Question: Chapter 12 Assignment i Saved 9 Problem 12-31 CAPM and Valuation (LO3) 11.12 points You are a consultant to a firm evaluating an expansion of

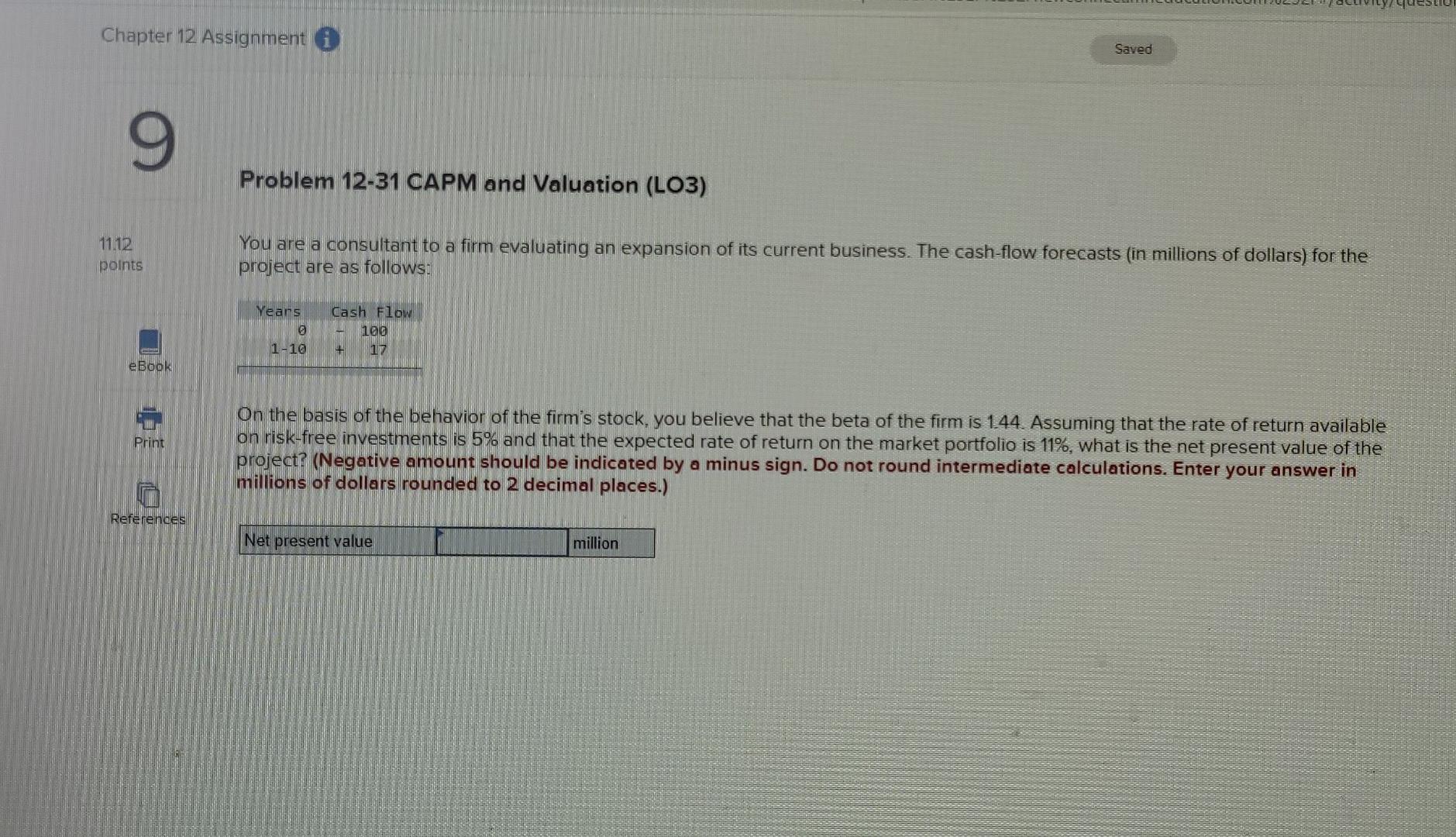

Chapter 12 Assignment i Saved 9 Problem 12-31 CAPM and Valuation (LO3) 11.12 points You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow 100 + 17 1-10 eBook Print On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.44. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 11%, what is the net present value of the project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.) References Net present value million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts