Question: Chapter 13: Learning Activity Scenario Sharon Edwards Complete a tax return for Sharon. Sharon Edwards (age 32, DOB: 10i28i88, SSN: 321-00-6798) is single and lives

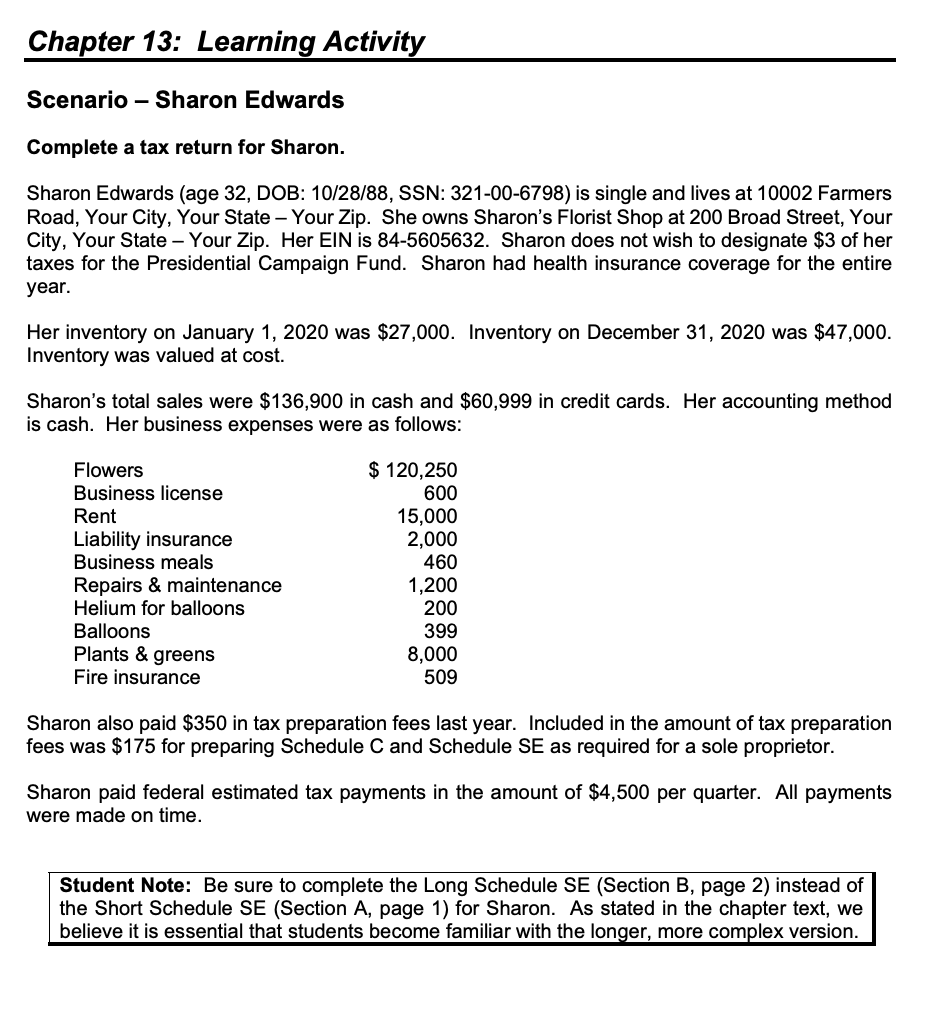

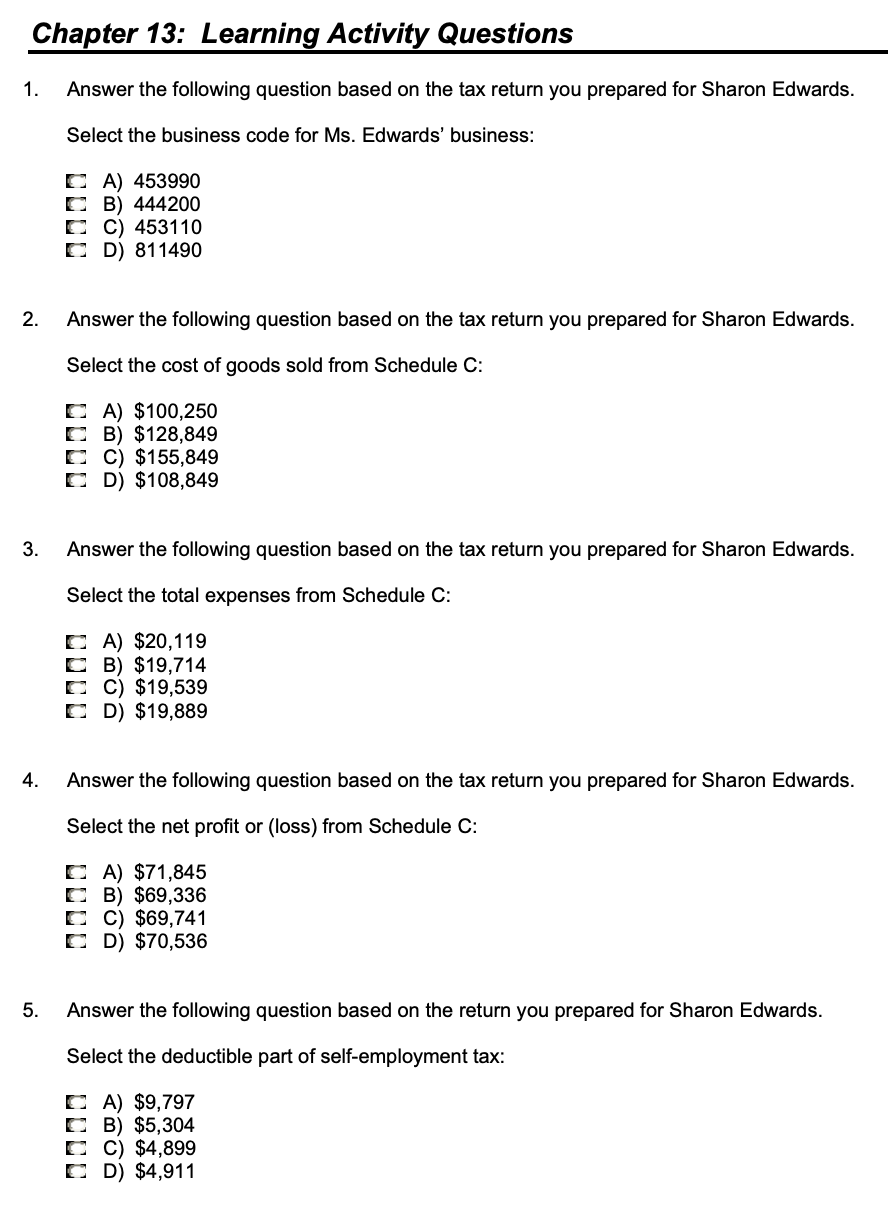

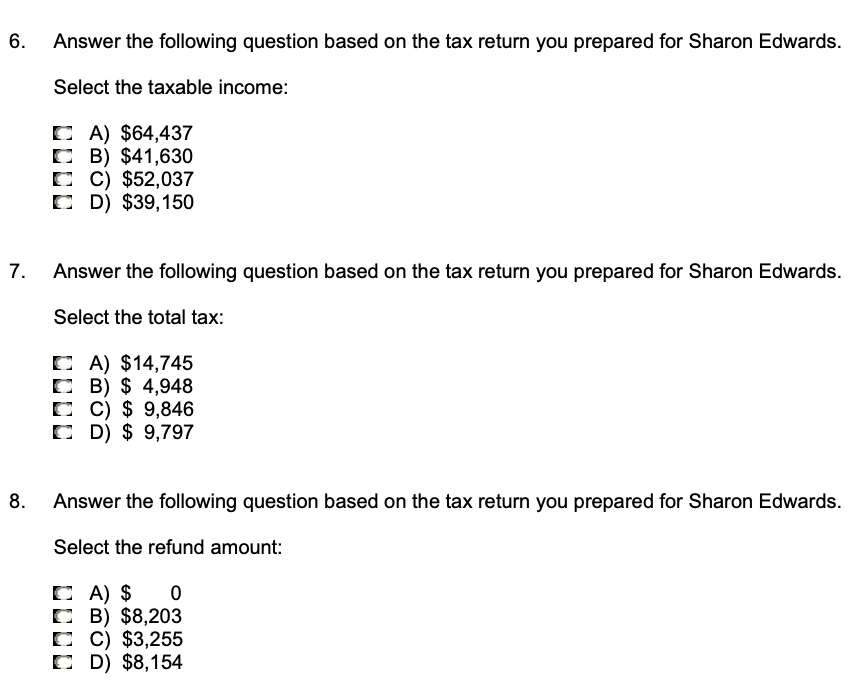

Chapter 13: Learning Activity Scenario Sharon Edwards Complete a tax return for Sharon. Sharon Edwards (age 32, DOB: 10i28i88, SSN: 321-00-6798) is single and lives at 10002 Farmers Road, Your City, Your State Your Zip. She owns Sharon's Florist Shop at 200 Broad Street, Your City, Your State Your Zip. Her EIN is 84-5605632. Sharon does not wish to designate $3 of her taxes for the Presidential Campaign Fund. Sharon had health insurance coverage for the entire yeah Her inventory on January 1, 2020 was $27,000. Inventory on December 31, 2020 was $47,000. Inventory was valued at cost. Sharon's total sales were $136,900 in cash and $60,999 in credit cards. Her accounting method is cash. Her business expenses were as follows: Flowers $ 120,250 Business license 600 Rent 15,000 Liability insurance 2,000 Business meals 460 Repairs & maintenance 1,200 Helium for balloons 200 Balloons 399 Plants 3. greens 8,000 Fire insurance 509 Sharon also paid $350 in tax preparation fees last year. Included in the amount of tax preparation fees was $175 for preparing Schedule C and Schedule SE as required for a sole proprietor. Sharon paid federal estimated tax payments in the amount of $4,500 per quarter. All payments were made on time. Student Note: Be sure to complete the Long Schedule SE (Section B, page 2) instead of the Short Schedule SE (Section A, page 1) for Sharon. As stated in the chapter text, we believe it is essential that students become familiar with the Ion er, more com Iex version. Chapter 13: Learning Activity Questions 1. Answer the following question based on the tax return you prepared for Sharon Edwards. Select the business code for Ms. Edwards\" business: A) 453990 B) 444-200 C} 453110 D} 811490 [\"1555 2. Answer the following question based on the tax return you prepared for Sharon Edwards. Select the cost of goods sold from Schedule C: A) $100,250 B) $123,349 C} $155,349 0) $103,349 [\"1555 3. Answer the following question based on the tax return you prepared for Sharon Edwards. Select the total expenses from Schedule C: A) $20,119 B) $19,714 0) $19,539 0) $19,339 571F171 4. Answer the following question based on the tax return you prepared for Sharon Edwards. Select the net prot or (loss) from Schedule C: A) $71,345 B) $39,333 0) $39,741 0) $70,533 [\"1555 5. Answer the following question based on the return you prepared for Sharon Edwards. Select the deductible part of self-employment tax: A) $9,797 B) $5.304 C) $4,399 D) $4,911 [\"1555 Answer the following question based on the tax return you prepared for Sharon Edwards. Select the taxable income: A) $94,437 B) $41,630 C) $52,037 0) $39,150 5355 Answer the following question based on the tax return you prepared for Sharon Edwards. Select the total tax: A) $14,745 B) $ 4.940 C) $ 9,349 o) $ 9,797 5555 Answer the following question based on the tax return you prepared for Sharon Edwards. Select the refund amount: A) $ 0 9) $0,203 C) $3,255 0) $0,154 5555

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts