Question: Chapter 12 - Q3: Please answer the questions in full as seen in the photo below: You are considering how to invest part of your

Chapter 12 - Q3: Please answer the questions in full as seen in the photo below:

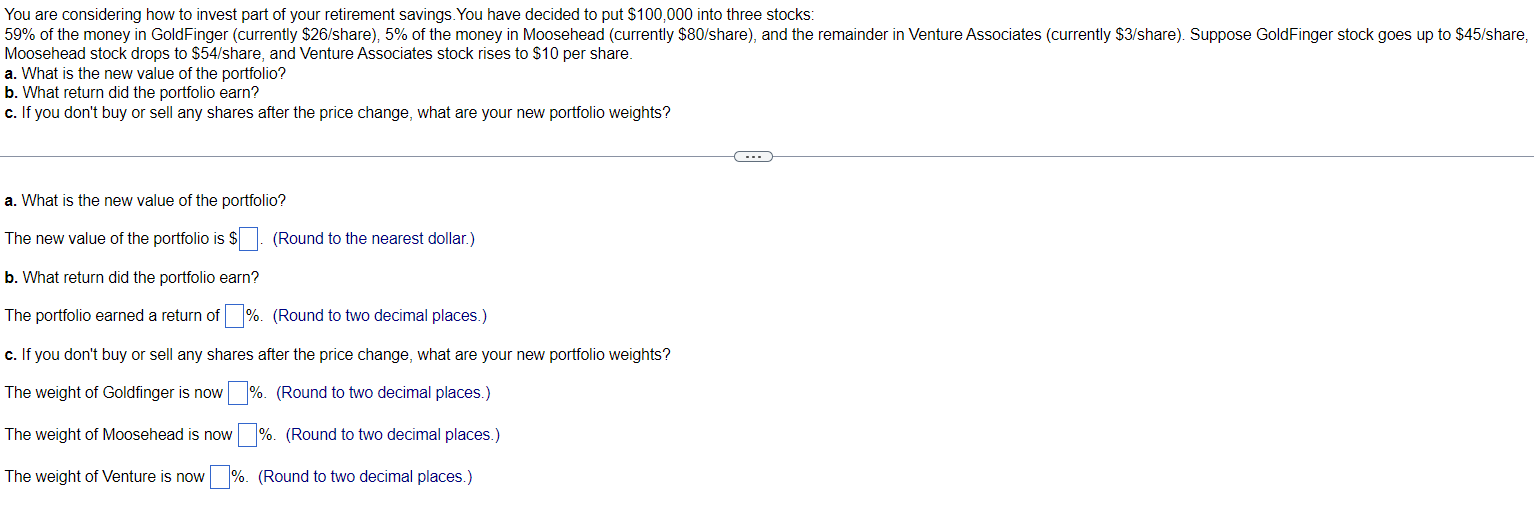

You are considering how to invest part of your retirement savings. You have decided to put $100,000 into three stocks: 59% of the money in GoldFinger (currently $26/ share), 5% of the money in Moosehead (currently $80/ share), and the remainder in Venture Associates (currently $3/ share). Suppose GoldFinger stock goes up to $45/ share Moosehead stock drops to $54/ share, and Venture Associates stock rises to $10 per share. a. What is the new value of the portfolio? b. What return did the portfolio earn? c. If you don't buy or sell any shares after the price change, what are your new portfolio weights? a. What is the new value of the portfolio? The new value of the portfolio is (Round to the nearest dollar.) b. What return did the portfolio earn? The portfolio earned a return of %. (Round to two decimal places.) c. If you don't buy or sell any shares after the price change, what are your new portfolio weights? The weight of Goldfinger is now %. (Round to two decimal places.) The weight of Moosehead is now 6. (Round to two decimal places.) The weight of Venture is now %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts