Question: Chapter 12 Problem Set A Problem 12.1 Southwest Gas and Oil Corporation recently issued 7,500 bonds with a $1,000 face value, 5-year bonds, with a

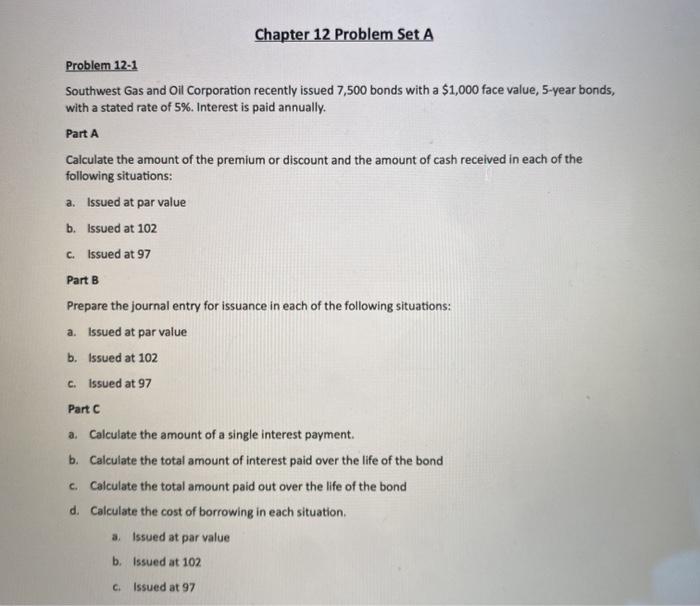

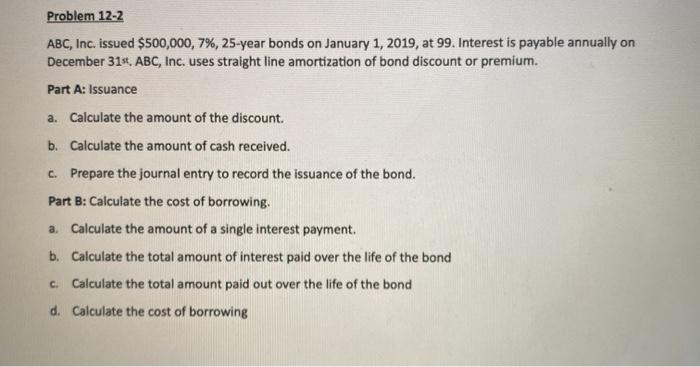

Chapter 12 Problem Set A Problem 12.1 Southwest Gas and Oil Corporation recently issued 7,500 bonds with a $1,000 face value, 5-year bonds, with a stated rate of 5%. Interest is paid annually. Part A Calculate the amount of the premium or discount and the amount of cash received in each of the following situations: a. Issued at par value b. Issued at 102 c. Issued at 97 Part B Prepare the journal entry for issuance in each of the following situations: a. Issued at par value b. Issued at 102 c. Issued at 97 Part C a. Calculate the amount of a single interest payment b. Calculate the total amount of interest paid over the life of the bond c. Calculate the total amount paid out over the life of the bond d. Calculate the cost of borrowing in each situation. a. Issued at par value b. Issued at 102 cIssued at 97 Problem 12-2 ABC, Inc. issued $500,000, 7%, 25-year bonds on January 1, 2019, at 99. Interest is payable annually on December 31. ABC, Inc. uses straight line amortization of bond discount or premium. Part A: Issuance a. Calculate the amount of the discount. b. Calculate the amount of cash received. c. Prepare the journal entry to record the issuance of the bond. Part B: Calculate the cost of borrowing. a. Calculate the amount of a single interest payment. b. Calculate the total amount interest paid over the life of the bond c. Calculate the total amount paid out over the life of the bond d. Calculate the cost of borrowing Chapter 12 Problem Set A Problem 12.1 Southwest Gas and Oil Corporation recently issued 7,500 bonds with a $1,000 face value, 5-year bonds, with a stated rate of 5%. Interest is paid annually. Part A Calculate the amount of the premium or discount and the amount of cash received in each of the following situations: a. Issued at par value b. Issued at 102 c. Issued at 97 Part B Prepare the journal entry for issuance in each of the following situations: a. Issued at par value b. Issued at 102 c. Issued at 97 Part C a. Calculate the amount of a single interest payment b. Calculate the total amount of interest paid over the life of the bond c. Calculate the total amount paid out over the life of the bond d. Calculate the cost of borrowing in each situation. a. Issued at par value b. Issued at 102 cIssued at 97 Problem 12-2 ABC, Inc. issued $500,000, 7%, 25-year bonds on January 1, 2019, at 99. Interest is payable annually on December 31. ABC, Inc. uses straight line amortization of bond discount or premium. Part A: Issuance a. Calculate the amount of the discount. b. Calculate the amount of cash received. c. Prepare the journal entry to record the issuance of the bond. Part B: Calculate the cost of borrowing. a. Calculate the amount of a single interest payment. b. Calculate the total amount interest paid over the life of the bond c. Calculate the total amount paid out over the life of the bond d. Calculate the cost of borrowing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts