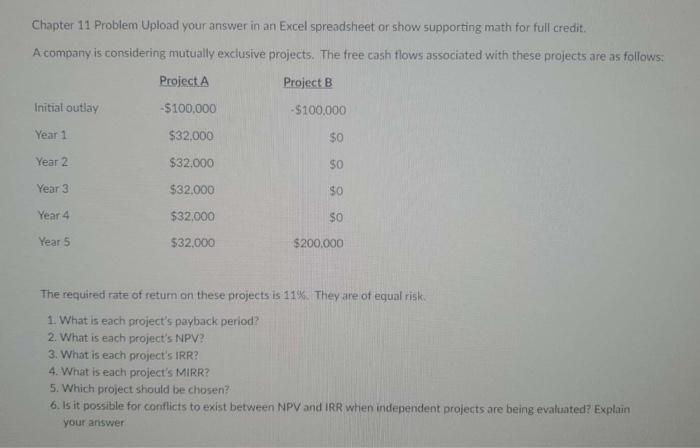

Question: Chapter 11 Problem Upload your answer in an Excel spreadsheet or show supporting math for full credit A company is considering mutually exclusive projects. The

Chapter 11 Problem Upload your answer in an Excel spreadsheet or show supporting math for full credit A company is considering mutually exclusive projects. The free cash flows associated with these projects are as follows: Project A Project B Initial outlay -$100,000 -$100,000 Year 1 $32,000 $0 Year 2 $32,000 $0 Year 3 $32,000 $0 Year 4 $32,000 $0 Year 5 $32,000 $200.000 The required rate of return on these projects is 11%. They are of equal risk. 1. What is each project's payback period? 2. What is each project's NPV?: 3. What is each project's IRR? 4. What is each project's MIRR? 5. Which project should be chosen? 6. Is it possible for conflicts to exist between NPV and IRR when independent projects are being evaluated? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts