Question: Chapter 13 Homework G 7 14.32 points eBook Print References Gibson Bike Company makes the frames used to build its bicycles. During Year 2, Gibson

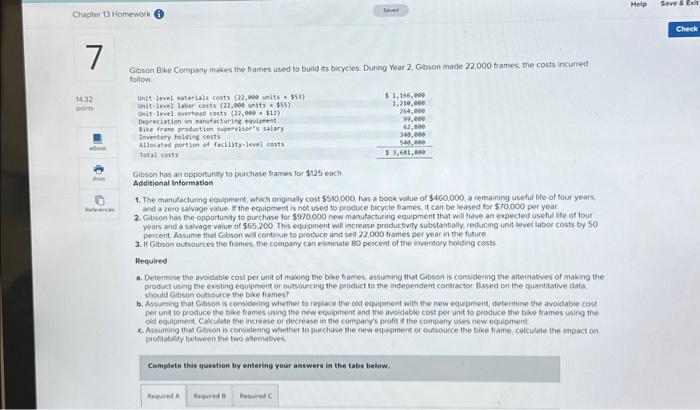

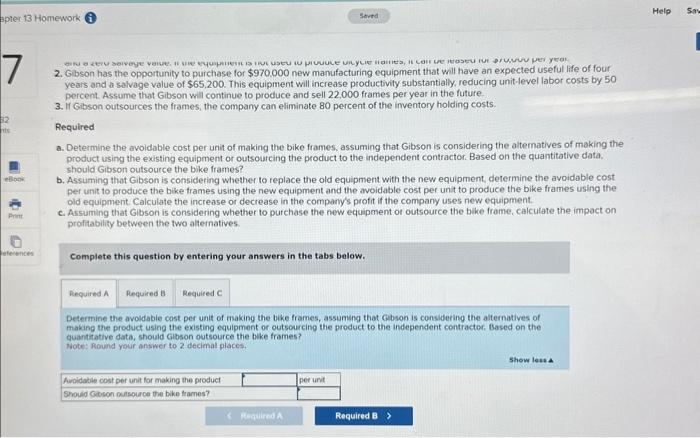

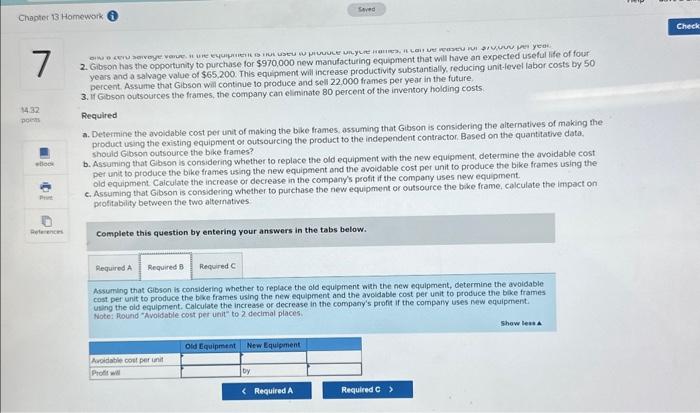

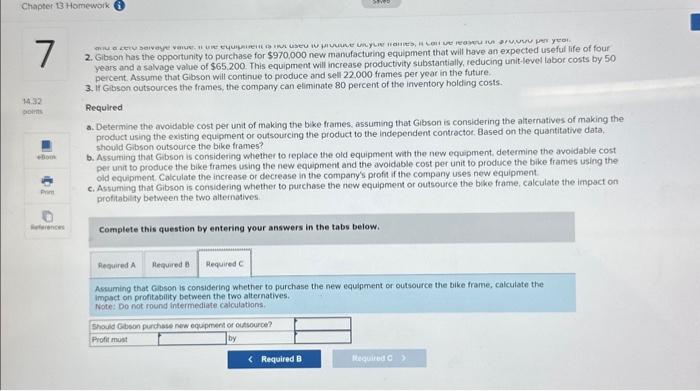

Gibson Bike Compary makes the frames used to buld is bicycles. During Year 2, Glbson made 22.000 trames, the costs incurred follow. Gibson thas an opportunity to purchase fraxes for $125 each Additional information 1. The manulactueing ecuipment which originally cont $510,000, tas a book value of $400,000, a remaining usuful life of fout years. and a zero saivage value. if the equipment is not used to produce bicycle frames, it can be leased for $70,000 per year. 2. Gitson has the opportunty to purchase for $970,000 now manufacturing equipment that wil have an expected useful ife of fout years and a salvage value of $65.200 This equipment will increase producbvity substantially reducing unit-level labor costs by 50 pericent Assume that Gbson wai contince to produce and sell 22.000 frames per year in the future. 3. If Gitson outsources the frames, the company can eliminate 80 porceat of the imvertory holding costs Required a. Determine the avoidable cost per unt of nuking the bike frames assuming tiut Goson is considering the alternatives of making the product using the exsting equpment or oulsourcing the product to the independent consractor Based on the quantitative data. should Gibson outsource the ble frames? b. Assuming that Cibson is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the base frames ising the new eosuprent and the avoldable cost per unit to produce the base trames using the gid equipment. Caculate the inciease of dectease in the comparys profit if the company uses new equipment. c. Assuming thar Cbion is consideang whether to pirchase tie new edupment or oulsource the bike frame, calculate the impact on profiabity between the two asernation. Complete this question by entering your answers in the tabs below. 2. Gibeon has the opportunity to purchase for $970.000 new manufacturing equipment that will have an expected useful life of four years and a salvage value of $65,200. This equipment will increase productivity substantially, reducing unit-level labor costs by 50 percent. Assume that Gibson will continue to produce and sell 22,000 frames per year in the future. 3. If Gibson outsources the frames, the company can eliminate 80 percent of the imventory holding costs. Required a. Determine the avoidable cost per unit of making the bike frames, assuming that Gibson is considering the aiternatives of making the product using the existing equipment or outsoutcing the product to the independent contractor. Based on the quantitative data. should Gibson outsource the bike frames? b. Assuming that Gibson is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the company's profit if the company uses new equipment. c. Assuming that Gibson is considering whether to purchase the new equipment or outsource the bike frame, calculate the impact on profitability between the two alternatives. Complete this question by entering your answers in the tabs below. Determine the avoldable cost per unit of making the bike frames, assuming that Gibson is considering the alternatives of making the product using the existing equipment or outsourcing the product to the independent contractor, Based on the guantitative data, should Gibson outsource the bike frames? Note: Round your answer to 2 decimal places. 2. Gbson has the opportunity to purchase for $970,000 new manufacturing equipment that will have an expected useful life of four. years and a salvage value of $65,200. This equipment will increase productivity substantally, rodiacing unit-level labor costs by 50 percent. Assume that Gibson wil continue to produce and sell 22,000 frames per year in the future. 3. 11 Gibson outsources the frames, the company can eliminate 80 percert of the inventory holding costs. Required a. Determine the avoidable cost per unit of making the bike frames assuming that Gibson is considering the aiternatives of making the product using the existing equipment of outsourcing the product to the independent contractor. Based on the quartitative data. should Gibson outsource the bike frames? b. Assuming that Gibson is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Caiculate the increase of decrease in the company/s profit if the compary uses new equipment. c. Assuming that Gibson is comsidering whether to purchase the new equipment or cutsource the bike frame, calculate the inpact on protitability between the two alternatives: Complete this question by entering your answers in the tabs below. Assuming that Gibson is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the bike frames using the new equipment and the aveldable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the comparry's profit if the company uses new equipment. Note: Pound "Avolidable cost per unit" to 2 decimal places. 2. Gibson has the opportunity to purchase for $970,000 new manufacturing equipment that will have an expected useful life of fouf years and a salvage value of $65,200. This equipment will increase productivity substantially, teducing unit-level labor costs by 50 percent. Assume that Gibson wilt continue to produce and sell 22.000 frames per year in the future. 3. If Gibson outsources the frames, the company can eliminate 80 percent of the inventory holding costs. Requlred a. Determine the avoidable cost per unit of making the bike frames, assuming that Gibson is considering the alternatives of making the product using the existing equipment or outsourcing the product to the independent contractoc. Based on the quantitative data, should Gibson outsource the bike frames? b. Assuming that Gibson is considering whether to replace the old equipment with the new equipment, determine the avoidable cost. per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Coliculate the increase or decrease in the company's profit if the company uses new equipment. c. Assuming that Gibson is considering whether to purchase the new equipment or outsource the bike frame, calculate the impact on profitability between the two alternatives. Complete this question by entering your answers in the tabs below. Astuming that cibson is considering whether to purchase the new equipment or outsource the bike frame, calculate the impact on profitability between the two alternatives. Note t bo not round intermediate calcuiations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts