Question: CHAPTER 11 IN-CLASS EXERCISE 11 (10 points) At the beginning of 2018, Robotics Inc. acquired a manufacturing facility for $12 million. $9 million of the

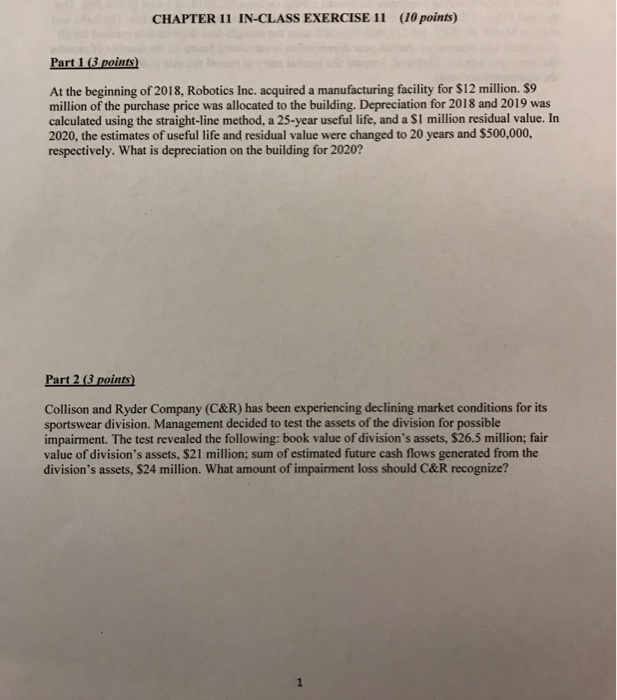

CHAPTER 11 IN-CLASS EXERCISE 11 (10 points) At the beginning of 2018, Robotics Inc. acquired a manufacturing facility for $12 million. $9 million of the purchase price was allocated to the building. Depreciation for 2018 and 2019 was calculated using the straight-line method, a 25-year useful life, and a S1 million residual value. In 2020, the estimates of useful life and residual value were changed to 20 years and $500,000, respectively. What is depreciation on the building for 2020? Part 2 3 points Collison and Ryder Company (C&R) has been experiencing declining market conditions for its sportswear division. Management decided to test the assets of the division for possible impairment. The test revealed the following: book value of division's assets, $26.5 million; fair value of division's assets, $21 million; sum of estimated future cash flows generated from the division's assets, $24 million. What amount of impairment loss should C&R recognize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts