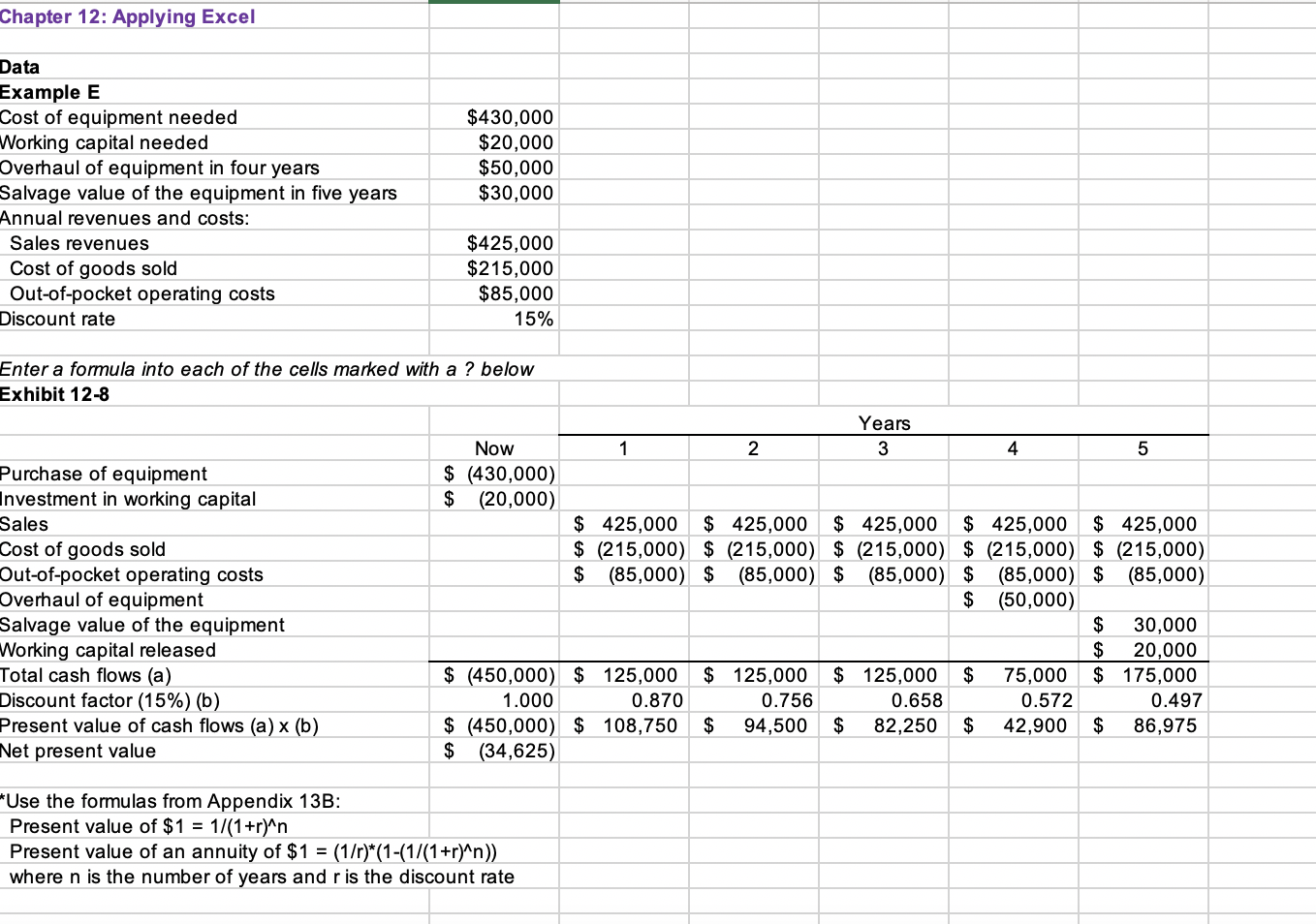

Question: Chapter 12: Applying Excel Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment

Chapter 12: Applying Excel Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate $430,000 $20.000 $50,000 $30,000 $425,000 $215,000 $85,000 15% Enter a formula into each of the cells marked with a ? below Exhibit 12-8 Years Now 1 23 4 Purchase of equipment $ (430,000) Investment in working capital $ (20,000) Sales $ 425,000 $ 425,000 $ 425,000 $ 425,000 $ 425,000 Cost of goods sold $ (215,000) $ (215,000) $ (215,000) $ (215,000) $ (215,000) Out-of-pocket operating costs $ (85,000) $ (85,000) $ (85,000) $ (85,000) $ (85,000) Overhaul of equipment $ (50,000) Salvage value of the equipment $ 30,000 Working capital released $ 20,000 Total cash flows (a) $ (450,000) $ 125,000 $ 125,000 $ 125,000 $ 75,000 $ 175,000 Discount factor (15%) (b) 1.000 0.870 0.756 0.658 0.572 0.497 Present value of cash flows (a) x (b) $ (450,000) $ 108,750 $ 94,500 $ 82,250 $ 42,900 $ 86,975 Net present value $ (34,625) *Use the formulas from Appendix 13B: Present value of $1 = 1/(1+r)^n Present value of an annuity of $1 = (1/r)*(1-(1/(1+r)^n)) where n is the number of years and r is the discount rate d. Reset the discount rate to 15%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? ******* Minimum salvage value required to generate a positive net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts