Question: Chapter 13 - Review Problems (Graded) i Saved Help Save & Exit Submit Check my work Problem 13-14 Calculating Flotation Costs 12.5 points Suppose your

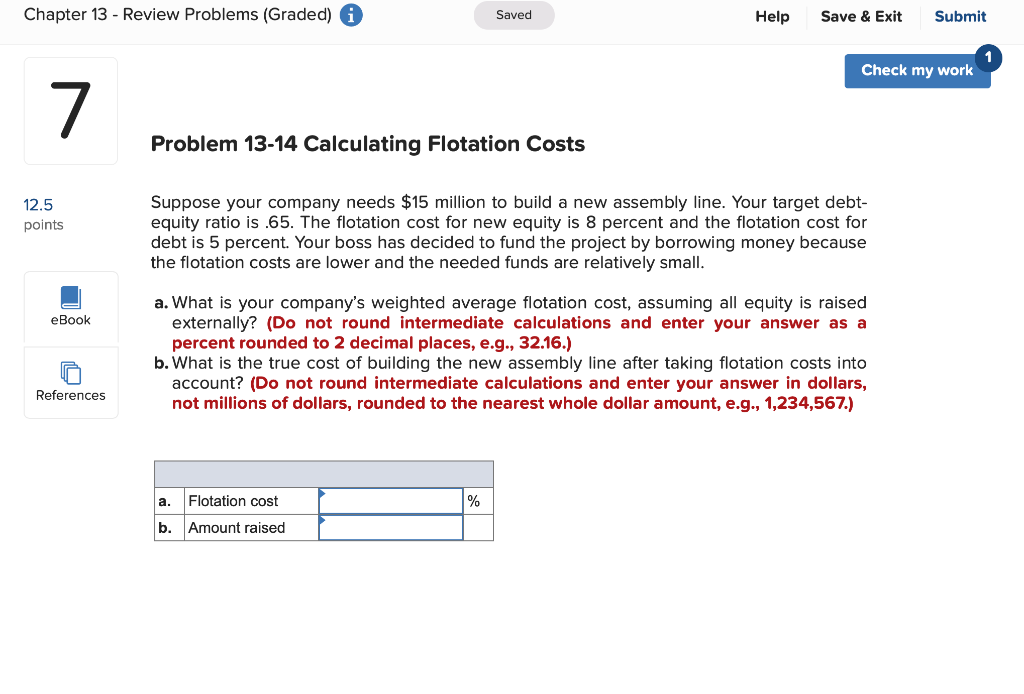

Chapter 13 - Review Problems (Graded) i Saved Help Save & Exit Submit Check my work Problem 13-14 Calculating Flotation Costs 12.5 points Suppose your company needs $15 million to build a new assembly line. Your target debt- equity ratio is .65. The flotation cost for new equity is 8 percent and the flotation cost for debt is 5 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. eBook a. What is your company's weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) References Flotation cost b. Amount raised

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts