Question: Chapter 12 Pre-Built Problems i Saved Help Suppose we have the following returns for large-company stocks and Treasury bills over a six-year period: Screen Shot

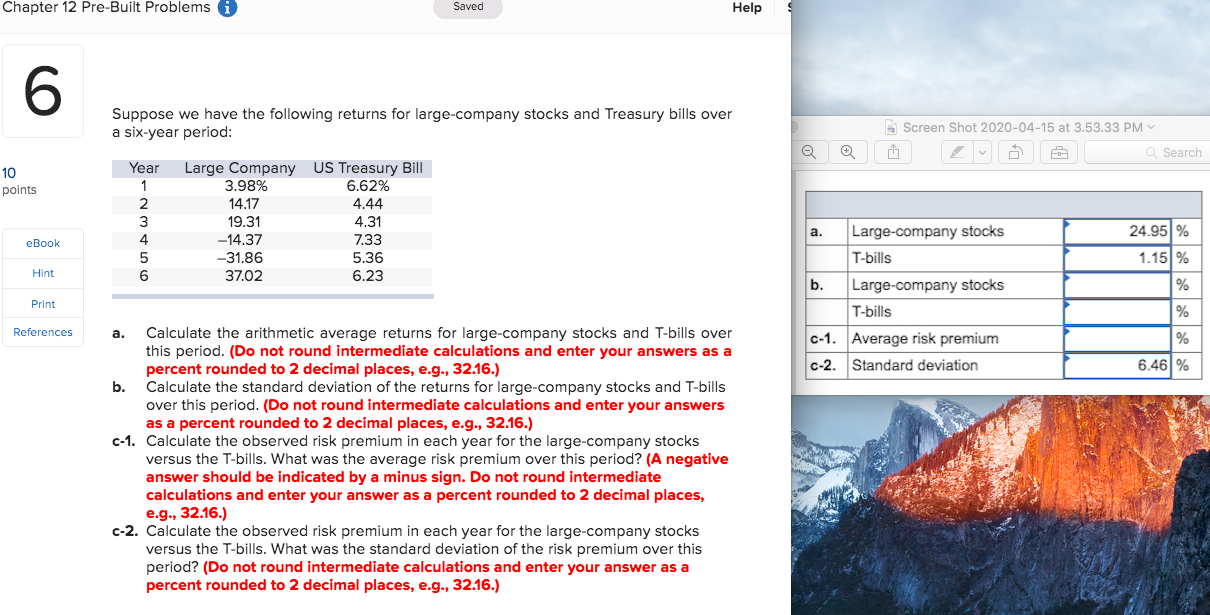

Chapter 12 Pre-Built Problems i Saved Help Suppose we have the following returns for large-company stocks and Treasury bills over a six-year period: Screen Shot 2020-04-15 at 3.53.33 PM Q Search 10 Year points Large Company US Treasury Bill 3.98% 6.62% 14.17 4.44 19.31 4.31 -14.37 7.33 -31.86 5.36 37.02 6.23 eBook OWN- 24.95% 1.15 % Hint b. Large-company stocks T-bills Large-company stocks T-bills C-1. Average risk premium c-2. Standard deviation Print References 6.46% Calculate the arithmetic average returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this period? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the standard deviation of the risk premium over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts