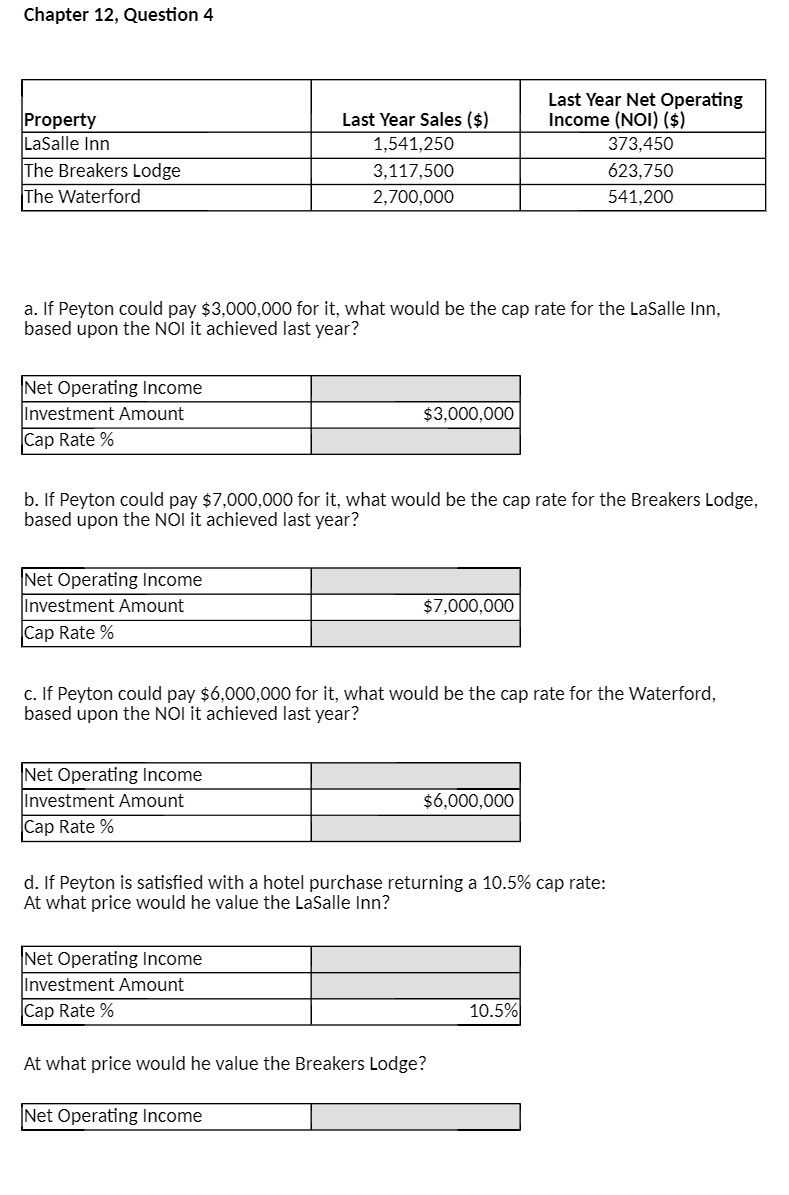

Question: Chapter 12 , Question 4 Property Last Year Sales ( $ ) Last Year Net Operating Income ( NOW ) ( $ ) LaSalle Inn

Chapter 12 , Question 4 Property Last Year Sales ( $ ) Last Year Net Operating Income ( NOW ) ( $ ) LaSalle Inn 1 , 541 , 250 373 , 450 The Breakers Lodge 3 . 117 , 500 623. 750 The Waterford 2. 700 , 000 541 , 200 a . If Peyton could pay $ 3, 000 , 000 for it , what would be the cap rate for the Lasalle Inn ." based upon the NOI it achieved last year ?" Net Operating Income* Investment Amount $3 , 000 , 000 Cap Rate % b . If Peyton could pay $ 7 , 000 , 000 for it , what would be the cap rate for the Breakers Lodge , based upon the NOI it achieved last year ?" Net Operating Income* Investment Amount $7, 000 , 000 Cap Rate 9/0 C . If Peyton could pay $6 , 000, 000 for it , what would be the cap rate for the Waterford . based upon the NOI it achieved last year ?" Net Operating Income Investment Amount $ 6.000, 000 Cap Rate 90 d. If Peyton is satisfied with a hotel purchase returning a 10.5% cap rate : At what price would he value the Lasalle Inn ? Net Operating Income Investment Amount Cap Rate 90 10.5%| At what price would he value the Breakers Lodge ?" Net Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts