Question: Chapter 12: Capital Budgeting Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $300,000

Chapter 12: Capital Budgeting

-

Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $300,000 for a marketing research study that provided evidence about the demand for this product at this time. The new line will require an additional investment of $70,000 in raw materials to produce the candies. The projects life is 7 years and the firm estimates sales of 1,600,000 packages at a price of $1.22 per unit the first year; but this volume is expected to grow at 17% for the next two years, 13% for the following two years, and finally at 7% for the last two years of the project. The price per unit is expected to grow at the historical average rate of inflation of 3%. The variable costs will be 60% of sales and the fixed costs, which increase annually at the rate of inflation, will be $500,000.

The equipment required to produce the candies will cost $600,000, and will require an additional $30,000 to have it delivered and installed. This equipment has an expected useful life of 7 years and will be depreciated using 7 Year MACRS depreciation percentages on the spreadsheet. After 7 years, the equipment can be sold at a price of $200,000. The cost of capital is 9% and the firms marginal tax rate is 35%.

-

Calculate the initial investment, annual after-tax cash flows for each year, and the terminal cash flow.

-

Determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR of the new line of candies. Should the firm accept or reject the project?

-

The firm is considering three scenarios for the new line of cookies and bars. Under the best, base, and worst-case scenario the firm will sell 1,700,000, 1,500,000, and 1,100,000 packages the first year with the same expected growth rates in units and price described in the problem. Re-examine the decision criteria in part (a) under each of these scenarios.

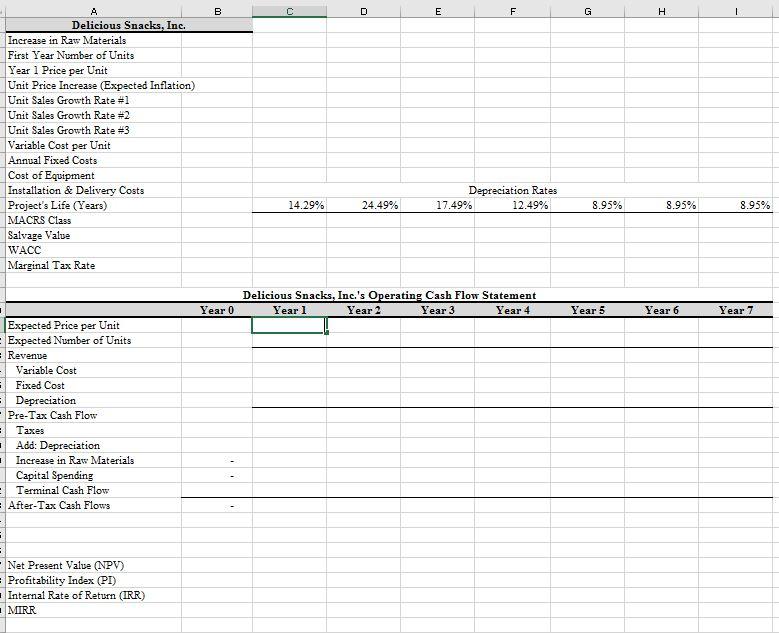

B D E F H A Delicious Snacks, Inc. Increase in Raw Materials First Year Number of Units Year 1 Price per Unit Unit Price Increase (Expected Inflation) Unit Sales Growth Rate #1 Unit Sales Growth Rate 2 Unit Sales Growth Rate 3 Variable Cost per Unit Annual Fixed Costs Cost of Equipment Installation & Delivery Costs Project's Life (Years) MACRS Class Salvage Value WACC Marginal Tax Rate Depreciation Rates 17.49% 12.49% 14.29% 24.49% 8.95% 8.95% 8.95% Delicious Snacks, Inc.'s Operating Cash Flow Statement Year 1 Year 2 Year 3 Year 4 Year 0 Year 5 Year 6 Year 7 Expected Price per Unit Expected Number of Units Revende Variable Cost Fixed Cost Depreciation Pre-Tax Cash Flow - Taxes Add: Depreciation Increase in Raw Materials Capital Spending Terminal Cash Flow After-Tax Cash Flows Net Present Value (NPV) Profitability Index (PI) Internal Rate of Return (IRR) MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts