Question: Chapter 12- Homework InterCont is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to

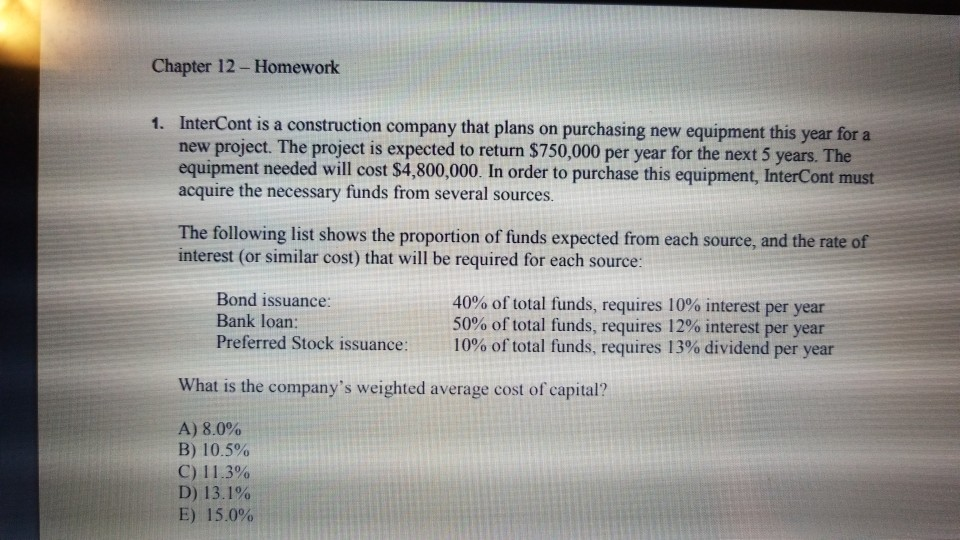

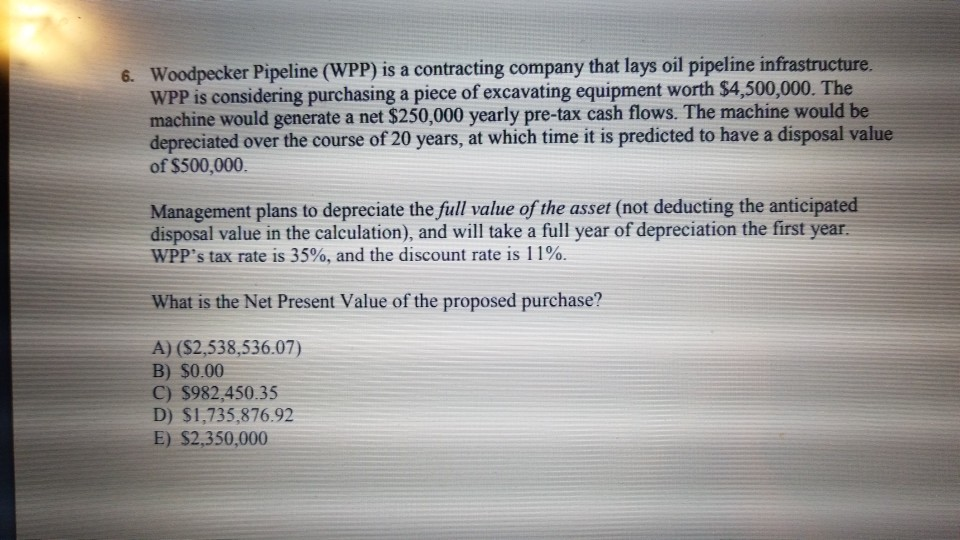

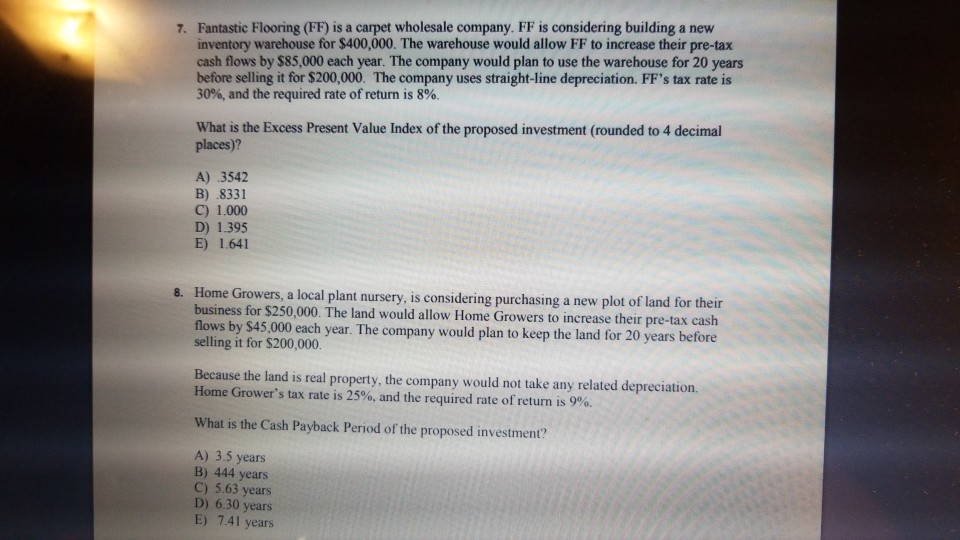

Chapter 12- Homework InterCont is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $750,000 per year for the next 5 years. The equipment needed will cost $4,800,000. In order to purchase this equipment, InterCont must acquire the necessary funds from several sources. 1. The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source: Bond issuance: Bank loan: Preferred Stock issuance: 40% of total funds, requires 10% interest per year 50% of total funds, requires 12% interest per year 10% of total funds, requires 13% dividend per year What is the company's weighted average cost of capital? A) 8.0% B) 10.5% C) 11.3% D) 13.1% E) 15.0% Woodpecker Pipeline (WPP) is a contracting company that lays oil pipeline infrastructure. WPP is considering purchasing a piece of excavating equipment worth $4,500,000. The machine would generate a net $250,000 yearly pre-tax cash flows. The machine would be depreciated over the course of 20 years, at which time it is predicted to have a disposal value of $500,000. 6. Management plans to depreciate the full value of the asset (not deducting the anticipated disposal value in the calculation), and will take a full year of depreciation the first year. WPP's tax rate is 35%, and the discount rate is 11%. What is the Net Present Value of the proposed purchase? A) (S2,538,536.07) B) $0.00 C) $982,450.35 D) $1,735,876.92 E) S2,350,000 Fantastic Flooring (FF) is a carpet wholesale company. FF is considering building a new inventory warehouse for S$400,000. The warehouse would allow FF to increase their pre-tax cash flows by $85,000 each year. The company would plan to use the warehouse for 20 years before selling it for $200,000. The company uses straight-line depreciation. FF's tax rate is 30%, and the required rate of return is 8%. 7. What is the Excess Present Value Index of the proposed investment (rounded to 4 decimal places)? A) 3542 B) 8331 C) 1.000 D) 1.395 E) 1.641 8. Home Growers, a local plant nursery, is considering purchasing a new plot of land for their business for $250,000. The land would allow Home Growers to increase their pre-tax cash flows by $45,000 each year. The company would plan to keep the land for 20 years before selling it for $200,000. Because the land is real property, the company would not take any related depreciation. Home Grower's tax rate is 25%, and the required rate of return is 9%. What is the Cash Payback Period of the proposed investment? A) 3.5 years B) 444 years C) 5.63 years D) 6.30 years E) 7.41 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts