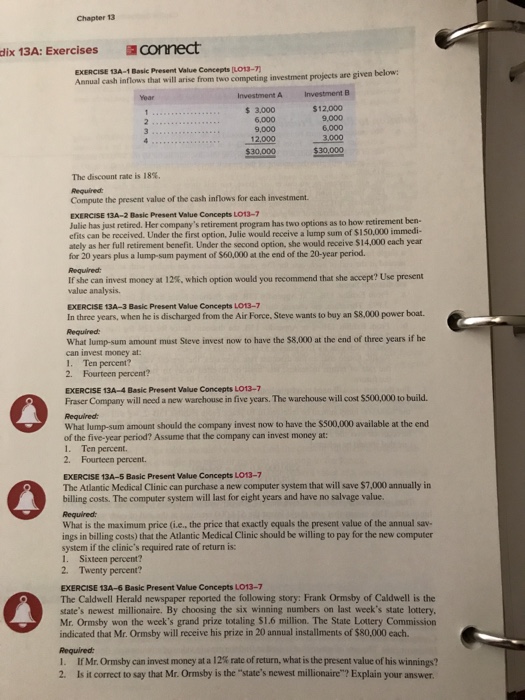

Question: Chapter 13 13A: Exercises connect dix EXERCISE 13A-1 Basic Present Value Concepts (L013-7 Annual cash inflows that will arise from two competing investment projects are

Chapter 13 13A: Exercises connect dix EXERCISE 13A-1 Basic Present Value Concepts (L013-7 Annual cash inflows that will arise from two competing investment projects are given below: Investment A Investment B $ 3,000 6,000 9,000 12.000 530,000 9,000 The discount rate is 18%. Required Compute the present valuc of the cash inflows for each investment. EXERCISE 13A-2 Basic Present Value Concepts LO13-7 ben- Julie has just retired. Her company's retirement program has two options as to how retirement efits can be received. Under the first option, Julie would receive a lump sum of $150,000 immedi ately as her full retirement benefit. Under the second option, she would receive $14,000 each year for 20 years plus a lump-sum payment of $60,000 at the end of the 20-year period Required If she can invest money at 12%, which option would you recommend that she accept? Use present value analysis EXERCISE 13A-3 Basic Present Value Concepts LO13-7 In three years, when he is discharged from the Air Force, Steve wants to buy an $8,000 power boat. Required What lump-sum amount must Steve invest now to have the $8,000 at the end of three years if he can invest money at: 1. Ten percent? 2. Fourteen percent? EXERCISE 13A-4 Basic Present Value Concepts LO13-7 Fraser Company will need a new warehouse in five years. The warehouse will cost $500,000 to build Required What lump-sum of the five-year period? Assume that the company can invest money at: 1. Ten percent. 2. Fourteen percent. amount should the company invest now to have the $500,000 available at the end EXERCISE 13A-5 Basic Present Value Concepts LO13-7 The Atlantic Medical Clinic can purchase a new computer system that will save $7,000 annually in billing costs. The computer system will last for eight years and have no salvage value. What is the maximum price (i.e., the price that exactly equals the present value of the annual sav- ings in billing costs) that the Atlantic Medical Clinic should be willing to pay for the new computer system if the clinic's required rate of return is: 1. Sixteen percent? 2. Twenty percent? EXERCISE 13A-6 Basic Present Value Concepts LO13-7 The Caldwell Herald newspaper reported the following story: Frank Ormsby of Caldwell is the state's newest millionaire. By choosing the six winning numbers on last week's state lottery Mr. Ormsby won the week's grand prize totaling $1.6 million. The State Lottery Commission indicated that Mr.Ormsby will receive his prize in 20 annual installments of $80,000 each Required: 1-1f Mr. Onnsby can invest money at a 12% rate ofreturn, what is the present value oflis winnings? 2. Is it correct to say that Mr. Ormsby is the "state's newest millionaire"? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts