Question: Chapter 11, Problem 011 (GO Tutorial) 5 years ago, a multi-axis NC machine was purchased for the express purpose of machining large, complex parts used

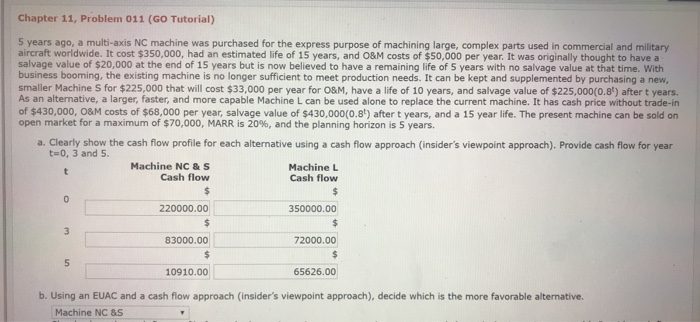

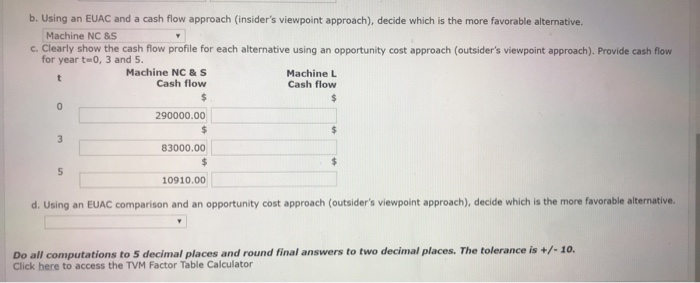

Chapter 11, Problem 011 (GO Tutorial) 5 years ago, a multi-axis NC machine was purchased for the express purpose of machining large, complex parts used in commercial and military aircraft worldwide. It cost $350,000, had an estimated life of 15 years, and 08M costs of $50,000 per year. It was originally thought to have a salvage value of $20,000 at the end of 15 years but is now believed to have a remaining life of 5 years with no salvage value at that time. With business booming, the existing machine is no longer sufficient to meet production needs. It can be kept and supplemented by purchasing a new, smaller Machine S for $225,000 that will cost $33,000 per year for O&M, have a life of 10 years, and salvage value of $225,000(0.8) after t years. As an alternative, a larger, faster, and more capable Machine L can be used alone to replace the current machine. It has cash price without trade-in of $430,000, O&M costs of $68,000 per year, salvage value of $430,000(o.8) after t years, and a 15 year life. The present machine can be sold on open market for a maximum of $70,000, MARR is 20%, and the planning horizon is S years. a. Clearly show the cash flow profile for each alternative using a cash flow approach (insider's viewpoint approach). Provide cash flow for year t-0, 3 and 5 Machine NC & S Cash flow Machine L Cash flow 220000.00 350000.00 83000.00 72000.00 10910.00 65626.00 b. Using an EUAC and a cash flow approach (insider's viewpoint approach), decide which is the more favorable alternative. Machine NC &S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts