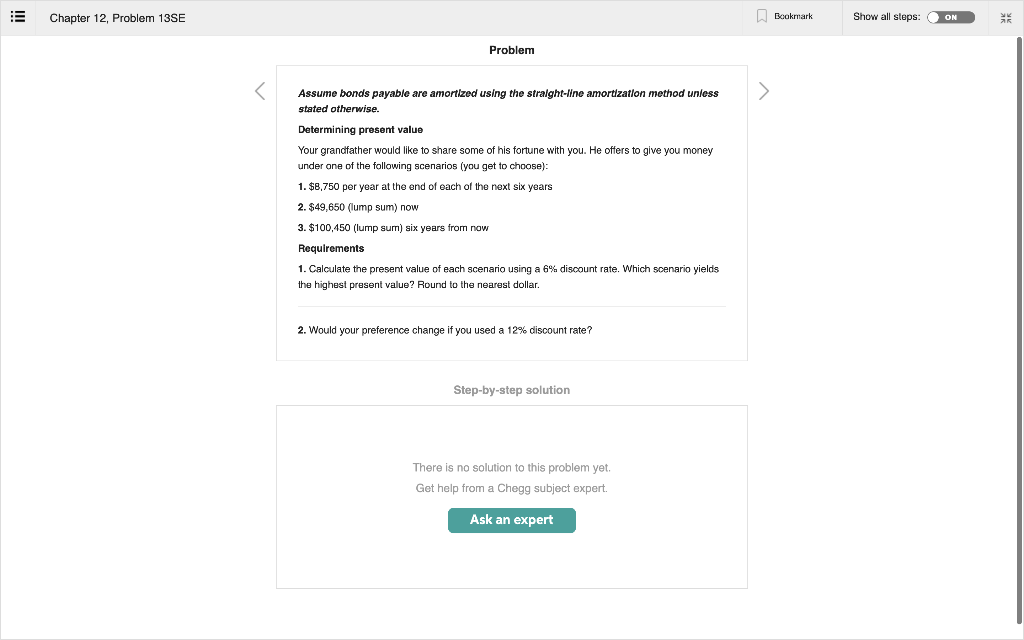

Question: Chapter 12, Problem 13SE Bookmark Show all steps: ON Problem > Assume bonds payable are amortized using the stralght-line amortization method unless stated otherwise. Determining

Chapter 12, Problem 13SE Bookmark Show all steps: ON Problem > Assume bonds payable are amortized using the stralght-line amortization method unless stated otherwise. Determining present value Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $8,750 per year at the end of each of the next six years 2. $49,650 (lump sum) now 3. $100,450 (lump sum) six years from now Requirements 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? Round to the nearest dollar. 2. Would your preference change if you used a 12% discount rate? Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert. Ask an expert

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts