Question: (CHAPTER 13) A company offers a 16.7% return on its stock. The Beta of its stock equals 2.12. The risk-free rate equals 3.6% and the

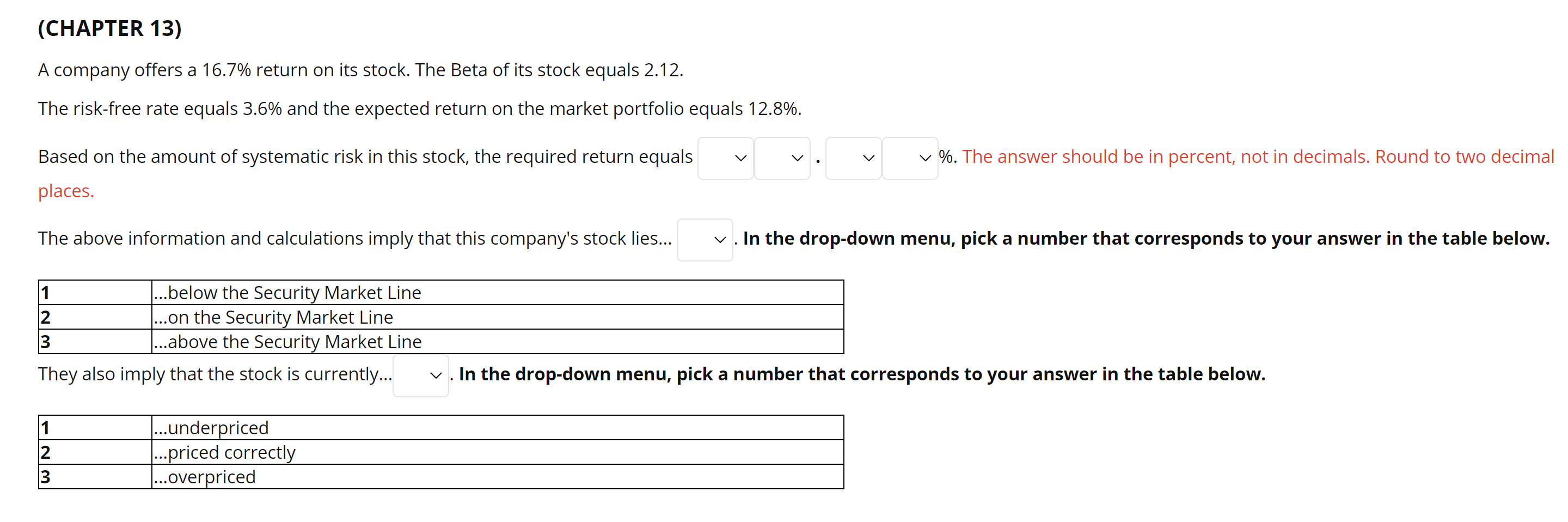

(CHAPTER 13) A company offers a 16.7% return on its stock. The Beta of its stock equals 2.12. The risk-free rate equals 3.6% and the expected return on the market portfolio equals 12.8%. v %. The answer should be in percent, not in decimals. Round to two decimal Based on the amount of systematic risk in this stock, the required return equals places. The above information and calculations imply that this company's stock lies... In the drop-down menu, pick a number that corresponds to your answer in the table below. 1 ...below the Security Market Line 12 ...on the Security Market Line 3 ... above the Security Market Line They also imply that the stock is currently... In the drop-down menu, pick a number that corresponds to your answer in the table below. 1 12 ...underpriced ...priced correctly ...overpriced 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts