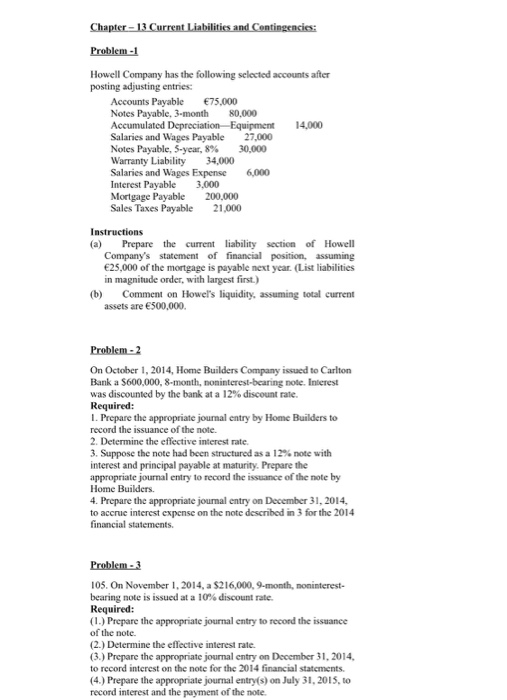

Question: Chapter 13 Current Liabilities and Contingencies: Problem-1 Howell Company has the following selected accounts after posting adjusting entries Accounts Payable 75.000 Notes Payable, 3-month 80.000

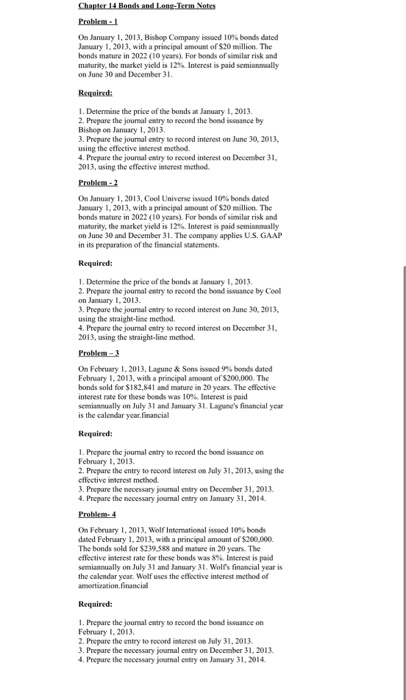

Chapter 13 Current Liabilities and Contingencies: Problem-1 Howell Company has the following selected accounts after posting adjusting entries Accounts Payable 75.000 Notes Payable, 3-month 80.000 Accumulated Depreciation Equipment 14,000 Salaries and Wages Payable 27,000 Notes Payable, 5-year, 8% 30,000 Warranty Liability 34,000 Salaries and Wages Expense 6,000 Interest Payable 3,000 Mortgage Payable 200.000 Sales Taxes Payable 21,000 Instructions (a) Prepare the current liability section of Howell Company's statement of financial position, assuming 25,000 of the mortgage is payable next year. (List liabilities in magnitude order, with largest first.) (b) Comment on Howel's liquidity, assuming total current assets are 500,000. Problem - 2 On October 1, 2014, Home Builders Company issued to Carlton Bank a $600,000, 8-month, noninterest-bearing note. Interest was discounted by the bank at a 12% discount rate. Required: 1. Prepare the appropriate journal entry by Home Builders to record the issuance of the note. 2. Determine the effective interest rate. 3. Suppose the note had been structured as a 12% note with interest and principal payable at maturity. Prepare the appropriate journal entry to record the issuance of the note by Home Builders. 4. Prepare the appropriate journal entry on December 31, 2014, to accrue interest expense on the note described in 3 for the 2014 financial statements. Problem - 3 105. On November 1, 2014, a $216,000, 9-month, noninterest bearing note is issued at a 10% discount rate. Required: (1.) Prepare the appropriate journal entry to record the issuance of the note. (2.) Determine the effective interest rate (3.) Prepare the appropriate journal entry on December 31, 2014 to record interest on the note for the 2014 financial statements (4.) Prepare the appropriate journal entry(s) on July 31, 2015, 10 record interest and the payment of the note. Chapter 14 Bonds and Long-Term Notes Probleme On January 1, 2013, Bishop Company issued 10% bonds dated January 1, 2013, with a principal amount of $20 million. The bonds mature in 2022 (10 years). For bonds of similar risk and maturity. the market yield is 12% Interest is paid semiannually on June 30 and December 31 Required: 1. Determine the price of the bonds at January 1, 2013. 2. Prepare the journal entry to record the bond issuance by Bishop on January 1, 2013 3. Prepare the journal entry to record interest on June 30, 2013 using the effective interest method. 4. Prepare the journal entry to record interest on December 31, 2013, using the effective interest method Problem - 2 On January 1, 2013, Cool Universe issued 10% bonds dated January 1, 2013, with a principal amount of $20 million. The hands mature in 2022(10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. The company applies US. GAAP in its preparation of the financial statements. Required: 1. Determine the price of the bonds January 1, 2013 2. Prepare the journal entry to record the bond issuance by Cool on January 1, 2013 3. Prepare the journal wtry to record interest on June 30, 2013 using the straight line method. 4. Prepare the journal entry to record interest on December 31. 2013, using the straight-line method. Problem On February 1, 2013, Lagune&Sons iad 9 hondsdated February 1, 2013, with a principal amount of $200,000. The bonds sold for $182,841 and mature in 20 years. The effective interest rate for these bonds was 10%. Interest is paid semiannually on July 31 and January 31. Layun's financial year is the calendar year. Financial Required: 1. Prepare the journal entry to record the bond issuance on February 1, 2013 2. Prepare the entry to record interest on July 31, 2013, using the cffective interest method 3. Prepare the necessary journal entry on December 31, 2013 4. Prepare the necessary journal entry on January 31, 2014 Problem On February 1, 2013, Wolf Internationalised 10% bonds dated February 1, 2013, with a principal amount of $200,000 The bonds sold for $219.5% and mature in 20 years. The eflective interest rate for these bonds was 8%. Interest is paid semiannually on July 31 and January 31. Wolf's financial year is the calendar year. Wolf uses the effective interest method of amortization financial Required: 1. Prepare the journal entry to record the bond issuance on February 1, 2013. 2. Prepare the entry to record interest on July 31, 2013 3. Prepare the necessary journal entry on December 31, 2013 4. Prepare the necessary journal entry on January 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts