EX. 11.20 The total amount withheld from employee wages for federal taxes was $75,200. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of July 15. If an amount box does not require an entry, leave it blank. Cash Medicare Tax Payable Social Security Tax Payable State Unemployment Tax Payable Wages Expense the payroll tax expense incurred for the week of July 15. If an amount box does not require an entry, leave it blank. Progress: 5/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item O Payroll Entries ? 1. EX. 11.02 Urban Window Company had gross wages of $320,000 during the week ended July 15. The amount of wages subject to social security tax was $320,000, while the 2. EX. 11.03 amount of wages subject to federal and state unemployment taxes was $40,000. Tax rates are as follows: 3. EX. 11.09 Social security 4. EX. 11.13 Medicare 1.5% State unemployment 5.4% 5. EX. 11.14 Federal unemployment 0.6% 6. EX. 11.20 The total amount withheld from employee wages for federal taxes was $75,200. 7. PR. 11.01A.BLANKSHEET a. Journalize the entry to record the payroll for the week of July 15. If an amount box does not require an entry, leave it blank. Cash Payroll Tax Expense Salaries Expense Social Security Tax Expense ford the payroll tax expense incurred for the week of July 15. If an amount box does not require an entry, leave it blank. Social Security Tax Payable Progress: 5/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero x *Course Hero x y! calculator for frac x Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item 1. EX. 11.02 Accrued Product Warranty Print Item ? Logan Manufacturing Co. warrants its products for one year. The estimated product warranty is 2.5% of sales. Assume that sales were $398,000 for January. In February, 2. EX. 11.03 a customer received warranty repairs requiring $410 of parts and $250 of labor. 3. EX. 11.09 a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. 4. EX. 11.13 5. EX. 11.14 6. EX. 11.20 b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank. 7. PR. 11.01A.BLANKSHEET Progress: 6/7 items Previous Next Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item 1. EX. 11.02 Accrued Product Warranty ? Logan Manufacturing Co. warrants its products for one year. The estimated product warranty is 2.5% of sales. Assume that sales were $398,000 for January. In February, 2. EX. 11.03 a customer received warranty repairs requiring $410 of parts and $250 of labor. 3. EX. 11.09 a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. 4. EX. 11.13 5. EX. 11.14 Cash 6. EX. 11.20 Product Warranty Expense cord the warranty work provided in February. If an amount box does not require an entry, leave it blank. Product Warranty Payable 7. PR. 11.01A.BLANKSHEET Supplies Wages Payable Progress: 6/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item Accrued Product Warranty ? 1. EX. 11.02 Logan Manufacturing Co. warrants its products for one year. The estimated product warranty is 2.5% of sales. Assume that sales were $398,000 for January. In February, 2. EX. 11.03 a customer received warranty repairs requiring $410 of parts and $250 of labor. 3. EX. 11.09 a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. 4. EX. 11.13 5. EX. 11.14 6. EX. 11.20 b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank. 7. PR. 11.01A.BLANKSHEET Accounts Payable Accounts Receivable Product Warranty Expense Product Warranty Payable Supplies Progress: 6/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item Accrued Product Warranty ? 1. EX. 11.02 Logan Manufacturing Co. warrants its products for one year. The estimated product warranty is 2.5% of sales. Assume that sales were $398,000 for January. In February, 2. EX. 11.03 a customer received warranty repairs requiring $410 of parts and $250 of labor. 3. EX. 11.09 a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. 4. EX. 11.13 5. EX. 11.14 6. EX. 11.20 b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank. 7. PR. 11.01A.BLANKSHEET Cash Product Warranty Expense Product Warranty Payable Supplies Wages Payable Progress: 6/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for GradingBb Lessons / Assignr X CengageNOWv2 | x Cengage Learning X Course Hero * *Course Hero x y! calculator for frac X Mathway | Algebra X Homework Help - X + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Paused Update : Chapter 11 Homework eBook Show Me How Print Item Accrued Product Warranty ? 1. EX. 11.02 Logan Manufacturing Co. warrants its products for one year. The estimated product warranty is 2.5% of sales. Assume that sales were $398,000 for January. In February, 2. EX. 11.03 a customer received warranty repairs requiring $410 of parts and $250 of labor. 3. EX. 11.09 a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. 4. EX. 11.13 5. EX. 11.14 6. EX. 11.20 b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank. 7. PR. 11.01A.BLANKSHEET Accounts Receivable Cash Product Warranty Expense Product Warranty Payable Wages Payable Progress: 6/7 items Previous Assignment Score: 0.0% All work saved. Email Instructor Save and Exit Submit Assignment for Grading