Question: chapter 12 question 3 will also be posted many many more questiond if this was easy please find the other questions thank you a. Equipment

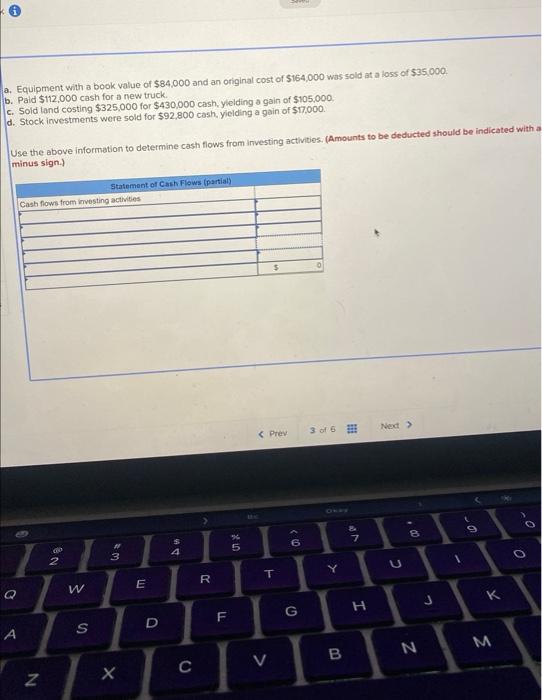

a. Equipment with a book value of $84,000 and an original cost of $164,000 was sold at a loss of $35,000. b. Paid $112,000 cash for a new truck. c. Sold land costing $325,000 for $430,000 cash, ylelding a gain of $105,000. d. Stock investments were sold for $92,800cash, yielding a gain of $17,000. Use the above information to determine cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts